Against the constant barrage of tech stocks news, Investment Counsellor Philip Doyle does some decluttering. In this piece, he evaluates how the market’s fixation on technology has left some companies undervalued, how the significance of geography plays a vital role, and how a long-term perspective and a healthy dose of caution is critical in overcoming a static short term.

Warren Buffett has said many times that he won the “genetic lottery” by being born in 1930 in the Midwestern United States and brought up in comfort and security. In other words, Buffett acknowledges right off the bat that being in the right place, at the right time, provides a critical starting point for success.

In the past year, we have seen how true this can be for short-term investment performance. In the 12 months leading up to June 30, 2020, being in the right part of global stock markets was critical, and owning large-cap technology stocks (particularly in the U.S.) was key to finding success.

While Burgundy maintains the belief that long-term success in investing is about owning high-quality companies at reasonable valuations, it is important to recognize that this does not always translate into success over the short term. When market returns are led by a very concentrated group of stocks, Burgundy’s diversified and often contrarian portfolios can sometimes lag.

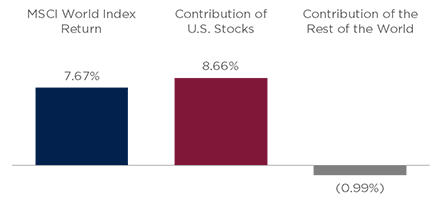

GLOBAL STOCK MARKET RETURNS OVER THE LAST YEAR

From a geographical perspective, the U.S. has been the engine driving world stock market returns over the last year. Looking back from June 30 over the 12 preceding months, the U.S. stocks in the MSCI World Index delivered a return of 13.24% (all returns in Canadian dollars). This was not a world-beating return. Among developed countries, several others had higher returns; however, because the U.S. represented 64% of the MSCI World Index by market capitalization, U.S. stock returns were the biggest driver of the index’s overall return. If we look at the results in terms of contribution, multiplying the returns of countries by their average weight in the index over the 12 months, we get the following results:

Source: FactSet

Data presented in Canadian dollars.

In other words, pretty much all the returns in world stocks last year came from owning U.S. companies. Collectively, stocks in the rest of the world were a drag on stock returns globally. This is not to say that there were not individual stocks that did well outside the U.S., but on average, non-U.S. companies contributed negatively to the return of the world stock index.

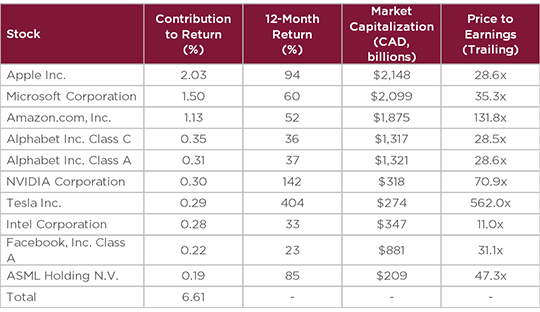

Taking a deeper dive into the U.S. market, one sector stands out: technology. Of the 8.66% contribution of U.S. stocks to the MSCI World Index, 6.64%, or over three-quarters, came from technology companies. In fact, if we look at the top 10 contributors to world stock returns over the 12 months to June 30, seven were U.S. technology companies (with one represented twice, due to its dual-share structure). One was a European technology company and one was Tesla, a U.S. company that is formally categorized as an industrial company but regarded by markets as heavily technology-driven.

TOP 10 CONTRIBUTORS OF THE MSCI WORLD INDEX AS AT JUNE 30, 2020

Source: FactSet

Data presented in Canadian dollars.

If we look at the next 10 contributors to world stock returns, technology continues to be heavily represented, with Adobe, PayPal, Shopify, and Netflix included in the top 20.

WHY DOES THIS MATTER TO BURGUNDY INVESTORS?

This is significant to Burgundy investors on a number of levels. On the positive side, we own shares in several of the top contributors, and these had a positive impact on our investment returns. By investing considerable time and effort to understand the technology landscape in the U.S. and elsewhere, and by owning shares of the great businesses that we can find in the sector, we believe we are well-positioned to generate long-term returns for our clients. We believe that our fundamental, bottom-up research process gives us distinct insights into the competitive advantage of the key companies in this space and that the technology companies that we own have the characteristics – such as strong network effects, high switching costs for customers, and high returns on invested capital – that could enable them to compound value for shareholders over the long term.

EVALUATING THE MARKET’S FIXATION ON TECHNOLOGY

We also see reasons to approach the market’s apparent fixation on technology and growth with caution. As we look at some of the technology companies that we do not own, we see many business models that lack the economic moat that ensures long-term profitability. We come across many companies that are very expensive in relation to current and historical earnings, but also in light of the competitive risks that they face, which could erode their long-term profitability. It appears that markets in recent years have been willing to focus on growth stories, without giving much consideration to profitability. If that changes, we could see a considerable shakeout among technology stocks. We believe that our holdings are well-positioned to weather such a shift in investor sentiment.

The market’s focus on technology and growth has left many strong businesses under-appreciated and, in some cases, undervalued. We believe that our portfolios and Dream Team lists include many such companies, which again positions us well to generate attractive returns for clients when the markets change their focus.

Buffett might chalk up his success to genetic good fortune, but that’s only part of what makes him the Oracle of Omaha. At Burgundy, we share Buffett’s appreciation for time and place, but find our comfort and security in our investment approach. Whether they are in technology or in any other sector, we find companies that we would feel confident in holding for the long term.

BENCHMARK DEFINITION

The benchmark is an index or a blend of indices that represents the investment universe from which managers typically select securities. The MSCI World Index captures large and mid-cap representation across 23 Developed Markets countries. The index covers approximately 85% of the free-float-adjusted market capitalization in each country.

GENERAL DISCLAIMER

The references to companies made in this document are for illustrative purposes only and the companies referenced herein are not necessarily owned by Burgundy. This article is not intended to be taken as investment advice, a recommendation or an offer of solicitation, and it does not consider unique objectives, constraints, or financial needs. Figures may not add up due to rounding. Forward-looking statements are based on historical events and trends and may differ from actual results. Burgundy provides investment advisory services on a discretionary basis to non-Canadian persons and investors (including U.S. persons) where permitted by law. Prospective investors who are not residents of Canada should consult with Burgundy to determine if these securities may lawfully be sold in their jurisdiction. Investing in foreign markets may involve certain risks relating to interest rates, currency exchange rates, and economic and political conditions. Because Burgundy’s portfolios make concentrated investments in a limited number of companies, a change in one security’s value may have a more significant effect on the portfolio’s value.

Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. Burgundy funds are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.