At Burgundy, we believe understanding the management teams behind the companies we invest in is essential. But what does that actually entail? In this deep dive, Portfolio Managers Ching Chang and Dimitar Shapov highlight this critical aspect of our investment process through the lens of Burgundy’s Emerging Markets portfolio, where this role is even more pronounced.

OVERARCHING THEMES:

- Management is one of the most important investment criteria.

- When assessing management teams in emerging markets, we need to go beyond traditional markers of management alignment such as incentives, share ownership, track record, and capital allocation.

- Serving the customer should be a top priority.

- Great management teams are made up of adaptable and innovative thinkers.

- Promoting culture and developing a rich talent pool distinguishes a company.

- Sustainable competitive advantage comes from passion, strategy, and a long-term mindset.

A company’s performance is heavily influenced by its management team making critical decisions and taking actions that drive the company’s direction. While we believe this applies to all the regions we invest in, in emerging markets, management’s influence is magnified for a few reasons.

First, emerging markets are inherently more volatile, experiencing a faster pace of change due to less entrenched structures, exposure to dynamic consumption patterns, sometimes unstable political or macroeconomic environments, and new competition. Countries in emerging markets also lack the mechanisms for change that we often see in developed markets, where, for instance, activist investors or private equity firms can monitor underperforming or unethical management teams. Additionally, many companies in these markets are characterized by higher growth rates and often operate in fragmented industries. In such fast-paced growth environments, management decisions, strategies, and execution become even more important. For instance, a company growing at 5% a year would take 14 years to double in size, which often exceeds the tenure of most Chief Executive Officers (CEOs). A company growing at 20% a year, however, would double its size in just four years. While this example highlights how management decisions profoundly affect the short term, their strategies can have a huge difference in the company’s long-term outcomes as well.

When investors look for indicators of management quality, they typically consider incentives (such as management compensation), share ownership (as a way to gauge alignment of interests), track record (past performance of management), and capital allocation. Although we also consider these aspects and recognize their importance, we view them as lagging indicators of company and management success. We don’t think they provide the level of insight that we need to truly understand the future direction of execution.

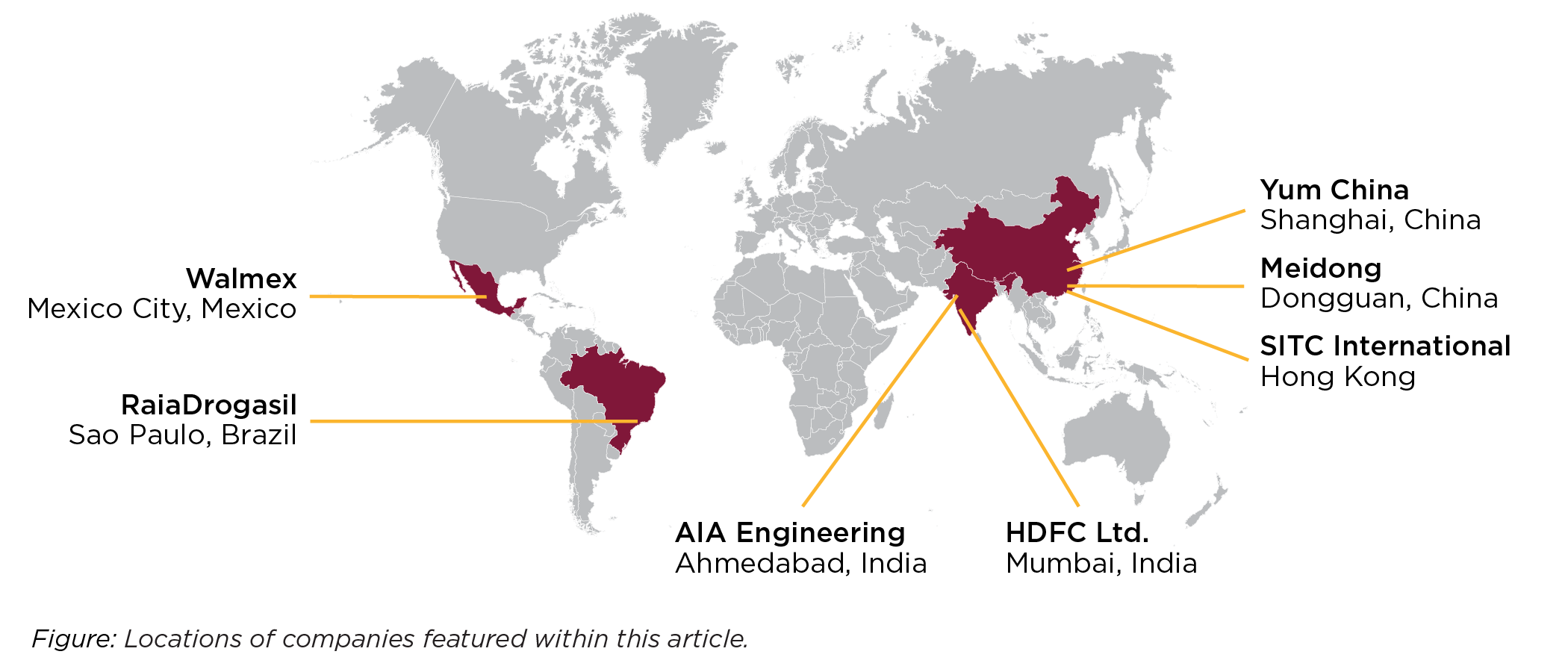

Below we break down what we believe are the leading indicators of a high-quality management team. We are highlighting companies with customer-centric approaches, differentiated and adaptable mindsets, high talent density, and passionate leadership teams with long-term visions.

Intense Customer Focus

Even if it means forgoing some revenue and profits in the short term

Since customers represent the ultimate source of all value for any company, to maintain and grow, companies must continually create value for their customers and increase their willingness to pay. Though many management teams claim to be “customer focused,” they often mean they are trying to maximize the value of each customer solely for the benefit of the company, and at that point in time. At Burgundy, we focus on identifying companies that prioritize long-term value creation, even if it means sacrificing some short-term revenues. We examine value creation from a holistic customer perspective and prioritize companies that share their value creation, which helps them increase consumer surplus (the difference between the maximum price a consumer will pay for a product or service and the actual price they will pay) and foster long-term loyalty. Management teams that truly prioritize customers (and not the value of the customer to the company) are also able to meet their ever-evolving needs.

When organizations are small, every customer is critical to their survival. However, as organizations grow, internal issues and politics begin to take more time and attention away from the management team and away from customers. The best management teams can resist this institutional creep by focusing on the needs of their customers. We look for management teams that have this dedication to the customer, and we see this characteristic in many of the companies in our portfolio.

One example from our portfolio is India-based AIA Engineering, a niche supplier of engineering components primarily to the global cement and mining industries, which specializes in the manufacturing of high-chromium mill internals (such as grinding media balls and liners) used as wear parts (i.e., they must be replaced) in crushing clinker into cement and grinding mining ore. This portfolio company is still under the control of its original founder, and management has maintained an impressive focus on creating customer value since it was founded 40-plus years ago.

AIA benefits from the low cost of operations (relative to its competitors), but management’s strategy is to share some of that benefit with its customers, going beyond just providing products by offering customized solutions that include services such as design, customization, and installation of components. We are consistently impressed by management’s dedication to enhancing customer value. Their primary focus transcends simply maximizing profit per customer. They are also paying attention to increasing yields for clients, decreasing wear rates for their grinding media, and helping customers save on power costs.

“[A]s organizations grow, internal issues and politics begin to take more time and attention away from the management team and away from customers.”

Another portfolio example is Yum China, a large restaurant group based in China. Through consistent menu innovation and a focus on providing good value for customers, management has ensured delicious and interesting food items for its consumers. Like many of its peers, Yum China has recently experienced input cost pressures. Still, the company is working with suppliers to continue to keep the consumer in mind. We see these efforts in Yum China’s burger line. Despite being traditionally known for its chicken items, KFC (Yum China’s main brand) has managed to build out a tiered burger series, which includes wagyu and Angus beef burgers. Fifteen months after its launch, it surpassed 1 billion RMB (or roughly US$140 million as of September 2022) in revenue. Yum also responded to the substantial increase in the price of palm oil, which is used for deep frying, by introducing a roasted chicken to the menu. Given the circumstances, the company was able to attractively price the healthier chicken alternative.

Some management teams forget to prioritize their customers and adapt to their needs, but the best management teams never do. These are the management teams we look for.

Differentiated and Adaptable Thinkers

We also look for management teams that are willing to challenge the basic assumptions of how to do business in a particular industry. Great management teams adapt their strategies to shifting market dynamics. This ties in with the previously mentioned emphasis on customer-centricity and catering to evolving consumer needs. This adaptability is also evident when management teams display the courage to discard unsuccessful strategies, viewing past mistakes not as failures, but as valuable lessons for future success.

Luxury auto dealership Meidong is one example from our portfolio. When CEO Ye Tao’s brother asked him to help run Meidong, Ye Tao diligently studied the auto dealer industry in China. He observed that auto dealers were often capital-intensive, with poor cash flow generation, and that they usually didn’t attract the best talent. He set out to fix each of these issues by implementing a standardized process for his team. Ye Tao turned his attention to inventory, which is the biggest cost for auto dealers. Since cars sitting on the lot are financed by the auto dealer, the faster the dealers can sell the car, the less financing costs they must pay, and the higher the return they can earn per amount of capital needed to finance the inventory. In the words of Ye Tao: “Fast-turns make us a cash-printing machine; slow-turns turn us into a cash-sucking black hole.”

While dealers typically turn their inventory four to five times a year, Meidong turns their inventory over 15 times per year, resulting in significantly better returns on capital. To turn its inventory faster, Meidong prefers to discount earlier instead of discounting later and leaving the cars sitting on the lot. The difference in price is only a few percent, which is more than made up for by the increase in inventory turns. Ye Tao also prioritizes getting sales by making sure customers visit the dealership and encouraging Meidong’s salespeople to reach out to customers. Sales data is also monitored by the hour to ensure that the company is tracking sales targets. Part of this process involves placing a heavy emphasis on upgrading the quality of people working at Meidong. By building a culture and tracking the right key performance indicators to get the most out of his people, Ye Tao has been successful in achieving industry-leading returns on capital.

One way we try to find promising investment opportunities is by exploring sectors known for their service intensity that are not typically known to produce many high-quality companies. Here, we look for operators that deliver differentiated results through differentiated thinking. One such portfolio example is SITC International, an intra-Asia shipping freight supplier.

SITC operates smaller ships that make more frequent trips compared to its peers who operate larger ships. SITC can offer faster service for customers who value speed over just price and, therefore, SITC can charge a premium versus more commoditized container shipping companies. The company trades off load factor (how full a ship is) for more frequent trips. On top of a price premium, SITC turns its ships around faster (smaller ships are faster to load and unload) and can access ports that larger ships cannot go into. The company’s ship turnover is over 20 times per year, while its peers average five to 10 times per year. SITC also provides more integrated logistic services to its customers, such as warehousing and arranging ground transportation to increase its value add to customers. Many of SITC’s customers have been with the company for over a decade.

“Beyond mastering the intricacies of their own industries, great management teams also derive insights from successful companies in other industries, continuously looking to expand their knowledge base and improve their operations.”

Another quality we look for, closely linked with innovative thinking, is a focus on continuous learning. Beyond mastering the intricacies of their own industries, great management teams also derive insights from successful companies in other industries, continuously looking to expand their knowledge base and improve their operations.

Walmart de México y Centroamérica (or “Walmex”), one of Mexico’s largest retailers and a publicly listed subsidiary of Walmart, is an example from our portfolio. Walmex’s management successfully adapted the parent’s original American big-box business model to satisfy the unique needs of Mexican consumers through a multi-format strategy. This multi-format strategy led to the establishment of Walmart hypermarkets, Superama and Walmart Express supermarkets, Sam’s Clubs, and the highly successful Bodega Aurrera discount stores, each catering to distinctive customer preferences. This localized strategy and adaptability has been instrumental in Walmex’s success in Mexico.

More recently, management further adapted to changing shopping habits and transformed Walmex from a traditional brick-and-mortar retailer into an organization with an omnichannel shopping offering. Walmex now has over 1,000 stores with on-demand capabilities (and more than 1,400 with in-store pickup services), but rather than attempting to create a digital platform for its own sake, the company has remained firmly committed to its core proposition: focusing on helping consumers save money and providing value on everyday essentials. A prime example of this customer-centric approach and adaptability is their innovative solution to a common problem faced by their Bodega customers, many of whom are less affluent and do not own cars. Recognizing that these customers often had to pay for a taxi to visit a supermarket, Walmex simply matched the starting fare cost for their delivery service, directly addressing a significant pain point for their customer base.

Building Talent Density & The Importance of Culture

Another important attribute of a high-quality management team is their ability to build talent density. This entails not just attracting but also retaining the best employees. Companies run by exceptional management often exhibit employee turnover rates that are considerably lower than the industry average. Our interactions with former employees (part of our broader due diligence process) reveal compensation alone isn’t enough. Rather, it’s the vision of the management team and/or founder that truly captivates and motivates them to stay.

We believe that fostering a distinctive company culture is another integral component of developing a rich talent pool. Culture is a magnet, drawing in individuals who identify with a company’s values. It’s this cultural alignment that not only attracts the right kind of talent but also encourages them to stay, thereby cultivating a workforce that is committed and engaged over the long term. We view a company’s culture as its operating system, and the physical assets as the hardware. Culture guides what the company does and how it does it. For instance, a culture that emphasizes customer service can shape the everyday decisions employees make. Replicating a company’s culture and management quality (getting a multitude of small things right) is far more challenging than merely copying a physical asset. The culture and quality of management distinguish a company and add an extra layer of resilience that is hard to replicate.

“The culture and quality of management distinguish a company and add an extra layer of resilience that is hard to replicate.”

A great portfolio example is HDFC Ltd.*, the leading mortgage issuer in India. We believe that what really sets HDFC apart is its distinctive entrepreneurial culture, characterized by conservative lending practices, an emphasis on efficiency, and a focus on embracing technology in its operations. Over the years, HDFC evolved beyond its original mortgage business into a financial conglomerate. Management strategically leveraged surplus capital from the mortgage business to sponsor other lucrative ventures (run by people who identify with the company’s culture), thereby creating substantial value. HDFC successfully incubated a multitude of financial businesses spanning banking, asset management, and both life and general insurance. We believe that this unique culture, shaped by a disciplined and entrepreneurial management team, has been instrumental in the company’s success, and in attracting and retaining top-tier talent.

Passion, Strategy & Long-Term Thinking

Lastly, we look for management teams that have a deep passion for their business and demonstrate a commitment to long-term thinking. We find that these management teams are not lured by the allure of making a “quick buck.” They are intent on building sustainable and enduring competitive advantages, even if it requires them to sacrifice short-term results. We are aware that long-term thinking sometimes means waiting years for the seeds of what these management teams have planted to start to bear fruit, and we are happy to wait.

Although it is inherently challenging to measure, assessing management’s passion for their business is a critical element of our evaluation process. Passion often follows a normal distribution, making it inherently difficult to evaluate for most management teams that fall within the middle range. However, it becomes easier at the extremes. At one end, you have those who clearly lack the necessary fervour. These are the ones we strive to avoid. On the other end, there are those whose dedication to their business is palpable, often to the extent that they consider their company to be their life’s work. Our focus and investment preference lies with these passionate founders, controlling families, and management teams, as they are often the driving force behind successful and enduring enterprises.

One such example in our portfolio is RaiaDrogasil, the largest drugstore chain in Brazil. The company was established in 2011 following the merger of two long-standing pharmacy chains, Droga Raia and Drogasil. Both founding families remain in the control group today, with a combined stake of over 25% and six out of 11 board seats.

In our view, Raia’s management stands out as one of the finest across our coverage universe. Their long-term track record of sustained outperformance in a complex industry, and within an even more challenging country to conduct business, speaks volumes about their capabilities. The team has demonstrated a combination of strategic foresight and excellent execution, which has facilitated their above-industry growth. At the same time, we have witnessed a strong desire to continue to learn and improve. We have had the opportunity to have in-depth discussions with the company on what we are seeing from pharmacies in other markets that we cover and how these companies elsewhere are dealing with the challenges of digitalization, e-commerce, and building and sustaining corporate cultures.

Over time, this thinking has led to enhanced competitive advantages that are driven by scale. In fact, Raia’s size surpasses the combined scale of the second through fifth players in the Brazilian market. Management has also effectively sustained Raia’s rapid physical store expansion while concurrently establishing a robust e-commerce operation. Given today’s market capitalization at over US$9 billion and the substantial ownership stake held by the families, they don’t necessarily have a financial need to be actively involved daily. However, our regular interactions with Eugenio de Zagottis, a senior executive from one of the families, indicate an unmatched passion, intensity, and long-term vision for the business. The families are fully committed for the long haul, thoroughly enjoying every step of the journey, and we share their enthusiasm.

Concluding Thoughts

We believe that investing in the management team is just as important as the characteristics of the business, perhaps even more important in emerging markets. While they offer valuable insight, conventional markers of management quality alone fall short of fully appraising a management team. For a more accurate assessment of a management team’s calibre and projection of future operational performance, we focus on management teams that exemplify a customer-centric ethos, an adaptable mindset, high talent density, and a passionate leadership team with a long-term vision.

When we are assessing management, we look for a combination of these characteristics and strive to identify an industry’s leading management team. And given the many intricacies and dynamic nature of capital markets, the role of management will continue to be of paramount importance in our assessment of investment opportunities.

*Note: On July 1, 2023, HDFC Ltd. completed its merger with HDFC Bank, resulting in the company adopting the name “HDFC Bank.”

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.

Investing in foreign markets may involve certain risks relating to interest rates, currency exchange rates, and economic and political conditions. Because Burgundy’s portfolios make concentrated investments in a limited number of companies, a change in one security’s value may have a more significant effect on the portfolio’s value.

Investing in foreign securities typically involves more risks than investing in Canadian and U.S. securities, and includes risks including but not limited to those associated with political/economic developments, volatility, trading practices, information availability and accessibility, market limitations, and currency considerations. Investing in Greater China and its surrounding regions, however, involves an even greater degree of heightened, specific risks which may result from but are not limited to the following: China’s dependence on exports and international trade, increasing competition, imposition of tariffs and other financial limitations, volatility, government control, regulatory risk and a heightened regulatory regime, political/economic relationships, trading suspensions/government interventions and decisions, and/or the risk of nationalization or expropriation of assets.