Views & Insights

Periodically we publish content that puts our principles and views into practice, because education is an essential component of long-term investment success.

Beyond the Returns: Selecting a Money Manager

The Journal | May 2013

When selecting a manager, most people start, logically enough, with the returns. That is the money manager’s product, after all. But all too often the disclosure that past performance...

On Gold

The Journal | April 2013

Given the dramatic drop this week in the price of gold, we thought it timely to revisit Burgundy’s view on the topic. At Burgundy, we are often asked about...

Warren Buffett: Contrarian Thinking & Investing in Action

The Journal | April 2013

Warren Buffett's annual shareholder letter is always a major event at Burgundy and this year was no exception. The release of the letter on March 1st, a Friday afternoon, meant...

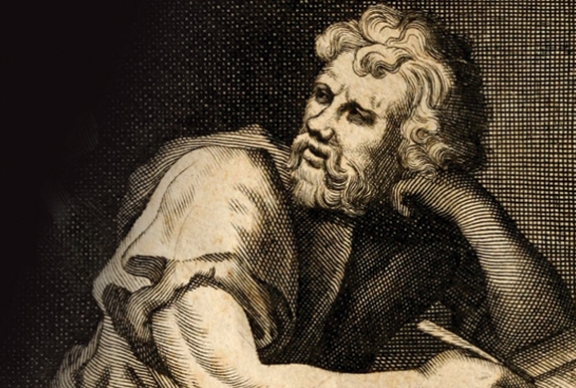

PDF: Stoicism and the Art of Portfolio Intervention

The View | February 2013

Warren Buffett and other successful quality/value investors have given us a capital compounding system that works. But few follow the program. In this issue of The View from Burgundy,...

Narrowing the Scope for Effective Decision-Making

The Journal | February 2013

In a post last month, Anne Maggisano provided one step towards better investment decision-making: to consider the range of possible outcomes and the probability of their occurrence before making a...

The Multi-Stage Time Horizon

The Journal | January 2013

If you have spent any time in consultation with an investment firm/advisor, you will have had some experience with what the industry refers to as the Know Your Client (...

Go Global

The Journal | January 2013

Burgundy has long been a proponent of global investing. We believe that limiting the geographic scope of your equity investments will both reduce return potential and add to portfolio risk....

Make the Choice to Think Deliberately

The Journal | January 2013

In November I had the great fortune to participate in the Investment Decisions and Behavioural Finance course at the Harvard Kennedy School in Cambridge. It was an intense and exhilarating...