Views & Insights

Periodically we publish content that puts our principles and views into practice, because education is an essential component of long-term investment success.

Boots on the Ground

The View | June 2016

Travel plays an essential role in Burgundy’s bottom-up investment research process. Our portfolio managers and analysts regularly travel to find new investment ideas, conduct due diligence on portfo...

PDF: Not the Time to Sell

The View | December 2015

Suncor Energy Inc. (Suncor) announced a hostile offer to buy all of the outstanding shares of Canadian Oil Sands Limited (COS) on October 5, 2015. As the owner on behalf of our...

PDF: Ain't Misbehavin'

The View | October 2015

Value investing is simple: buy stocks when they are trading for less than their intrinsic value. But simple doesn’t mean easy. There are many roadblocks standing in the way...

PDF: Top Quartile: A Survey of Canadian CEO Compensation Programs

The View | September 2014

In 1998, we wrote about the unintended consequences that options have on manager behaviours in an issue of The View from Burgundy entitled “Stealing a Fortune.” We illustrated our thoughts with...

PDF: Confessions of a Buffetteer

The View | July 2014

The value investing tent is inhabited by several different tribes: the Orthodox, the Bears, the Gold Bugs and the “Buffetteers.” These groups are united by a common admiration for Ben...

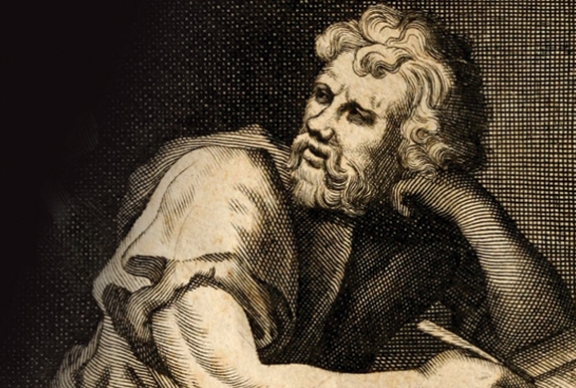

PDF: Stoicism and the Art of Portfolio Intervention

The View | February 2013

Warren Buffett and other successful quality/value investors have given us a capital compounding system that works. But few follow the program. In this issue of The View from Burgundy,...

Surviving Success: Investment Management and Value Added

The View | October 2012

The job we do as trustees is one of the hardest I can think of. I say we, because I have served as trustee on several pension and endowment funds....

PDF: Is Japan Our Future?

The View | July 2012

It has been 14 years since Burgundy began investing in Japanese stocks. While we have generated a reasonably positive rate of return, the experience has been challenging and at times frustrating....