Views & Insights

Periodically we publish content that puts our principles and views into practice, because education is an essential component of long-term investment success.

CATEGORY: Investment counselling

Minerva Issue 2: Invert, Always Invert

Minerva | October 2019

The past 30 years have truly been a spectacular period to be invested in stocks. A US$10,000 investment in the S&P 500 Index at the end of 1988 would have grown...

Tough October

The Journal | November 2018

It was another tough October—famously the most difficult month of the year for the stock market. There once was a rational explanation for this phenomenon. In the old days,...

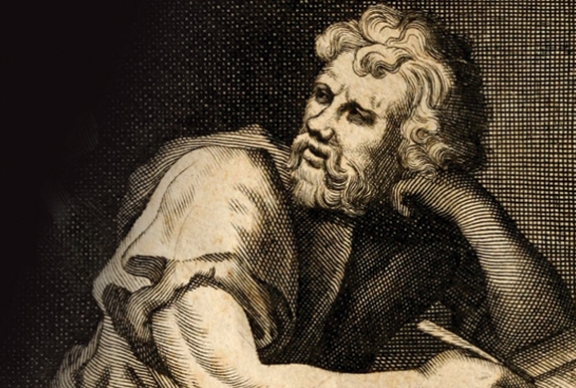

Stoic Training for Private Investors

The Journal | March 2018

Philosophy seems to be trending these days. In 2013, Burgundy sought investing inspiration from ancient Greece, publishing a View on Stoicism and the Art of Portfolio Intervention. Several tech entrep...

Time in the Market

The Journal | July 2017

There was a recurring theme at the annual Burgundy Client Day on June 8th: the market is getting expensive. Burgundy’s Portfolio Managers highlighted the difficulties finding high-quality companies...

CRM2, Time-weighted and Money-weighted Rates of Return

December 2016

CRM2 refers to a new set of regulations put in place to enhance transparency in the investment industry, particularly around fees and performance....

What are Money-weighted Rates of Return?

The Journal | December 2016

Over the last few months, you may have heard reference to “CRM2,” a set of regulations meant to enhance transparency in the investment industry by mandating investment management firms, dealers...

PDF: Measuring Investment Performance

December 2016

Investment industry regulators have made a significant move to enhance transparency for investors regarding the method in which performance returns are reported. We see this as a positive for the...

Our Best Guess

The Journal | June 2016

Investors often have a notion about what is an acceptable or desired rate of return on their capital. This rate of return is typically expressed in percentage terms. For example, “...