The world is facing a pandemic unlike anything we have seen before. As public health officials continue to learn about the trajectory of COVID-19, Burgundy has kept a watchful eye on the uncertainty by monitoring the response from the financial markets, which has included bouts of extreme volatility.

At Burgundy, when confronted by market volatility, we use our available tools to assess how incremental changes affect the businesses we own or would like to own. While the conditions today are affecting many companies differently than the conditions of past recessions or other economic events, we maintain an investment approach focused on quality and value. This piece illustrates our decision-making process for a potential investment idea. In this discussion, we will refer to the company simply as XYZ.

XYZ is a cosmetics retailer that has grown rapidly over the last decade to become a major industry player. Its revenue growth has averaged 20% per year and its earnings have compounded at 30%-plus annually. It carries no debt, is run by a savvy management team, and is a company we admire greatly. Should we buy it?

We know a great business can make for a poor investment if it is not purchased at a sensible price. But what is a sensible price? In mid-2019, the price for one share of company XYZ was nearly double its price at the end of March 2020. When high-quality business experiences a price decline of this magnitude, we pay attention.

Before we dig into XYZ, let’s review Burgundy’s valuation process. After diving deep into a business and its industry dynamics, we build a discounted cash flow (DCF), model. This DCF model is our primary tool to assess what the entire business is worth by estimating the future cash profits (also called free cash flow, or FCF) it will earn over its lifetime.

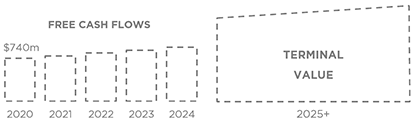

During our research process, we estimate how much FCF the business is likely to generate over the next several years. This work requires us to make many assumptions covering a range of scenarios. It is impossible to predict each variable accurately beyond the next few years, but our qualitative research can give us insight into whether a great business has an enduring moat beyond the foreseeable future. We then use a formula to conservatively estimate the company’s long-term value (known as terminal value), which points to FCF beyond the next few years. The terminal value typically represents the most significant part of a company’s worth.

Before COVID-19 hit, we estimated XYZ would earn $740 million in FCF in 2020 and would grow at 6% annually over the ensuing four years.

PRE-COVID-19

$269 PER SHARE INTRINSIC VALUE

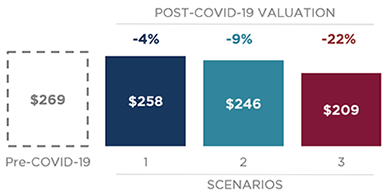

Since a dollar today is worth more than a dollar five years from now, we discount the value of all future profits by our annual return hurdle (i.e. 8% or greater) to derive its worth today. As profits accrue to all shareholders equally, we simply divide by the number of shares outstanding to calculate the value per share or intrinsic value. Before COVID-19 hit, our estimate of XYZ’s intrinsic value was $269 per share.

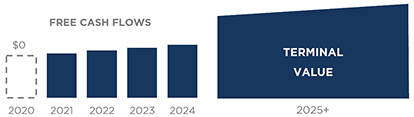

The impact COVID-19 will have on the demand for XYZ’s products is unknown, but we can test the share price sensitivity by changing one variable while isolating the others. In our first scenario, we assume all profits (i.e. FCF) are wiped out in 2020. What happens to intrinsic value?

SCENARIO 1

COVID-19 ELIMINATES 2020 PROFITS | $258 PER SHARE INTRINSIC VALUE

Despite effectively being down $740 million in profits this year, the intrinsic value per share only falls by 4% to $258 using a DCF approach. This result may seem surprising, though it makes sense for a company that is expected to grow its FCF in the future. As already noted, the most significant part of a company’s worth comes from cash flows that occur beyond the foreseeable future. If we think the global economy will return to pre-COVID-19 levels by 2021, then the share price decline in mid-March seems overdone – assuming the company was fairly valued, to begin with.

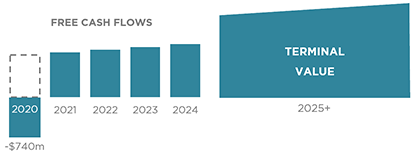

Let’s see what happens when we simulate a more challenging scenario for XYZ: 2020 revenue dries up entirely and the company continues to pay costs like rent, wages, utility bills, etc. The net effect is a loss of $740 million in FCF this year.

SCENARIO 2

CORONAVIRUS CAUSES 2020 LOSSES | $246 PER SHARE INTRINSIC VALUE

A $740 million loss this year would value the company’s shares today at $246, a 9% decline compared to the pre-COVID-19 outlook of $269.

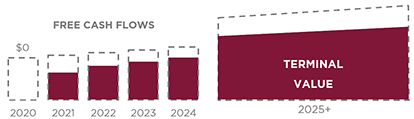

While each of these scenarios is a possibility, Burgundy’s investment team projected a different impact from COVID-19 on XYZ’s operations. Our analysis suggests the company will sell enough in 2020 to roughly cover its scaled-back cost structure. However, we anticipate XYZ’s profitability will be impaired in future years from lasting effects on consumers. In this analysis, the intrinsic value falls to $209 (down 22%) as illustrated in scenario three below.

SCENARIO 3

CORONAVIRUS CAUSES LASTING IMPAIRMENTS | $209 PER SHARE INTRINSIC VALUE

In each of these scenarios, the short-term impacts of COVID-19 negatively affect the company’s intrinsic value, but the impact is muted when you consider the ability of the company to generate longer-term FCF. Markets often overreact to short-term events and this can give rise to opportunities for long-term investors.

In mid-May, shares of XYZ traded near our $209 estimate of intrinsic value. We didn’t arrive at our figure by using the market consensus as a feedback loop. Instead, we used our independent analysis and sensible business judgement to derive our estimate. In this case, our analysis just happens to be consistent with the market’s expectations of XYZ’s future profitability.

To recap, scenarios one through three are compared to our pre-COVID-19 intrinsic value calculation.

INTRINSIC VALUE PER SHARE

PRE & POST-COVID-19

DID WE INVEST? WE DID NOT.

At Burgundy, we follow a margin-of-safety discipline, investing in companies that trade ideally at a 30% discount (or more) to our estimate of intrinsic value. If XYZ had traded at $146 or less it would have been a potential investment candidate. An attractively valued business cannot be considered in isolation, however. Each investment idea is compared to our existing investments as well as our potential ideas. A change within a portfolio must be accretive to the portfolio’s overall quality and/or value, and it must not over-expose the portfolio to any major risks.

While our calculations do not tell us what the market will do next week or next month, they do provide us with a North Star to guide our investment decisions. This approach is crucial in volatile market conditions when wavering emotions could potentially cloud our view of the future beyond COVID-19.

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.