Richard Rooney, President and Chief Investment Officer at Burgundy Asset Management Ltd., delivered the following speech on the occasion of the firm’s Client Day, April 23, 2009.

Have you ever watched the “talking head” interview shows on financial channels like CNBC? Usually they are structured with several guests who agree with each other and one who has major or minor differences from the majority. You may have noticed that when minority guests have very large differences of opinion, they run the risk of having their opinions treated with incomprehension or outright contempt. In 2006 and 2007, those who went public with their fears for the U.S. mortgage bubble and the likely effect on the financial system were often treated this way. Likewise those brave souls who questioned the tech mania in 2000 and the commodity bubble in 2008.

At market extremes, there is an almost Stalinist drive towards conformity of opinion among market participants. The consensus at such times is supported by long trails of strong returns, so that anyone expressing doubts or suggesting alternatives is espousing what appears to be a demonstrably inferior approach. Besides, all our instincts tell us to agree, to go along, that there is safety in numbers. In the small hunter-gatherer communities that we lived in when these instincts were formed, that was usually true. But in the capital markets, it can be disastrously wrong. In the capital markets, as conformity takes hold and confidence increases, so does danger.

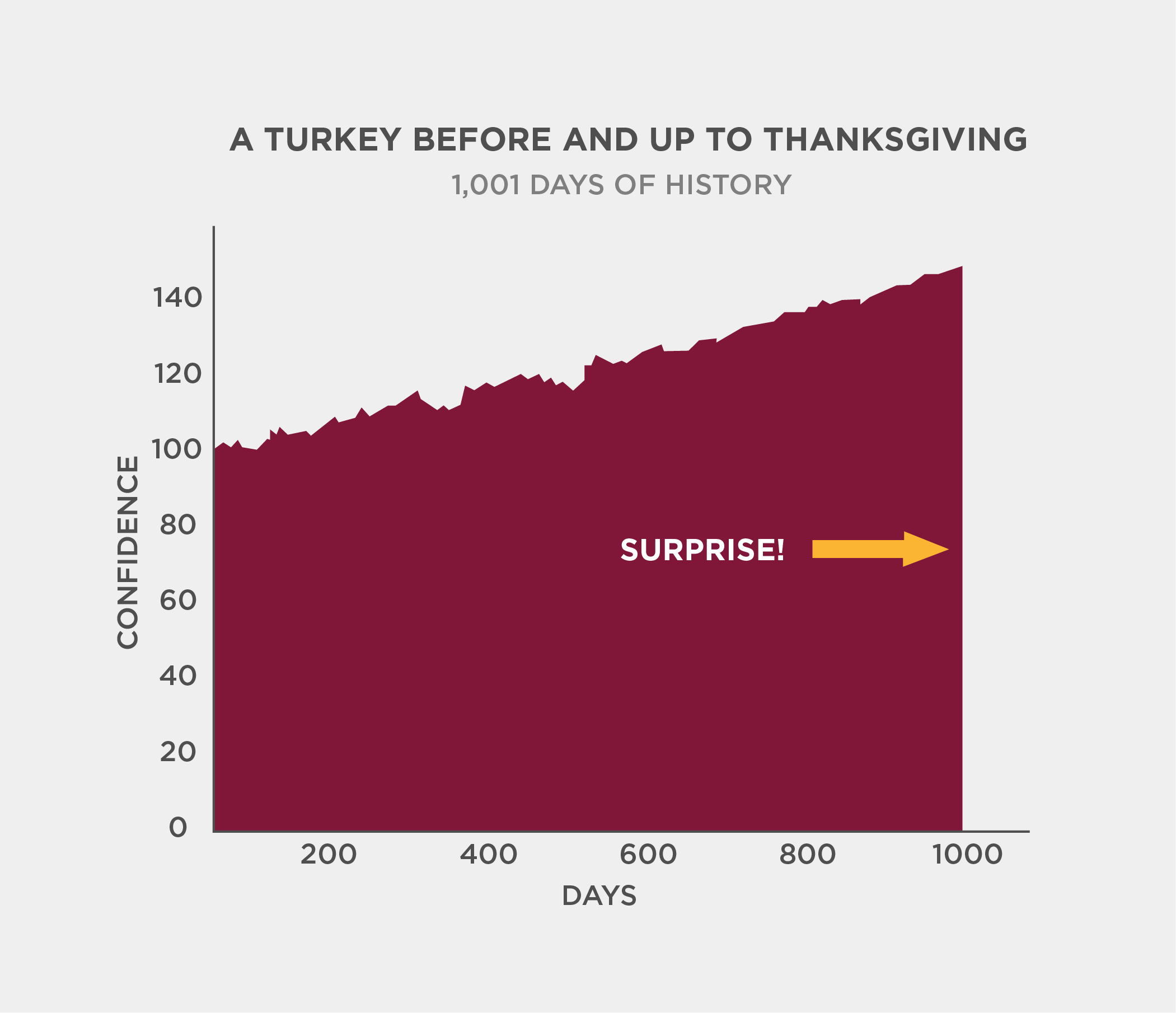

Nassim Nicholas Taleb has written a very entertaining book called The Black Swan about risk, uncertainty and the highly improbable. He has an illustration of misplaced confidence that I think is particularly apt today.

Following is a graph of the confidence level of a turkey in the good intentions of its owner.1 Over three years, as the turkey is housed, fed and given free medical care, its level of trust in these good intentions grows steadily, peaking just before Thanksgiving. At that point, its assumptions are challenged.

Source: Illustrative concept taken from The Black Swan

With apologies to the Chinese calendar, 2008 was the Year of the Turkey. Our assumptions on many levels were challenged, and often disproven. Today I want to discuss what we learned in 2008 about risk and uncertainty in the markets. I will show how our process is designed to protect us from the dangers of consensus, and why in some areas it did not do so in 2008. I will explain how and why we are positioned as we are in 2009.

BEWARE OF CONSENSUS INVESTING

Two years ago, I discussed in my presentation Michael Mauboussin’s analysis of opinion diversity as the key to efficiency in the capital markets.2 When a consensus forms, opinion diversity declines and valuation in the markets gets out of whack. The more powerful the consensus, the more distorted the valuations and the more dangerous the consensus play becomes.

At Burgundy, we feel our valuation approach and philosophy protect us from the worst excesses of consensus investing. This protection was most purely on show in the tech bubble period, when valuations were crazy and not owning tech shares led to massive excess returns when the consensus unravelled.

More recently, a major consensus emerged in the cyclical stocks. The BRIC (Brazil Russia India China) market growth story, with its Malthusian implications, became almost unanimously held and led to substantial outperformance by commodity producers over a period of years. By mid-2008, cyclical stocks were the most highly valued they had ever been, and nemesis followed. As usual, Burgundy was very early in exiting these stocks, but we protected the downside when commodity prices and stocks crashed in the second half of the year.

However, there was another, more insidious consensus underlying the financial markets over the past 25 years. A long period of benign conditions meant that very few people were attuned to deep-seated problems in the financial markets themselves. By the beginning of 2008, interest rates had completed a 25-year decline. Housing prices had been rising steadily for 60 years, in all kinds of macro environments. Securitization had created massive new markets where none had existed before. Economists spoke of the “Great Moderation” as financial assets appeared to have settled into a pattern of low volatility and steady price increases. The capital markets were turkeys on Thanksgiving Eve.

“I think the way Burgundy approaches investing makes us less likely than most to be Thanksgiving dinner.”

Now, aside from the superb performance of our Asian Equity Fund, I would not classify Burgundy’s performance in 2008 as good, or even acceptable. Although we usually outperformed the benchmarks and most other long-only managers, and although declines in our portfolio values were more than reversible, we will never look at a negative number as satisfactory. But, we did avoid the worst of what happened in that awful year.

I believe that is no accident. I think the way Burgundy approaches investing makes us less likely than most to be Thanksgiving dinner. This has to do with the way we distinguish risk from uncertainty. Let me elaborate.

According to economic theory, risk describes a situation where you have a sense of the range and likelihood of possible outcomes. Uncertainty describes a situation where it’s not even clear what might happen, let alone how likely the possible outcomes are. Trying to distinguish between the two is a primary task of investors.

MEDIOCRISTAN VS. EXTREMISTAN

Again, Taleb’s book provides a useful illustration. He divides the world into two realms: Mediocristan and Extremistan. In Mediocristan, normal statistical distributions apply; in Extremistan, they do not. In Mediocristan, there is risk; in Extremistan, there is uncertainty.

For example, if you filled the Rogers Centre with randomly selected adults, their heights and weights would fit within a normal distribution. You could wager with near certainty that nobody more than eight feet tall or less than two feet tall would be in attendance.

But if you measured their wealth rather than heights and weights, you might get a very different picture. If Warren Buffett or Bill Gates were among the sample, their wealth alone would dwarf that of all the others combined. If wealth were normally distributed, the likelihood of anyone ever being as rich as Warren Buffett or Bill Gates is infinitesimal, but in fact capitalism routinely produces superwealthy individuals at a rate many times the frequency predicted by normal distributions. So if you wagered that the net worth of your sample would be a normal distribution, you would be right very often, but would be running a substantial risk of being very wrong. Height and weight are in Mediocristan; wealth is in Extremistan.

The whole thrust of academic finance for two generations has been to apply normal statistical measurements to the capital markets, or in other words, to pretend that the markets are in Mediocristan. Modern Portfolio Theory defines risk as volatility, and volatility is assumed to occur within normal statistical bounds. Most derivatives were designed with that principle in mind, as were most quantitatively derived portfolio structures. The horrifying results of these assumptions are all around us in the wreckage of the “alphabet soup” of CDOs, CLOs, ABCPs and ARSs manufactured on fallacious statistical grounds, whose price collapse has savaged the world’s financial system.

Burgundy, on the other hand, has always defined risk as the risk of absolute capital loss, of being wiped out. Integral to our thinking is the fear that we may be in Extremistan with any investment. Irreversible capital losses, such as those suffered by “alphabet soup” investors in 2008, are the hallmark of investing in Extremistan, where, as they say, the tails are fat. The task of the prudent investor is to minimize, to the degree possible, the likelihood of such losses.

At Burgundy, we do so by drawing a distinction between the uncertainties inherent in the market, and those in the companies we invest in. The capital markets can price any security at any level on any day, so I agree that they are in Extremistan. But think about the kinds of companies in which we typically invest: they have frequent transaction cycles, large numbers of customers, broad-based distributions, international diversification and so on. This means that to a significant extent, our businesses compete in Mediocristan, where things are a great deal more predictable than in Extremistan. The market values that are set in Extremistan fluctuate, but the business value that occurs in Mediocristan does not. To translate that idea into Burgundy’s terms, the business value is the equivalent of our intrinsic value. The difference between the market price and that business value is our margin of safety.

“The task of the prudent investor is to minimize, to the degree possible, the likelihood of such losses.”

A brand name global consumer franchise undertakes uncertainties in more manageable quanta than a mining company with properties in Venezuela, or a construction company with a huge project, or an investment bank. All businesses undertake the dangers of regulation, political intervention, product obsolescence, operational disruption and systemic breakdown. The combination of all these things leads to uncertainty, and uncertainty can never be completely banished from any investment. But uncertainty can be diminished by the inherent nature of the business. Businesses with some inherent predictability are what we look to invest in at Burgundy.

DECLINE IN FINANCIAL SECTOR

No doubt you are saying to yourselves, if all that is true, why did we see substantial declines in value in some Burgundy portfolios in 2008? The reason is that there was an area where we were investing in Extremistan to a degree we did not appreciate until the damage had been done. The investments we made in the financial sector cost us dearly.

These investments were concentrated in Europe and Canada. Craig Pho, our Asia manager, has never had much exposure in financials, no doubt because Asia has experienced several financial crises in the past two decades, so he was naturally suspicious of big banks and insurers. Stephen Mitchell deserves a tip of the hat for smelling smoke from the U.S. financials and exiting them before much damage was done. But we did not appreciate the dangers of international contagion until we had taken some losses elsewhere.

In fairness to our Canadian and European teams, who acted with my full support, we were looking for financials whose characteristics we thought were indicative of a Mediocristan situation – strong deposit bases, diversified product profiles and oligopoly positions in multiple markets. None of that mattered in 2008. In a globalized financial system, all financial businesses are related and all their stocks are correlated. And it turns out there was a lot we didn’t know about the balance sheets of the banks and insurance companies coming into this crisis.

We now have the smallest investment in big balance sheet financials we have had since the late 1990s. That is in part because in this indiscriminate bear market there has been a lot of opportunities to buy high-quality, simpler and more predictable businesses. But it is also in part because we have had a forceful reminder of the inherent uncertainties of the financial sector. These investments cost our clients a lot of money in 2008 and for that we are sorry. We learn backwards; we live forwards.

“In a globalized financial system, all financial businesses are related and all their stocks are correlated.”

THE NEW CONSENSUS

Speaking of living forwards, how are most investors looking at the world today? Today the consensus among most investors is a bearish one. The bear narratives are supported by terrible trailing returns and will continue to be until at least the end of 2009. That’s just math. Every time the markets lurch lower, the bear case finds more adherents. The Elgin Theatre was sold out for a forum called “An Evening with the Bears” in early April. The state of opinion in the markets still shows a remarkably bearish tinge, though the extreme panic of early March has abated somewhat with rising equity and corporate bond prices.

The main problem the bears have is that they can’t decide what kind of disaster is about to befall us. Some feel we are facing a deflationary depression like in the 1930s, or at least like Japan’s. Others feel we are on the cusp of hyperinflation. It reminds me of that memorable Woody Allen proverb:

“More than any other time in history, mankind faces a crossroads. One path leads to despair and utter hopelessness. The other, to total extinction. Let us pray that we have the wisdom to choose correctly.”

Surprisingly few of the people who are most bearish now actually saved their clients any money in 2008. Many of the bears decided that the safe place was outside the U.S. in commodity plays, and they lost their clients 40–60% in 2008, sometimes even more. Warren Buffett calls it the Noah rule: Predicting rain doesn’t count; building arks does.

I honestly admire some of these bears for their courageous and lonely stance in 2006 and 2007; but while Burgundy didn’t do as good a job as these folks at predicting rain, we built a better ark than they did, because we used better materials.

“Warren Buffett calls it the Noah Rule: Predicting rain doesn’t count; building arks does.”

SUPERIOR VALUATION

The only thing all the bears currently seem to agree on is that you shouldn’t touch equities. Outside some specific commodity plays, they are virtually unanimous about that. We, of course, disagree. So once again, we find ourselves positioned against the consensus. And once again, our positioning is based on our most reliable support – superior valuation.

Valuations of high-quality equities are extraordinarily low; and therefore, we are fully invested and holding our weightings in equities at maximum levels. Global brand name companies are the best value we have ever seen. For the first time in decades, both Ben Graham-style investors (who emphasize low price-to-earnings ratios, high-dividend yields and strong balance sheets) and Warren Buffett-style value investors (who tend to add qualitative assessments of economic advantage to traditional valuation measures) are investing in these global consumer franchise companies. So Ben Graham purists like Prem Watsa (who got both the diagnosis and the prescription right last year) and Jim Grant (editor of Grant’s Interest Rate Observer and two-time speaker at Burgundy’s Client Day) are buying the same kind of stocks as Warren Buffett and Charlie Munger.

Given the track records of these two major schools of value investing, it is very exciting to see them converging in their stock picks. We expect good news.

NO TURKEYS HERE

Investing in the face of irrational valuations caused by runaway consensus in the markets has been the most salient characteristic of the past decade. We have arguably seen more powerful and virtually unanimous consensuses form in that period than in any previous decade of the last century. It is ironic that in an era where infinitely more information is available to the average investor with an internet connection than I ever had access to for the first 15 years of my career as an investment professional, there seems to be less rather than more diversity of opinion in the capital markets. Behaviour is absolutely lemming-like.

Burgundy has a generally positive and honourable report card from its behaviour at market extremes when consensus rules. I have been very proud of the character and firmness shown by our people in the face of relentless negative feedback from the rest of the financial community at these times. We have never wavered in applying our investment philosophy and approach and have generated a superior track record. We can always do better, of course, and will always try to, and we are frustrated as you are with the level of absolute returns. But with portfolios of strong and predictable businesses selling at outstanding valuations and with a powerful and probably mistaken bearish consensus opposing us, we are confident that there are no turkeys in this room.

1. Taleb, Nassim Nicholas. The Black Swan: The Impact of the Highly Improbable. Page 41. Random House Publishing Group. 2007.

2. Mauboussin, Michael. More Than You Know. “Investing – Profession or Business?” Pages 85–86. Columbia University Press. 2006.

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.