In a market that seems to have largely forgotten about the benefits of diversification, whether across the market-cap spectrum or geographies, CIO Anne Mette de Place Filippini explores why holding a range of investments makes for a pretty contrarian bet.

KEY POINTS

- U.S. megacaps are weighing heavy on global markets, with concentration at unprecedented levels.

- Diversification offers a contrarian approach to managing risk and preserving capital.

- No single country has a monopoly on high-quality businesses.

- Balanced exposure across geography and market caps supports long-term stability.

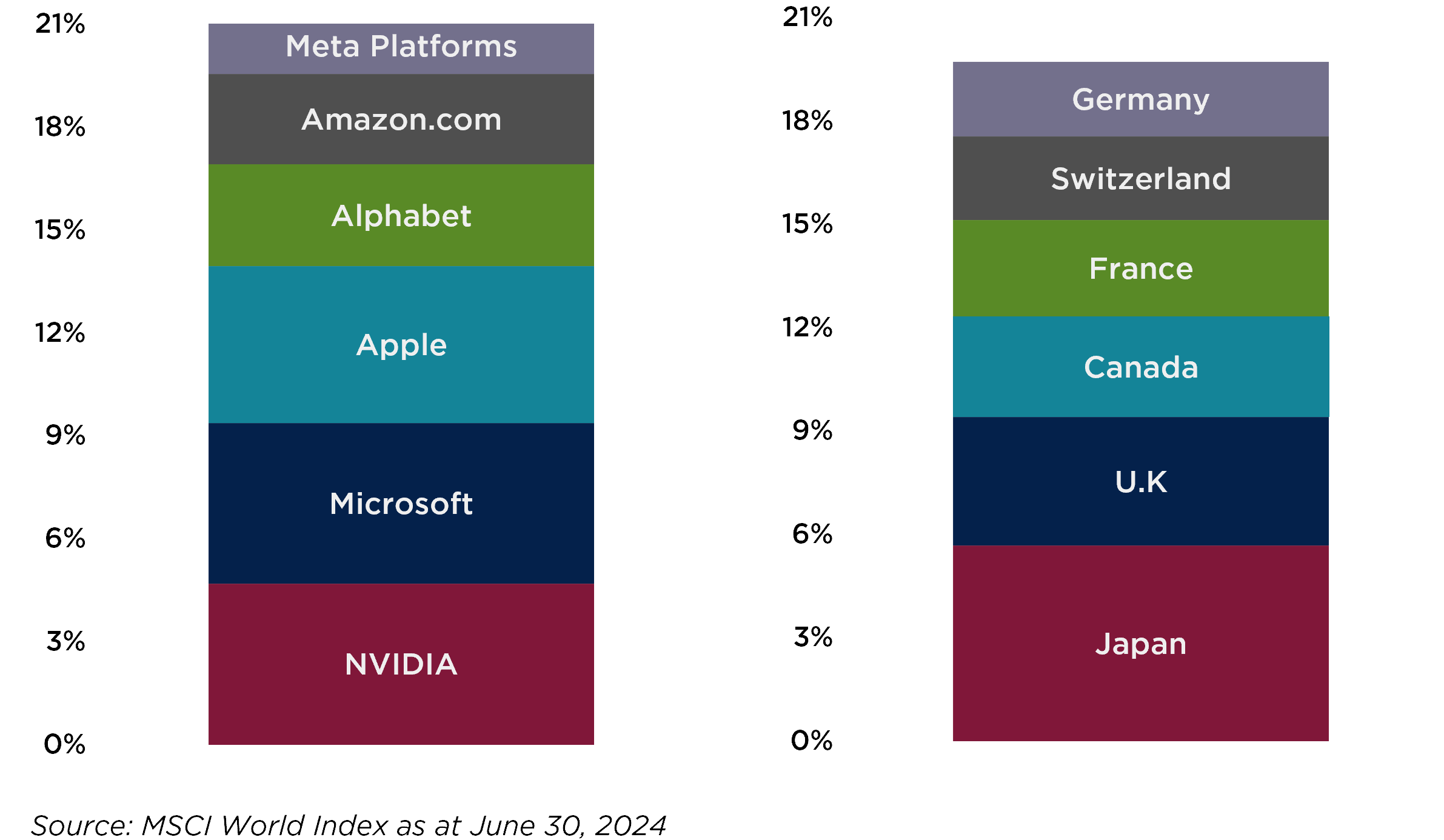

Six U.S. tech giants—Microsoft, Apple, Alphabet, Amazon, Meta, and Nvidia—weigh heavily in global markets today. Worth trillions of dollars each, these megacap companies now exceed the combined weightings of Japan, the U.K., Canada, France, Switzerland, and Germany (see Figure 1). While in the last few weeks, markets have shown early signs that this focus may be easing, the current level of concentration is unprecedented, and the enthusiasm for the exciting yet unpredictable field of AI remains high.

FIGURE 1. THE SHEER SIZE OF MEGACAP TECH

Market concentration is nothing new. Since the Global Financial Crisis, U.S. companies have come to dominate global market performance and now make up over 70% of global market indices (MSCI World Index), with a few megacaps making up over 20%—as shown above. This trend has persisted for well over a decade, but it has accelerated dramatically over the past year. This environment has led investors to question some of the most fundamental rules of investing, especially the value of diversification.

A Neglected Practice

At its core, diversification is about spreading risk across various assets, geographies, or sectors. Though it may sound straightforward, in practice, it demands a contrarian mindset. It means resisting the urge to chase trends, fighting the fear of missing out, and being willing to stand apart from the crowd. Picking winners is only easy in hindsight, and investing is about looking ahead, placing bets, and positioning oneself not knowing exactly how the future will unfold. Diversification is a way to help manage risks, which is a key component in preserving capital and generating sustainable, attractive long-term returns. It may seem less effective at times because it doesn’t capture the gains of the top-performing markets as significantly as a concentrated approach, but, importantly, it can protect against the downside when that trend changes. Given the premise that we cannot predict which investment, asset class, or market segment will do the best in the short run, being diversified can help manage risks and preserve capital. Ultimately, diversification is one way to hedge against a really bad outcome.

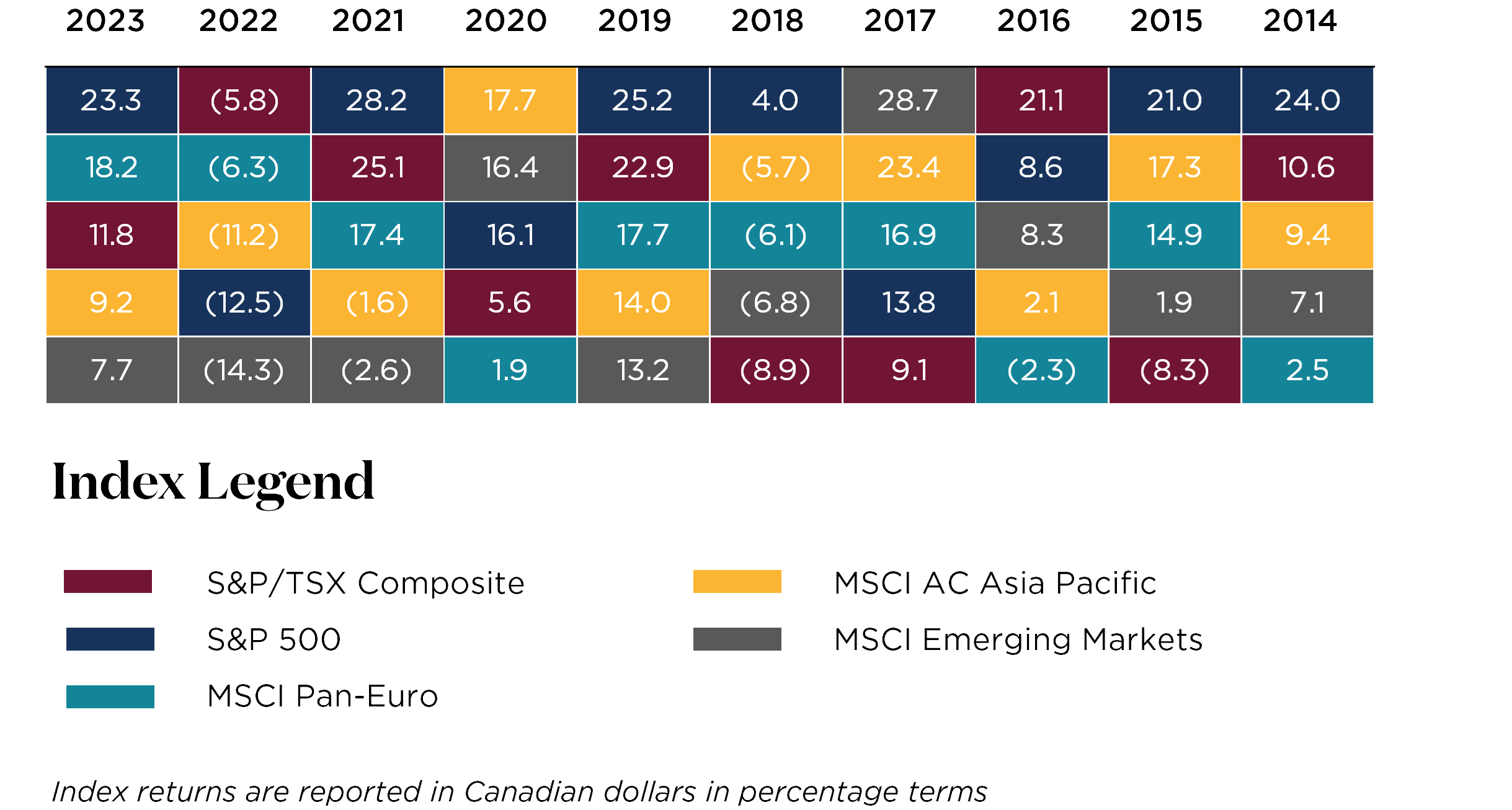

Over the past decade, returns have varied significantly from year to year across different geographies (see Figure 2). Today, while global investors have been focusing on the United States, it’s worth remembering that the first decade of the 2000s saw zero returns from the S&P 500 Index (in Canadian dollars).

FIGURE 2. REGIONAL MARKET RETURNS, YEAR OVER YEAR

High-Quality Businesses Aren’t Confined to One Country or Megacaps

At our most recent Burgundy Forum, we discussed the importance of holding a variety of investments across international markets and market capitalizations. Asian Equity Portfolio Manager Craig Pho captured it well when he said, “No single country has a monopoly on high-quality businesses.” Our U.S. Small Cap Portfolio Manager Steve Boutin pointed to the substantial valuation gap between large and small capitalization companies today after years of large cap outperformance, suggesting attractive opportunities in small caps when the trend reverses.

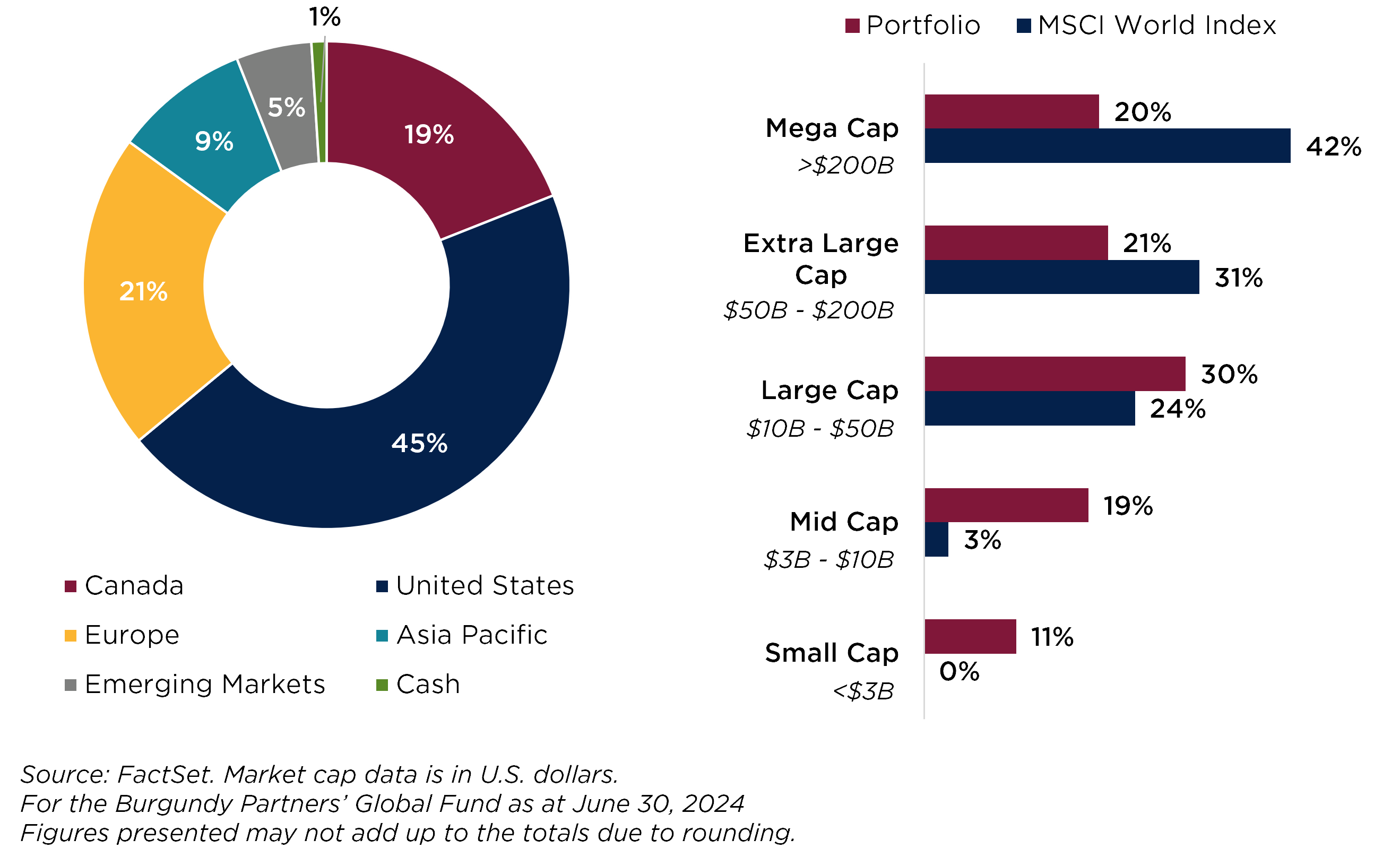

This sentiment is true across countries, sectors, and market capitalizations. Look to our Burgundy Partners’ Global strategy as an example of this risk management in action. While this portfolio for private clients holds core positions in some of the tech behemoths (Microsoft, Alphabet, and Amazon), it maintains a balanced exposure. Diversified by investments across the market-cap spectrum, it has plenty of quality and value beyond the U.S. mega-cap market darlings (see Figure 3).

FIGURE 3. BY REGION & MARKET CAPITALIZATION

Burgundy Partners’ Global Strategy

Don’t Forget the Fundamentals

Today, nobody has ever seen markets so concentrated, but nobody has ever seen the growth of companies at scale that is being demonstrated, either. Returns to sensibly diversified managers over the past year have been very good, while those who concentrated on U.S. tech have had the best experience. Proverbially, the good is the enemy of the best. If the good is sustainable and the best is not, time will tell.

In a market that seems to have largely forgotten about the benefits of diversification, whether across the market-cap spectrum or across geographies, holding a range of investments makes for a pretty contrarian bet. While a more diversified portfolio may not keep up with market indices during times of concentrated market gains or heightened speculation, our priority is to grow and preserve your capital, sustainably, while protecting against downside risk.

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.