Curious about how the U.S. presidential election could impact your investments? While it’s easy to assume that politics and stock market performance are closely linked, historical data tells a more nuanced story.

In this piece, Investment Counsellor Caroline Montminy highlights the surprising findings on market returns under different administrations and what they mean for your investment strategy.

Last week, the much-anticipated U.S. presidential debate highlighted the deep political divide in the world’s largest economy. As the candidates presented their visions for the country, it’s easy to see why many believe the outcome will significantly affect the stock market. Many of the business owners and executives I advise feel this way. After all, political decisions directly impact regulations, taxes, tariffs, and subsidies—factors that businesses must manage to stay competitive.

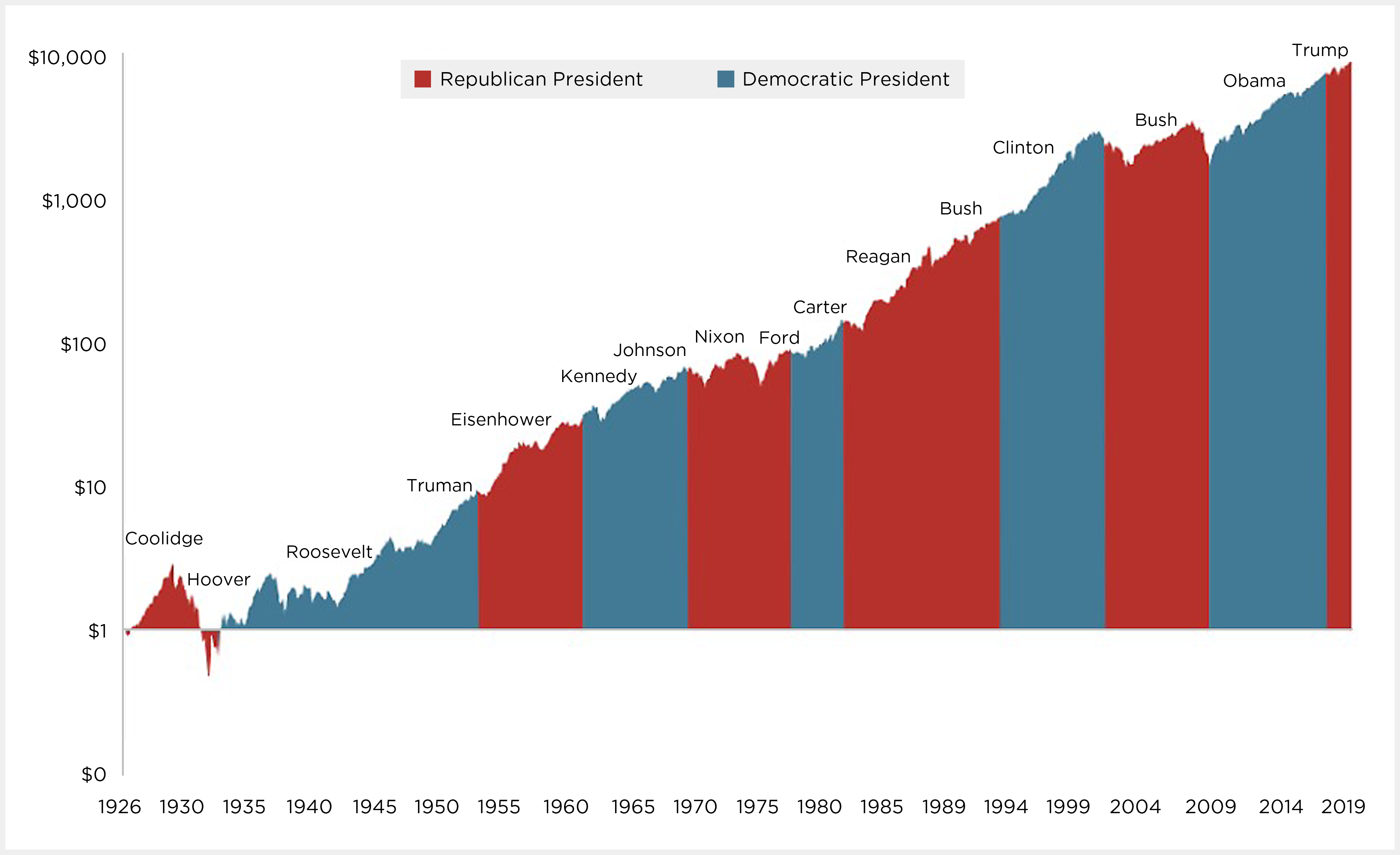

However, when it comes to investing, the relationship between politics and stock market returns is not as straightforward. While elections or policy announcements can cause short-term market volatility, it’s essential to remember that businesses, which make up the stock market, are resilient and adaptable to political changes. Often, the actual policy impact and companies’ responses are different from what is anticipated. As shown by the Dimensional Fund Advisors and Forbes graph in Figure 1, stock market downturns do not discriminate against any political party, and neither does the long-term upward trendline.

FIGURE 1. GROWTH OF A DOLLAR INVESTED IN THE S&P 500 INDEX SINCE 1926

Stock market returns by president from January 1926 – December 2019 in U.S. dollars. Source: Dimensional Fund Advisors; Forbes article dated June 28, 2021; S&P data © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Despite this, there does appear to be some correlation between U.S. politics and stock market performance. The common belief is that Republicans are more business-friendly, and short-term market reactions tend to be more positive under Republican presidents. However, over a full term, Democratic administrations have historically correlated with better stock market returns. Bob French of Retirement Researcher found that between 1926 and 2023, the average S&P 500 return was 9% under Republican presidents and nearly 15% under Democratic presidents (in U.S. dollars). A study by Santa-Clara and Valkanov (2003), covering a different dataset, found a Democratic premium of 9%, a significant difference. Santa-Clara and Valkanov’s search for explanations—such as market valuations, credit spreads, and risk—yielded no clear answers, leading them to call it the “Presidential Puzzle.” French provides a more straightforward explanation: “Democratic Presidents have presided over periods when the world performed better relative to expectations than it did under Republican Presidents. You can spin that statement however you want.”

While the Democratic premium is intriguing, should it guide your portfolio strategy ahead of the next U.S. presidential election?

Personally, I’d welcome a 15% return over 9%, but either end of that range is still acceptable. For those considering making a political statement with their investments, remember: political opinions are best exercised by voting, not by trading.

Subscribe to Views & Insights

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.