Views & Insights

Periodically we publish content that puts our principles and views into practice, because education is an essential component of long-term investment success.

The Challenge of Wealth Transfer

The Journal | April 2024

Wealth transfer can be a formidable challenge, whether on an individual level, within a family dynamic, or from a business standpoint. Drawing from decades of research experience, Chief Investment Off...

Leading the Way for Generational Wealth

The Journal | March 2024

As a third-generation wealth holder and parent to the fourth generation, Christina Sorbara understands the responsibility of managing wealth, which involves navigating family legacy, philanthropy, and...

Minerva: Issue 7

Minerva | March 2024

Generational wealth means more than the transfer of financial assets from one generation to the next. It is about the transfer of purpose and values that guide our decision-making....

3 for 30

The View | February 2024

Can you distill a three-decade career down to three essential lessons? On the heels of his 30th anniversary, Portfolio Manager David Vanderwood is up to the challenge. In this View...

Transitioning a Family Business

The Journal | January 2024

Are you a family business owner grappling with the challenges of generational transition? You're not alone. The next generation has a different vision for their future, and the family business...

Why Our Culture Is Your Advantage

The Journal | January 2024

How do you build a robust company culture? Off the heels of our recent firm-wide offsite, Robyn Ross, Head of People & Talent, identifies some of our key findings and...

2023 ESG Report

The Journal | December 2023

Read our 2023 report to learn more about Burgundy’s ESG integration over the past 12 months. Highlights include an update on our Sustainability Council, a look at recent developments from our...

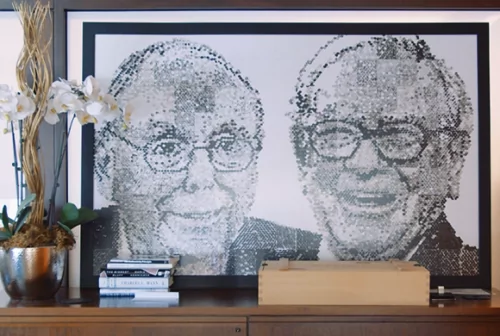

A Giant Departs

The Journal | November 2023

As the investment world mourns the passing of Charlie Munger, Burgundy’s Co-Founder Richard Rooney pays tribute to the business titan. The portrait featured of Charlie Munger and Warren Buffett...