Our goal is to protect and build your capital.

Focused on earning strong long-term absolute returns without taking excessive risks.

Quality/Value Investing

Burgundy invests using a quality/value approach to preserve and grow our clients’ capital over the long term. Quality/value investing is based on investing in great companies when we can buy them for less than they are worth and holding them for the long term.

Guided by our philosophy, we apply the following fundamental investment principles across all investment strategies.

Identify companies with strong business fundamentals, sustainable competitive advantages, and aligned management teams.

Focus on preserving and building client capital by avoiding excessive risks and investing with a margin of safety.

Build concentrated investment portfolios through rigorous, company-by-company analysis.

Conduct diligent, on-the-ground research worldwide to gain first-hand knowledge of companies and their management teams.

Take advantage of market volatility to invest in high-quality companies when they are undervalued, often by standing apart from the crowd and maintaining conviction in our independent research.

Focus on long-term absolute results, not short-term relative results. Maintain a disciplined investment approach regardless of short-term market fluctuations.

The Team

Our Investment Team consists of decentralized, autonomous, regional teams working in a unified, collaborative, idea-sharing environment.

Evaluating Companies

What makes a high-quality company?

We combine quantitative and qualitative research, along with experience and human judgment, to assess each company’s business characteristics, financial position and management team. Intensive, independent research into individual companies and their management is the critical process that supports our investment decisions.

- Strong and sustainable—or increasing—barriers to entry and competitive advantages

- Attractive value proposition to customers

- Manageable macro, political, and regulatory risks—and ideally some opportunities

- Capable and honest

- Good capital allocators

- Practical on ESG matters

- Interests aligned with shareholders and focused on long-term value creation

- Long-term growth in free cash flow and intrinsic value

- High underlying returns on capital

- Resilience, avoidance of high cyclicality

- Conservative debt levels

The Importance of Travel

Travel is a crucial element of our research process. Working from our hub in Toronto, Canada, our research includes frequent travel around the world to gain first-hand knowledge of companies and their management teams.

Time and time again, we have experienced the difference that a “boots on the ground” first-hand perspective brings when evaluating companies.

Assessing Value

Combining Independent Research & Rigorous Valuation Analysis

The value of an investment opportunity comes from the quality of a company’s business and the price we are willing to pay for it.

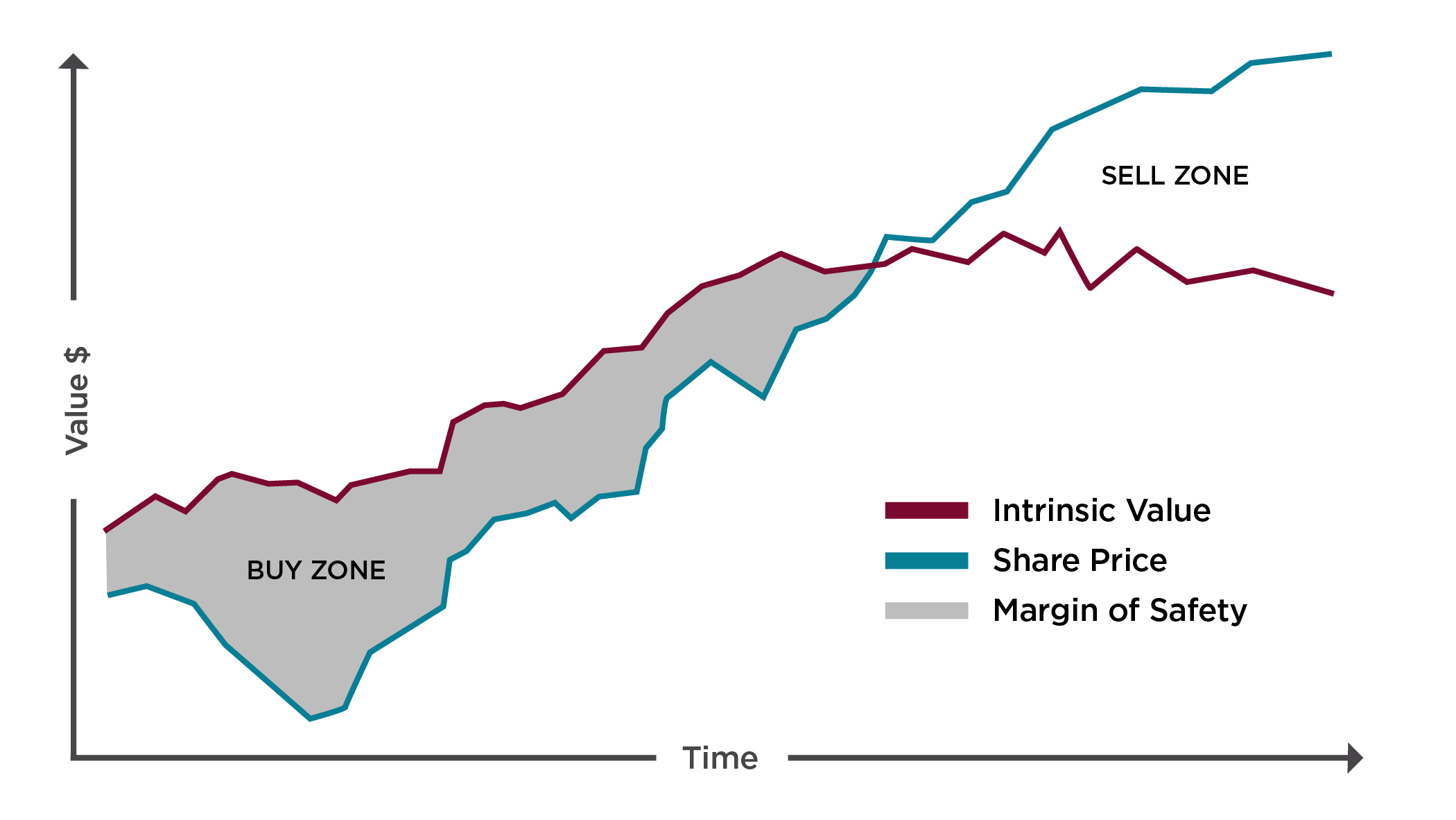

Once a company meets our quality criteria, we turn to our own conservative valuation analysis. The result is an estimate of what we believe the company is worth, known as its intrinsic value.

We’re sensitive to the price we pay and remain patient, investing in a company when its market price is lower than its intrinsic value, giving us a margin of safety.

The discount between a company’s market price and our estimate of its intrinsic value is called the margin of safety.

The greater the difference between a company’s price and its intrinsic value, the greater the margin of safety. Investing this way helps to protect and grow capital over time.

The companies that meet our quality criteria but not our valuation assessment go onto what we call our Dream Team list for further monitoring.

We continually evaluate our portfolio companies to ensure our assessments of their quality and value remain intact.

We consider selling if:

- A company’s share price becomes excessively overvalued

- There is a permanent deterioration in the company’s fundamentals or management

- We find a better investment opportunity

Views & Insights

Dive into the minds of the people making investment decisions on your behalf.

One Approach, Applied Globally

The Burgundy Investment Team is structured into geographic groups with investment expertise in Canada, the U.S., Europe, Asia, and emerging markets. In North America, we narrow our focus further, subdividing by market capitalization.

Our more than three decades of investment experience includes over 25 years investing outside North America, enriching our global perspective.

- Regional Generalists — Our Portfolio Managers and Investment Analysts specialize in their respective regions, allowing for a deep understanding of local businesses, regardless of the sector within which they reside.

- Decades of Experience — Our team has built extensive expertise from years of focused investment in their regions. For many of our senior members, this investment history spans decades.

- Autonomy & Accountability — Portfolio Managers have full decision-making authority over their investment strategy, within the framework of our investment philosophy and the guidelines set by our Chief Investment Officer.

Each year, our Investment Team meets with hundreds of company management teams worldwide to evaluate whether they meet—or continue to meet—our rigorous investment criteria. In 2024 alone, we conducted 1,100 meetings.

These interactions are critical to refining our investment process. From our Toronto office, 30 Burgundy team members collaborate across geographies, leveraging their regional insights to inform and strengthen our investment decisions on a global scale.

For many of our clients, investing internationally is a way to preserve and grow their capital.

Going global offers significant benefits, including access to thousands of high-quality companies and enhanced diversification. We offer a range of investment strategies, including multi-regional, global equity, and balanced, that incorporate investments across our regional strategies.

Additional Investment Resources

Credit Approach

One investment philosophy, applied to credit investing.

Sustainable Investing

We take an ESG integration approach to investing.

Investment Strategies

An overview of our equity, balanced, and credit offerings.

Interested in learning more?