You may be wondering why bondholders are on such shaky ground lately. Hear Portfolio Manager James Arnold explore how we got here and where we might be headed.

2022 has been an atrocious year for bondholders. Often labelled as the ballast of a balanced investment portfolio, bonds have, in many cases, shed over 10% of their value since January. 2022 has been a bad year for asset classes with greater volatility and a truly horrendous period for bondholders.

Investors experiencing pain right now want to know why bonds and equities have performed so poorly over the last several months and what the future holds.

To understand why bonds have performed so poorly in 2022, we need to look at the broader economy, and to understand the relationship between bond and equity performance, we need to understand negative correlation.

WHY HAVE BONDS PERFORMED SO POORLY?

Following extremely easy monetary policy in the wake of the pandemic, interest rates and bond yields dropped to extraordinarily low levels. This generated strong fixed income performance, but with rates near zero and minimal coupon protection, bonds were vulnerable to higher interest rates. As inflation has surged and labour markets have remained strong, central banks globally have been raising interest rates significantly faster than expected. Because bond prices fall when interest rates rise, this has led to significant negative performance across fixed income markets.

WHAT IS NEGATIVE CORRELATION?

When one goes up, one goes down. Generally speaking, returns from equities and fixed income have been negatively correlated. When equity markets post strong positive returns, bond markets tend to post low or negative returns. When equity markets post negative returns, bonds tend to produce positive returns. This is particularly true in times of elevated equity market stress and is most helpful to investors seeking to reduce the drawdown in their portfolios.

“When equity markets post strong positive returns, bond markets tend to post low or negative returns. When equity markets post negative returns, bonds tend to produce positive returns.”

WHY DOES THIS RELATIONSHIP EXIST IN THE FIRST PLACE?

When the economy is strong and growing, corporate earnings tend to increase and equity market multiples tend to expand, leading to higher equity prices. In this type of environment, central banks keen to avoid an overheating economy with high inflation tend to raise interest rates. As interest rates (and therefore bond yields) increase, bond prices fall, which leads to negative or very modest fixed income returns. Conversely, when an economy is slowing or in a recession and corporate earnings are falling alongside contracting equity multiples, we usually experience negative equity returns. Under these circumstances, central banks are eager to stimulate the economy. They lower interest rates to do so, which causes yields on existing bonds to decline and prices to rise, thus generating strong fixed-income returns.

WHY HAS THIS RELATIONSHIP BROKEN DOWN?

Put simply, very high inflation. This past year, we have seen inflation reports continue to surprise to the upside, culminating recently with 40-year highs in inflation (measured by the Consumer Price Index). Inflation of this magnitude creates significant uncertainty in the economy: Will higher costs erode corporate profitability? Will higher prices destroy consumer confidence and limit discretionary spending? Will wages keep up with inflation, and what will happen to corporate profitability if they do?

High and particularly unpredictable inflation drastically increases uncertainty, is bad for the economy, and typically leads to negative equity performance – as we have seen so far in 2022. High inflation is also bad for bond prices as central banks usually increase rates to combat inflation, thus lowering existing bond prices.

This particular bout of inflation has been very high by modern standards, and because central banks long believed that it would fizzle out on its own (note: it didn’t), they have been forced to play catch up and rapidly raise interest rates. This has caused a very strong and very correlated reaction among fixed income and equity markets.

WILL “NEGATIVE CORRELATION” RETURN?

While we certainly cannot provide a timeline, our view is that once inflation ceases to be the driving narrative of the market, bond and equity returns will start to exhibit the patterns we are more accustomed to. For that to happen, inflation must come down to such a degree that central banks no longer view it as such a significant risk factor for the economy. When/if that happens, the narrative will likely shift to economic growth, and bond and equity prices should react in ways more consistent with what we have seen in the past.

WHAT IS BURGUNDY’S CURRENT STRATEGY IN MANAGING BOND PORTFOLIOS?

Our overarching strategy hasn’t changed for a number of years: We are overweight corporate bonds and underweight interest rate risk. We feel our in-depth research style complements corporate credit. Our approach to uncovering improving stories or undervalued bonds does not work as well with government bonds. Given the inflationary environment we are in and rate hikes among central banks, we see more value in corporate bonds right now compared to government bonds.

WHY SHOULD INVESTORS STILL OWN BONDS?

While individual investor portfolios will vary according to their risk tolerance and upcoming cash needs, I can speak to reasons we’ve talked about in the past regarding this question of why investors should still own bonds. To learn more, read the 2020 Burgundy Journal Why Bonds?

- A Hedge Against Deflation: While that might not seem like it’s worth too much at the moment, you’re essentially getting it for free right now.

- Low and/or Negative Correlation to Equity Markets: While the unusual environment of the past several months has blown up that thesis, over time, we should see bonds again act as a ballast in a portfolio, dampening the volatility.

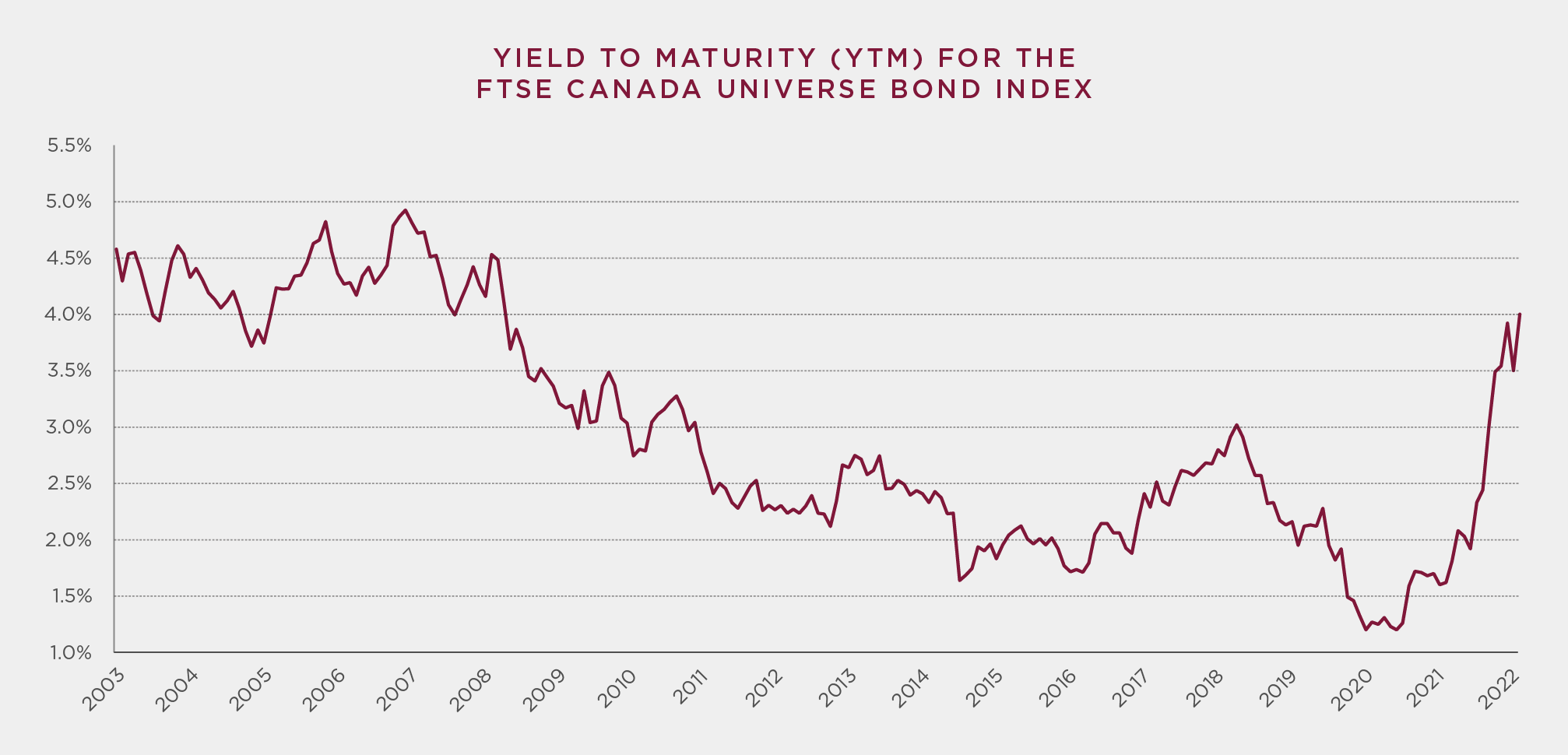

- Income from Bonds: Using market expectations, there is a positive real yield coming from bond funds today. On an absolute basis, it’s been a number of years since we’ve seen bonds yielding as much as they are today. Figure 1 showcases the FTSE Canada Universe Bond Index’s dramatic rise in yields after a steady 20-year decline.

FIGURE 1:

Source: FTSE Canada Universe Bond. Data as at August 31, 2022

Final Thoughts

While we can’t pinpoint the timing of a market reversal, at Burgundy, we are confident that bonds will again exhibit negative correlation with equity markets, particularly in times of market stress, and once again act as a volatility dampener within a broader and well-diversified investment portfolio. When this happens, bonds will have the added advantage of providing more income than we’ve seen in quite some time.

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.