In today’s environment of low interest rates, Portfolio Manager James Arnold tackles the million-dollar question in fixed income by breaking down the fundamental reasons for why investors should own bonds in their portfolio.

In a world of low interest rates, clients often ask us what purpose bonds serve in their portfolio. Who could blame investors for asking this question when the yield on the 10-year Government of Canada bond is a paltry 0.60%. To kick off this series looking at fixed income in a low interest rate environment, we will review and update the rationale for holding bonds, focusing on the steady income and incremental returns they provide, their tendency to be negatively correlated with equities, and their inherent hedge against deflation.

WHY DO INVESTORS HOLD BONDS?

Even when we consider today’s low interest rates, we nevertheless continue to believe that the primary reasons investors hold bonds have not actually changed and that fixed income securities still have a place in investors’ portfolios.

Steady Income and Incremental Returns

Although the amount of income is lower than it has been in the past, bonds continue to pay semi-annual interest. Continued payment only comes into question in the event of a default by the issuer. While defaults are not uncommon amongst lower-quality credits, they are rare amongst higher-quality credits, especially investment-grade-rated issuers. There are also opportunities for an active fixed income manager to generate additional returns above and beyond the yield of a bond portfolio.

Negative Correlation to Equities

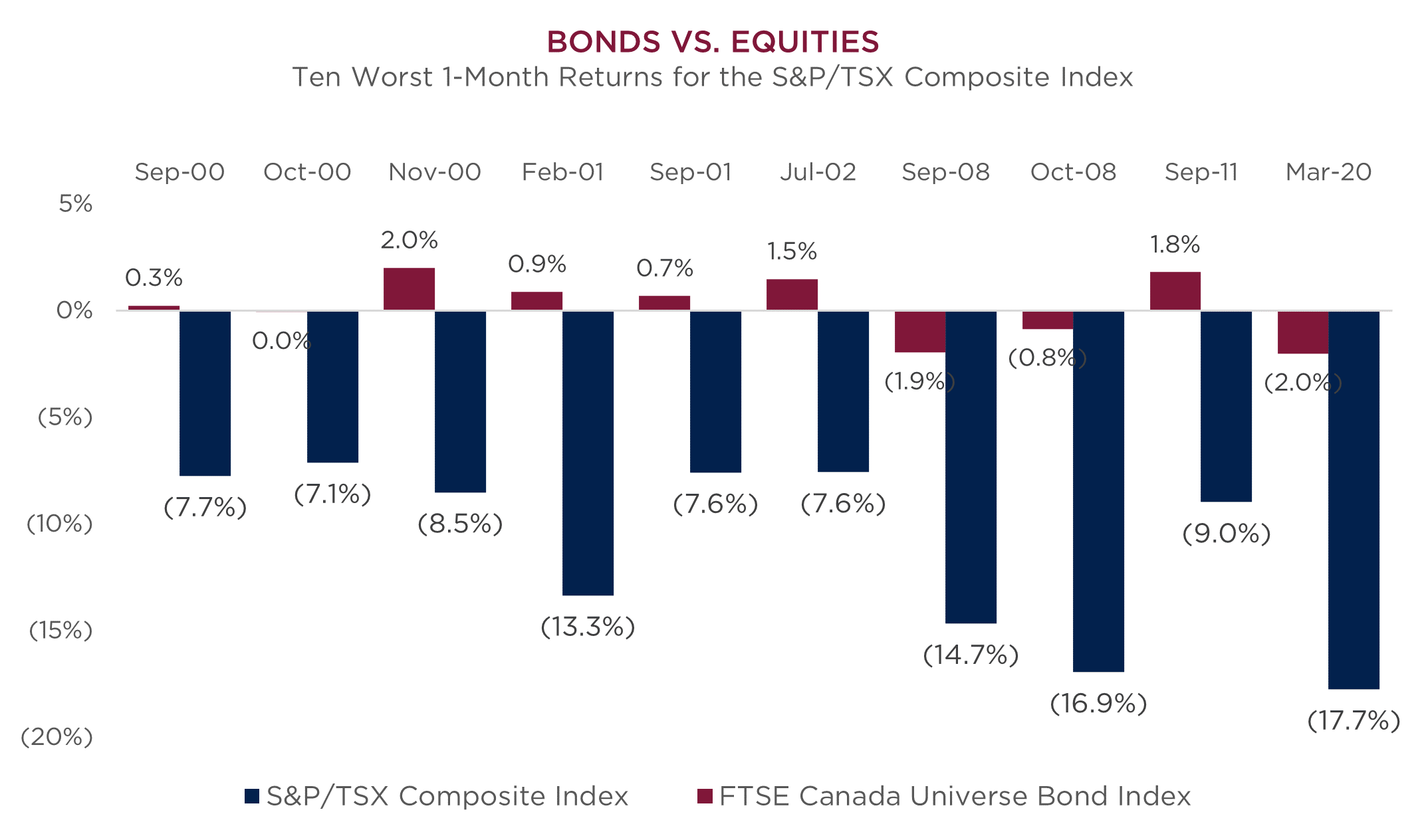

High-quality bonds, primarily those issued by highly rated governments such as those of Canada and the United States tend to move in the opposite direction of equities. When equity markets go up, bonds often decline in value and when equity markets decline, particularly during dramatic selloffs, bonds tend to increase or materially hold their value. This serves two purposes for most investors: first, it decreases the overall volatility of a portfolio; second, it provides capital for rebalancing towards equities while prices are depressed. The chart below shows how bonds have significantly outperformed equities during the largest one-month equity drawdowns since 2000. This includes March 2020, when COVID-19 took hold and led to steep equity market declines.

Source: Bloomberg in Canadian dollars.

Hedge Against Deflation

Deflation is when the general price level in an economy is falling. This usually coincides with and exacerbates a contracting economy as consumers choose not to spend their money but to hoard it, expecting that goods and services will cost less in the future. Bonds are an excellent hedge in this environment because they provide periodic interest payments and principal repayment in today’s dollars.

Even in the face of extremely low yields, these reasons to hold bonds in an investment portfolio remain intact. The income received from bonds will be lower than it has been in the past; however, with today’s low interest rates, textbook economics suggests that returns on other asset classes may be lower as well. Active management in a fixed income portfolio continues to provide opportunities to increase portfolio returns. Negative correlation with equities may not be as strong as interest rates approach the zero bound. In North America, it seems unlikely at this point that bonds will trade with negative yields, but the concept has proven to hold during the most recent pandemic-driven bout of market volatility. Finally, a hedge against deflation may actually be more valuable now than in the past as the focus of central banks to generate inflation suggests that deflationary forces are currently very powerful.

KEEPING THE FAITH

We continue to believe that fixed income should – and does – play an important role in investor portfolios. While the opportunity cost of holding fixed income may have changed and its correlations with other asset classes may not be exactly the same going forward, in our view, the fundamental reasons for holding fixed income securities remain intact. Given the wide range of potential economic outcomes we face in the current environment, we believe that investors continue to be best served by holding a diversified portfolio of assets that are consistent with their long-term risk and return expectations.

INDEX INFORMATION

The S&P/TSX Composite is the headline index and the principal broad market measure for the Canadian equity markets. It includes common stocks and income trust units.

The FTSE Canada Universe Bond Index is broad measure of the Canadian investment-grade fixed income market, covering government, quasi-government and corporate bonds. It is designed to track the performance of bonds denominated in Canadian dollars, with at least one year of remaining effective term to maturity, a rating of BBB of higher and at least 10 institutional buyers. Bonds included must have fixed rate coupons, payable semi-annually with a minimum issuance size of $100 million for corporate bonds and $50 million for government bonds, including municipal and provincial bonds.

GENERAL DISCLAIMER

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.