Before sailors discovered the North Star, they navigated by sight alone—straining to find land, never sure they were on course. With Polaris came direction, and the confidence to cross rough seas without fear of losing their way.

At this year’s Forum, Chief Investment Officer Anne Mette de Place Filippini reminded us that Burgundy also follows a North Star. In today’s volatile markets, our guiding principles keep us on course: invest in quality businesses, stay diversified, and maintain a long-term perspective.

Note: This speech was delivered on May 28th in Toronto and has been edited for clarity. Return data has been updated to June 30, 2025, where appropriate.

With elections on both sides of the border, the return of Donald Trump to the White House, and a continued wave of geopolitical and economic uncertainty, there is no doubt that the ground is shifting and that major changes are afoot.

The post-World-War-II consensus in trade, economics, and social policy is being upended. Topics like trade wars, deglobalization, onshoring, and supply chains are dominating headlines. It has been 12 months since we last met at this venue, and a lot has happened. Despite all this, for many of you in this room and watching online, returns have been strong.

At the end of June, Partners’ Global, our model equity portfolio for private clients, is up over 16.6% for the year (roughly 16% net of fees) in Canadian dollars. And even through the market weakness in April, the portfolio remained in positive territory and ahead of its benchmark year-to-date. So, what’s the secret? Not having all your eggs in one basket—being diversified.

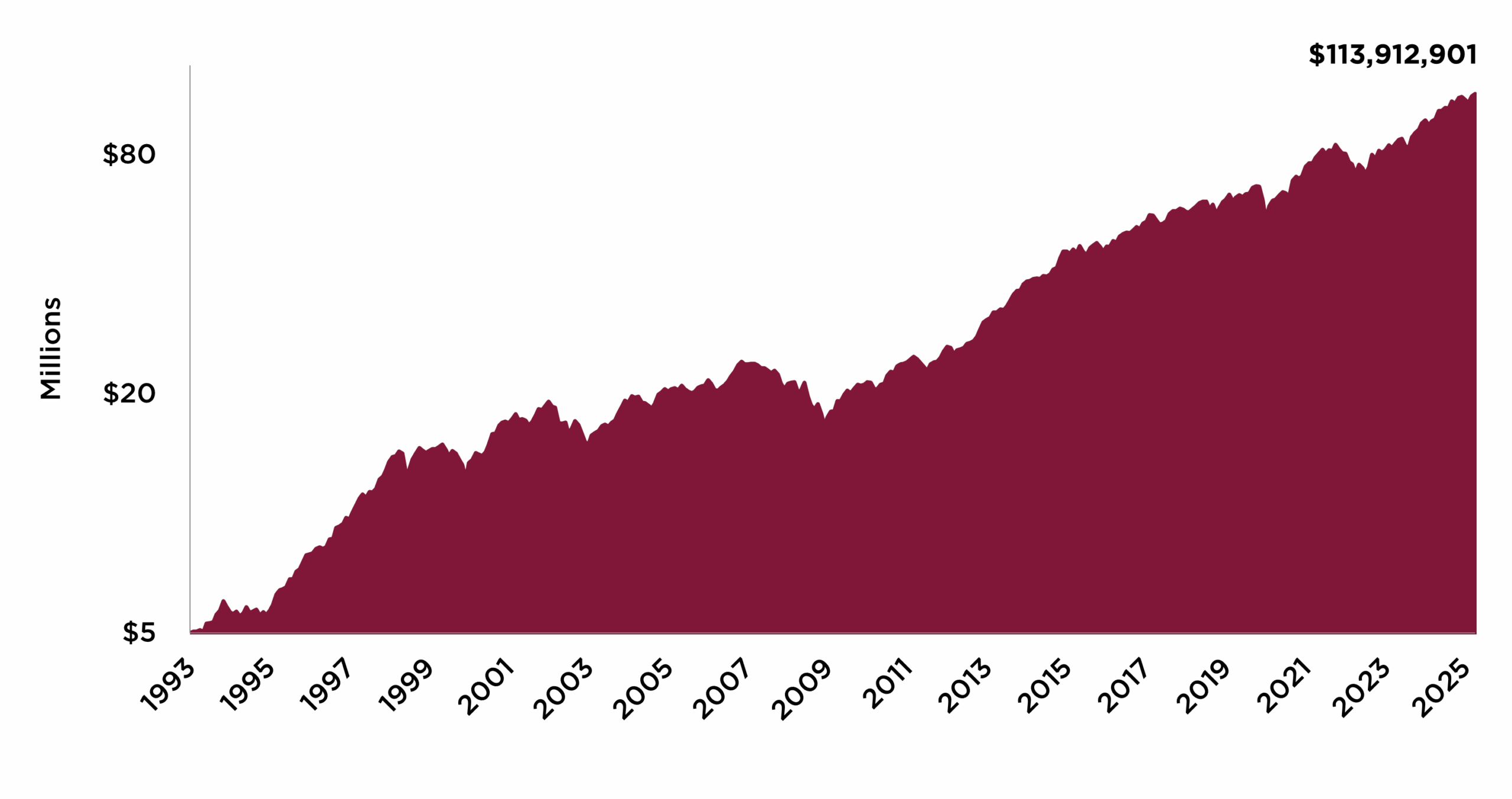

Over the past year, all regional geographies at Burgundy contributed positively to performance. And, looking further out, the power of compounding has added up to big numbers over time. An investment of $5 million at inception is now worth well over $100 million, net of fees (Figure 1).

Figure 1. Growth of $5 Million Since Inception, Net of Fees

Figure 1 shows the growth of $5 million for Burgundy’s Model Equity portfolio, the Burgundy Partners’ Global Fund since inception (March 31, 1993) to June 30, 2025. Figures are reported in Canadian dollars and includes the deduction of tiered management fees: 1.25% on the first $2 million, 0.75% on the next $3 million, 0.50% on the balance (per year).

Figure 1 shows the growth of $5 million for Burgundy’s Model Equity portfolio, the Burgundy Partners’ Global Fund since inception (March 31, 1993) to June 30, 2025. Figures are reported in Canadian dollars and includes the deduction of tiered management fees: 1.25% on the first $2 million, 0.75% on the next $3 million, 0.50% on the balance (per year).

This is all good news, but I can see why being diversified can sometimes be frustrating. At any given time, a portion of your portfolio will be underperforming, and you will ask yourself: Why didn’t we own more winners and fewer laggards? And when your winners keep winning for long stretches of time—like the last 15 years, when U.S. stocks (especially U.S. tech stocks) kept winning—one might start to question the very concept of diversification.

BEING DIVERSIFIED

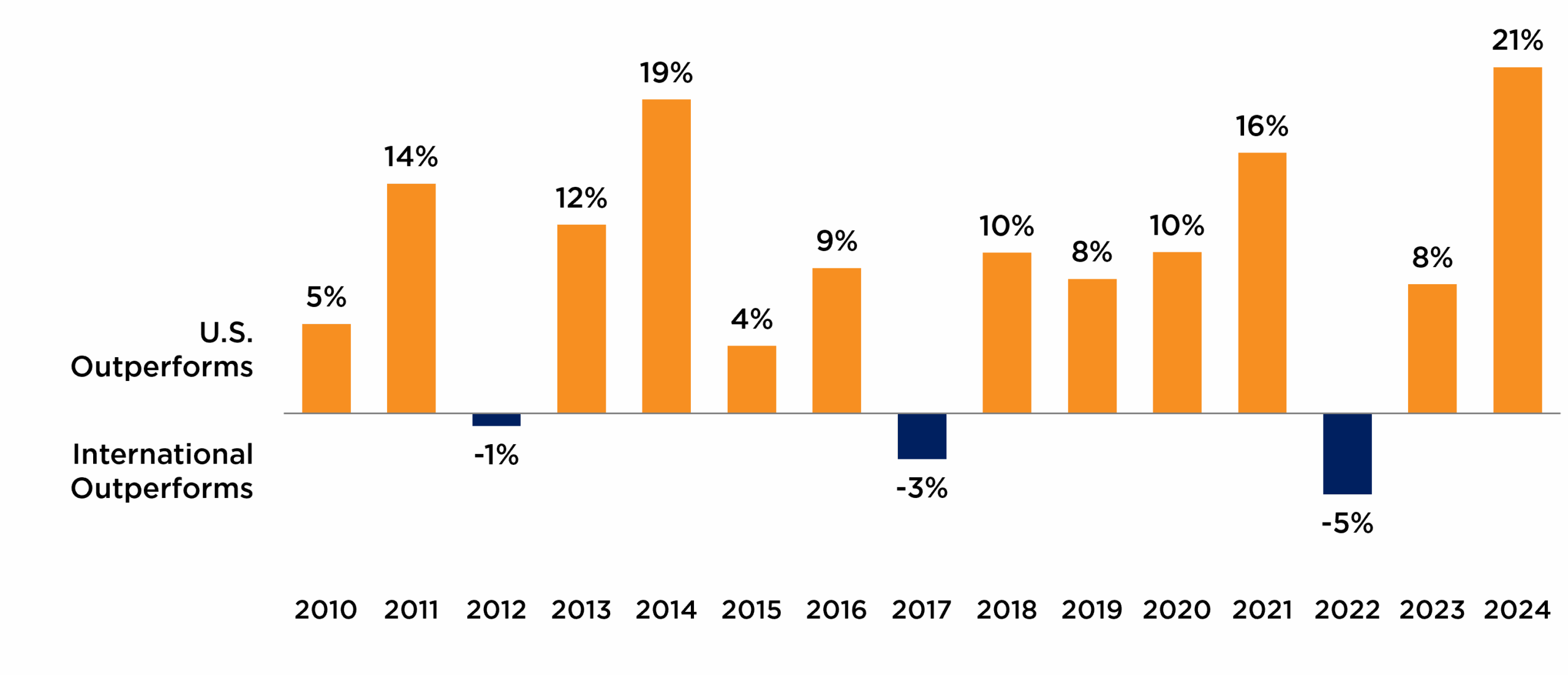

In Figure 2, we show U.S. outperformance against international stocks. As the yellow bars illustrate, U.S. stocks did better for 12 out of the last 15 years. The blue bars show the three years when international markets did better. But older investors like me also remember the 2000 to 2009 decade when investors lost money in the U.S.

Figure 2. U.S. vs. International Stocks (2010-2024)

Source: FactSet in Canadian dollars. For each calendar year, returns represent the S&P 500 minus the MSCI World ex USA Index.

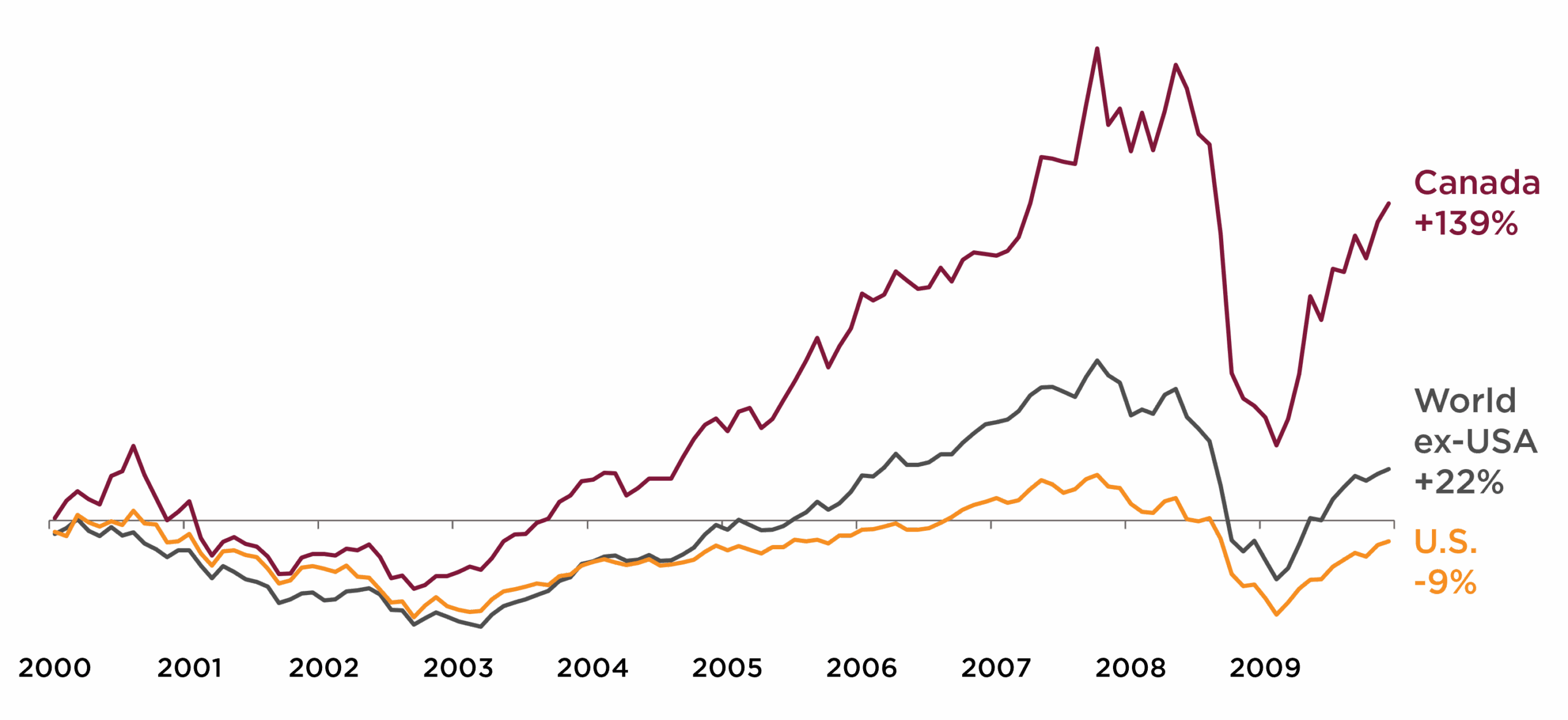

In Figure 3, you see cumulative returns over the 2000 to 2009 decade. The U.S. S&P 500, in yellow, was down 9% after 10 years. In this period, Canada, in burgundy, and emerging markets (not shown) were the outperformers. Over long periods, U.S. and international equities tend to have similar returns, with each experiencing periods of outperformance. Let’s remember that.

Figure 3. The Lost Decade for U.S. Stocks: Cumulative Returns in U.S. Dollars

Source: FactSet in U.S. dollars from January 1, 2000 to December 31, 2009.

In hindsight, everything is 20/20. Foresight is a lot harder, and that’s exactly the point. Interestingly, so far this year, it is the U.S. stock market that is lagging and showing signs of real weakness, rather than the allegedly lagging economies of Europe and Asia. Europe, in particular, is having a very strong year relative to the U.S. We continue to advise you, our clients, that owning a diversified portfolio of good businesses—selected across sectors, market capitalization, and, importantly, geographies—is the best way to preserve and grow capital over the long term. That is exactly how Partners’ Global is positioned today.

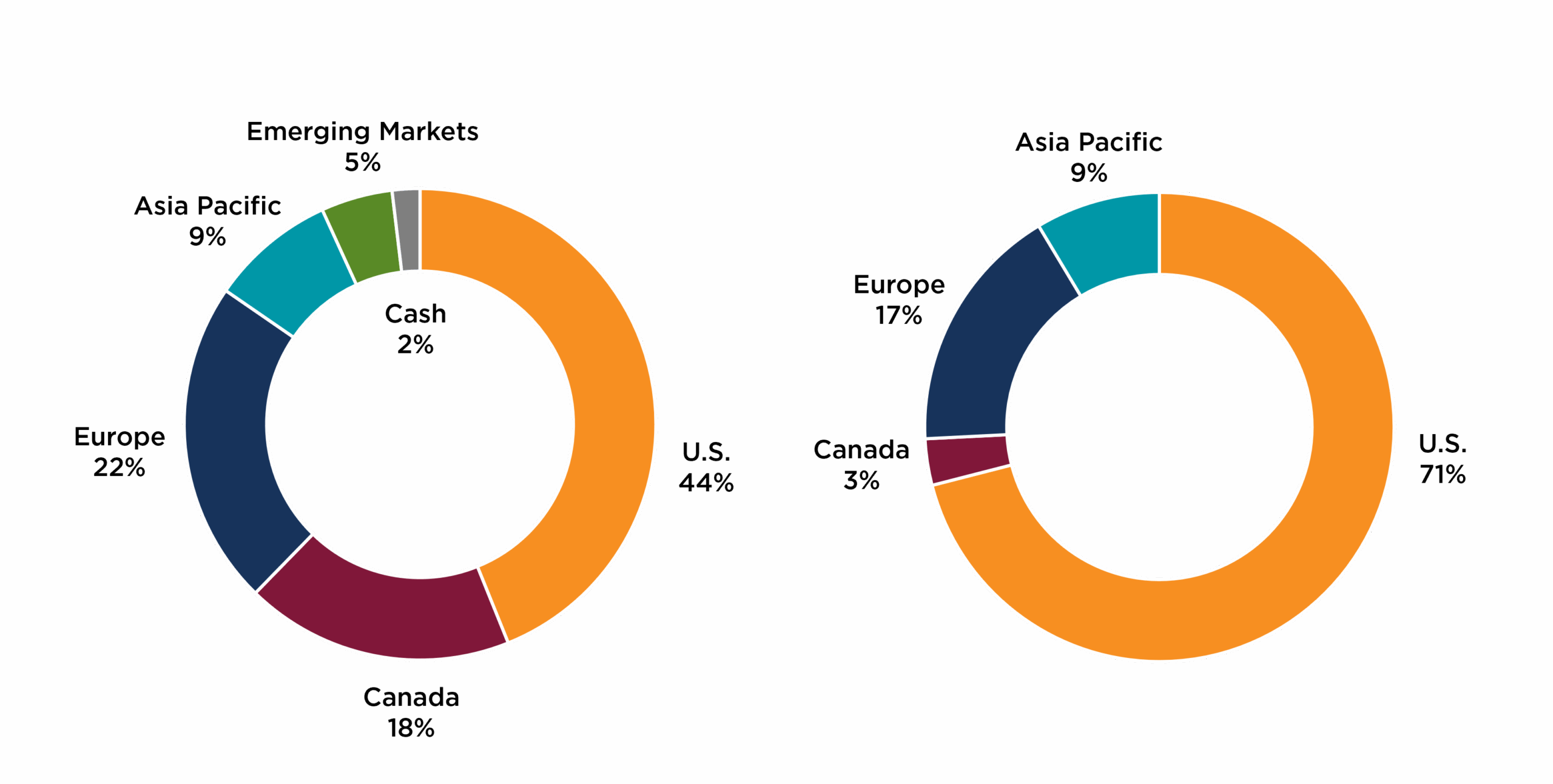

As you can see in Figure 4, we have meaningful positions in not only the U.S., in yellow, but also in Europe, Asia, and emerging markets, the blues and greens, as well as in Canada, our home base, in burgundy.

Contrast that with the global index shown in Figure 5. It is supposed to be broad, but it now has a 71% weight in one country, the U.S. That doesn’t seem that broad to me. After a very long stretch of U.S. outperformance—specifically, the long run of a few U.S. mega-cap tech companies—the index is now more lopsided than at any time since 1970.

Figure 4. Burgundy Partners’ Global Strategy (left) and Figure 5. MSCI World Index (right)

As of April 30, 2025. Index data is sourced from FactSet.

Undoubtedly, America has some of the greatest companies in the world—and Partners’ Global owns some of them—but even America doesn’t monopolize great businesses. There are more than 47,000 publicly listed companies in the world and around 6,000 in the U.S., representing 13% in numbers, 50% in market cap, and 71% in the global index. The way I look at this is that there are large hunting grounds in the rest of the world. We can look globally for great businesses—there are underappreciated opportunities to be discovered. On the dimension of size, we are also more diversified.

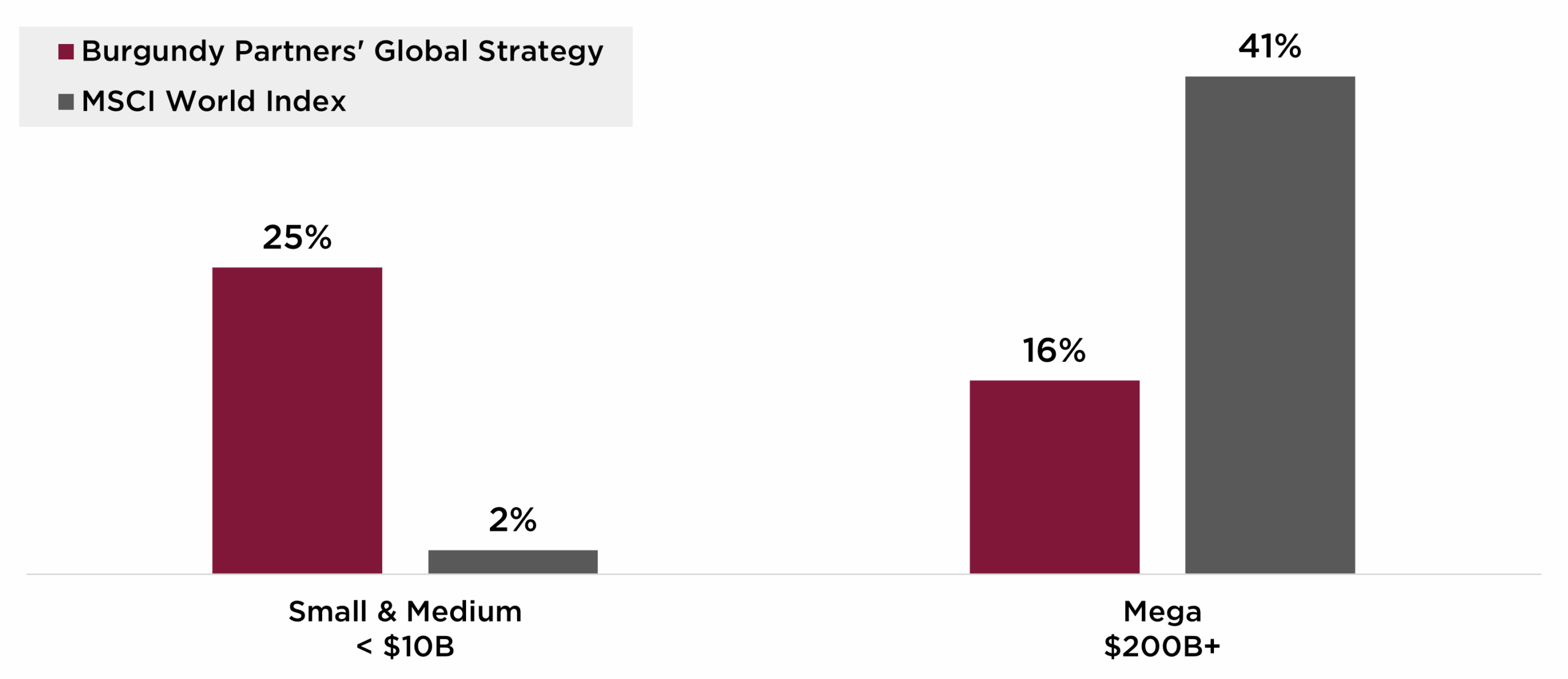

Figure 6 highlights that in our Partners’ Global strategy, small and mid-cap companies (in burgundy) make up 25% of our portfolio versus barely anything for the index (in grey). On the right side, you see how concentrated the markets have become in mega-caps, 41%, whereas we have kept a more balanced 16% weight.

Figure 6. Across the Market Cap Range

Source: FactSet as of April 30, 2025.

Ranges are in U.S. dollars.

In Partners’ Global, you own a piece of 225 well-positioned, well-managed companies. The top 30 stocks make up close to half of the portfolio. We own companies that we understand and know well, large and small, spread across the globe, with exposures to different consumers and demand cycles. And we believe they are worth more than they are trading for. This is a simple but proven approach, and it really stands apart from a price-agnostic passive approach of just owning the market. Volatility is surely unpleasant, but our approach is designed to take advantage of market swings because it recognizes that price is not the same as value. This is really important to remember. And for our institutional clients, this principle applies equally to our Global Equity Strategy or our Balanced portfolios.

Now let’s be clear, we don’t want to take a good idea too far. It is about achieving a balance, not being at either end of a pendulum.

KEEPING THINGS SIMPLE

Warren Buffett has called diversification a “protection against ignorance.” While ignorance is something we can guard against by diligent research, it seems prudent to take some protection against not being Warren Buffett. We want some diversification, but not at the expense of simplicity and understanding. As we all know, keeping it simple is just more efficient. And it’s also important for both learning and decision-making. That’s why our simple approach of owning good companies at attractive valuations and thinking long term is paramount. Taken too far, diversification leads to complexity, opaqueness, and higher costs that ultimately weigh on outcomes. Warren Buffett also said that there is no “degree-of-difficulty” factor in investing. The scorecard investors keep is not computed using Olympic diving or figure skating methods. In other words, the degree of difficulty doesn’t count, and complexity is not rewarded. Keeping things simple, as we know, is harder than it looks.

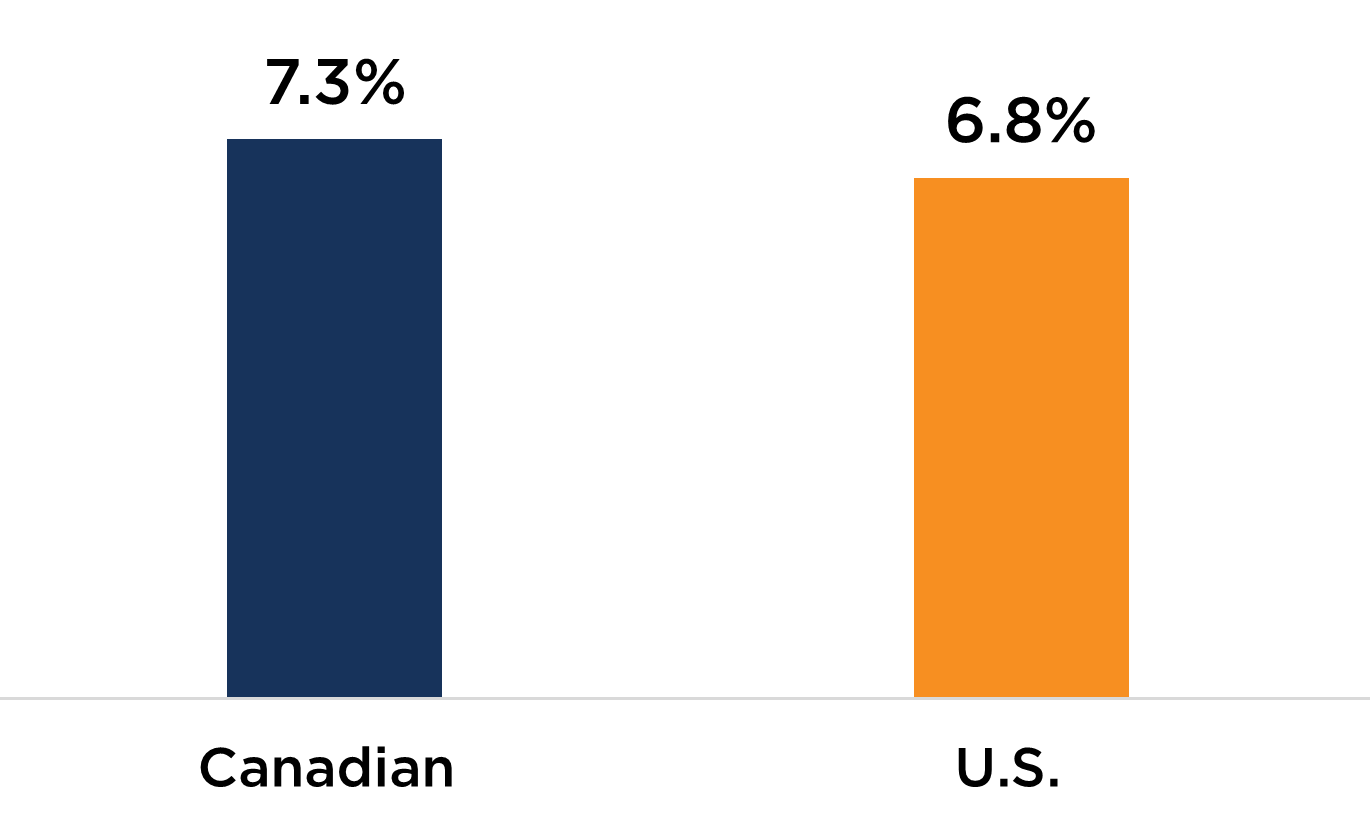

Take the endowment model, which was once considered the gold standard for investing. Over the 10 years ending June 30, 2024 (last year)—the latest annual numbers we have—the average Canadian endowment, think university or hospital foundation, returned 7.3% annually (Figure 7, blue). In the U.S., the average was lower at 6.8% (Figure 7, yellow).

Figure 7. 10-Year Annualized Net Return to June 30, 2024 (Endowments)

In Canadian dollars, net of fees to June 30, 2024. Sourced from the 2024 NACUBO-Commonfund Study of Endowments® (NCSE).

These returns are hardly compelling, especially when we consider the complexity, which I’ll get into a little more. As actual outcomes disappoint, this is increasingly coming under scrutiny. Ironically, some of the best-known U.S. endowments have begun to lag behind.

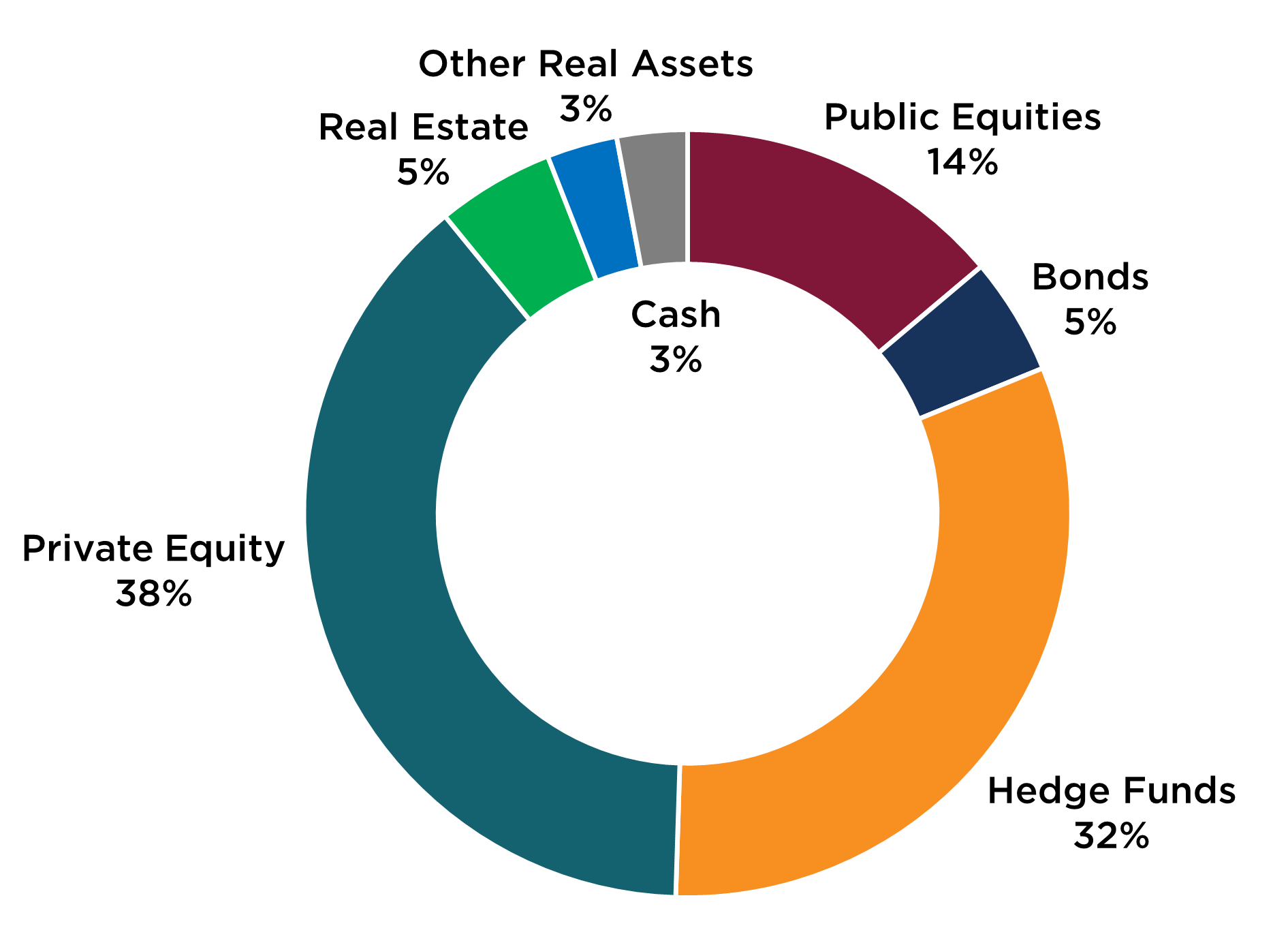

Figure 8. Asset Allocation: Largest University Endowment in the U.S.

The FY24 Financial Report for the largest university endowment in the United States.

Figure 8 shows the asset allocation of the largest endowment fund in the U.S., one of the Ivy League schools. It looks complex to manage. Internal and external managers must be selected, managed, and monitored, requiring large resources and teams. With very substantial allocations to private assets like private equity, it lacks transparency. It’s burdened by long lockups and illiquidity. Put another way, dollars invested are tied up for longer. Performance is only an estimate because assets are not traded in a market—so prices cannot be observed—and costs are high from layering of fees. Total cost to run this large endowment exceeds the total tuition fees received by the school—and by some estimates, run in excess of 2% of asset value. To me, it looks like “degree-of-difficulty” investing. Certainly, a far departure from Buffett’s motto: “Invest in stocks like you would in a farm.” In other words, use common sense and keep it simple. We began today by discussing our model portfolio, the Partners’ Global Fund, including its longer-term returns.

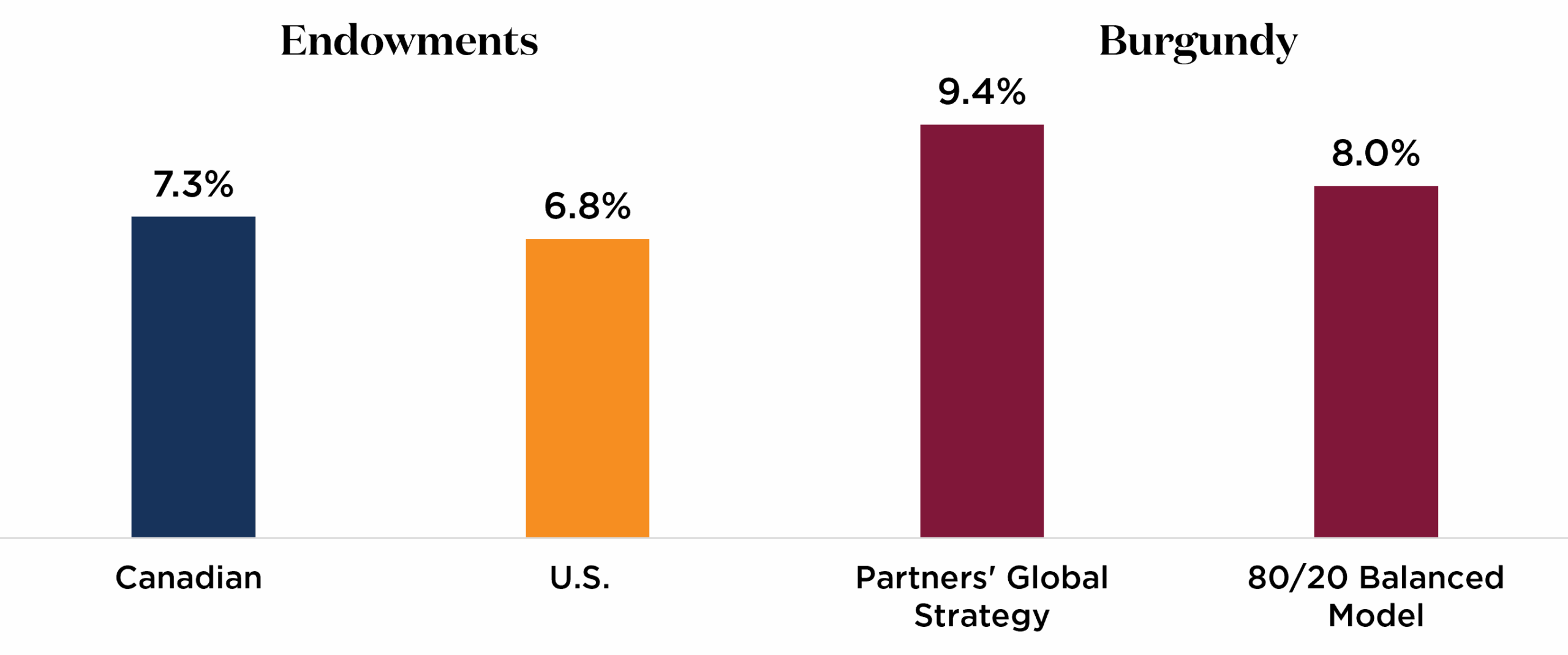

Figure 9. 10-Year Annualized Net Return to June 30, 2024

In Canadian dollars, net of fees to June 30, 2024. Sourced from the 2024 NACUBO-Commonfund Study of Endowments® (NCSE). Burgundy fee calculations are based on a private client with a $5 million portfolio at inception, tiered according to our standard fee schedule. The “80/20 Balanced Model” assumes an 80% allocation to Partners’ Global Fund and a 20% allocation to Partners’ Bond Fund (and the Bond Fund prior to its inception in 2019).

Figure 9, the 9.4% bar (in burgundy), shows the 10-year return, net of fees, for our Partners’ Global Strategy. Now, you might interject here that a comparison to endowment returns is not fair because Partners’ is a pure equity fund. Endowments are obligated to pay out 5% every year and, therefore, need annual liquidity to cover scholarships, bursaries, and other things. Fair enough. So, I have adjusted returns by adding an allocation to low-risk bonds to allow for an apples-to-apples comparison.

Making the adjustment using an 80% allocation to Partners’ Global and a 20% allocation to low-risk bonds, this balanced model delivered an 8% compound annual return—as shown in the “80/20 Balanced Model” bar. Our strategies offered better returns. And importantly, they’ve done so in a way that is understandable, liquid, and built for long-term capital preservation and growth. Where do we go from here? Let’s come back to where we started.

Subscribe to Views & Insights

TRUE NORTH

There is no doubt that the ground is shifting, and major changes are afoot. Trump and his cabinet are looking to implement a set of policies that do away with the 80-year-long consensus we have shared in trade, economics, and social policy—and to do so fast. Governments the world over are doubling down on stealth industrial policies that protect national interests, good jobs, and tax revenues. We are de-globalizing, onshoring, and securing supply chains for products and services of strategic importance—from steel to technology chips, from medicines to defence. Governments will claim a larger role in the economy, and businesses will have to adapt to an environment that is more complex and probably more uncertain too. We know that change is a given, and, arguably, both technology and geopolitics are accelerators of change. We also know that adaptability is key to survival and success, and that also applies to business and investing. We want to own companies that stack the odds in their favour—companies that innovate, offer better or cheaper products to their customers, keep costs lean, and think and operate with a long-term mindset.

“The long-term trend is up. Nobody knows what the market will do tomorrow, next week, or next month. But they spend all their time talking about it because it’s easy to talk about. But it has no value.” That was plain-speaking Warren Buffett at his shareholder meeting earlier in May. Short term, nobody knows. Long term, the trend is up. Businesses create value, and they can adapt. Later, he added, “We are always in the process of change.”

Nothing is new. So, what can we do as investors? How do we navigate between the short and the long term?

Imagine what it would have been like to navigate the oceans before we discovered that we could navigate by the stars. Before stars, sailors relied on being able to see land to navigate from point A to point B. They had difficulty staying on course for extended periods. Eventually, they learned that the North Star, Polaris, in the Northern Hemisphere could be used to determine true north, and other constellations could be used to orient the ship. They could now confidently navigate their route in a more direct way, without having to keep land in sight.

Since our founding almost 35 years ago, we have maintained a steady investment approach. To put it in the simplest of terms: invest in good businesses and be careful not to overpay; stay away from trying to predict the future—we just cannot know; maintain a diversified investment portfolio; and operate with a margin of safety, as we are bound to pass through rough seas.

We have conviction in the companies we own and their ability to adapt in a more complex environment. And importantly, combining quality and valuation discipline allows us to better manage risks in this uncertain environment. So, maintain Polaris in sight and keep it simple! Thank you for coming today and thank you for your trust in Burgundy.

The Burgundy Forum is our flagship event, offering our clients the chance to hear directly from our Investment Team. Each year, we share our market perspective and discuss maintaining a long-term view in a short-term-focused world.

Pictured above, Anne Mette de Place Filippini on stage at the 2025 Burgundy Forum

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.