In September 2008, Slumdog Millionaire won the People’s Choice Award at the Toronto International Film Festival (TIFF). The movie follows 18-year-old Jamal from the Juhu slums in Mumbai to his winning spot on the Indian version of Who Wants to Be a Millionaire. This award was perhaps a reflection of the growing interest of North Americans in stories coming from fast-growing, faraway lands. This interest also extended to investors’ appetite for exotic growth stocks.

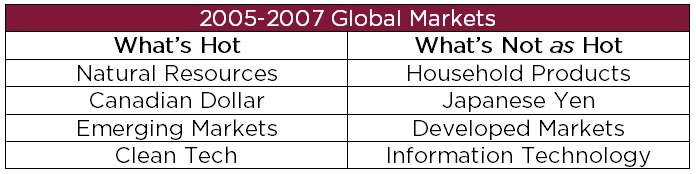

The stock market performance of BRIC countries (Brazil, Russia, India and China, a term coined by Jim O’Neill of Goldman Sachs) had returned well over 200% between 2005 and 2008. In turn, growth in developing economies elevated oil prices, which peaked over US$140 per barrel in July 2008. Jeff Rubin, then chief economist at CIBC World Markets and peak oil prophet, predicted oil would reach US$225 by 2012 and later wrote the book Why Your World is About to Get a Whole Lot Smaller. Fearing this scenario, billions of dollars poured into an emerging sector, Cleantech, driving prices for crystalline silicon (used to make solar panels) from US$50 per kilogram in 2004 to US$300 in 2008. The Canadian dollar turned into a petro-currency and traded at around $1.07 in U.S. dollars.

Some of you will remember that time. Our longer-term clients may also remember that many of our investment strategies were lagging in 2008. Our returns were positive but behind those of the market, as we did not own many of the cyclical companies that were the successes of the day. Our portfolios had little exposure to the Canadian energy sector – or to global commodities for that matter. We were yet to invest in Emerging Markets companies. Even worse, our clients had a considerably larger allocation to foreign equities than what was considered common at the time, which meant the appreciation of the loonie was a serious headwind compared to more domestically focused portfolios.

On September 8, 2008, Tom Bradley, president of Steadyhand Investment Funds and frequent contributor to the Globe and Mail and the National Post, wrote an article comparing Burgundy with Sprott Asset Management, who had experienced phenomenal returns in the years prior1. Tom is one of Canada’s leading authorities on investment manager analysis. Here is what he said about the situation:

It’s well known that Sprott has done well with its prescient call on energy and commodities. Lesser-known Burgundy was riding just as high three years ago after making all the right moves following the tech bubble. But its clients have had little or no exposure to energy in recent years, so returns have been poor and its long-term record has come down to earth.

As we know now, the market reversed dramatically in the days following Tom’s article. On September 15th, Lehman Brothers declared bankruptcy and from September until March 2009, the S&P 500 tumbled by 55% (in U.S. dollars) and Europe later found itself in a sovereign debt crisis. The stories of yesteryear fell abruptly. BRICs crashed by over 50%2. Oil went down to US$35 per barrel. Many American solar manufacturers, like Solyndra, had to wind down their operations.

Following the crash, investors entered a period of rational expectations. As markets began their slow and steady ascent, investors sought out high-quality, profitable companies like Nestlé and Johnson & Johnson. This was a good period for us. We maintained our quality approach during the crash, which paid off for our clients. As Tom had observed, “strengths and biases fit some markets better than others.”

In 2016, eight years after the beginning of the last crisis, La La Land took home the People’s Choice Award at the TIFF. The all-American comedy-drama musical tells the story of two aspiring artists trying to make it in Los Angeles’ competitive entertainment industry.

The risks of these protagonists paralleled the larger investor interests of the time, when risk appetite came roaring back, mainly channeling to the West Coast of the United States. The FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks emerged as the winners of the digital economy, returning on average 16% per year from October 2016 to May 2019. A number of other Californian stars, such as Pinterest, Uber, Lyft and Beyond Meat, went public without a profit in near sight. Bitcoin soared, tanked and rose again, propelling returns of companies expected to benefit from cryptocurrency development. North of the 49th parallel, Canadian marijuana stocks arrived, enjoying valuations that imply a gigantic addressable market which, if materialized, would certainly put a dent on Canada’s labour productivity numbers (if not the world’s!). This is nothing to worry about, however, as robots and artificial intelligence should promptly resolve this output gap…

Our portfolios often contain the incumbents from which today’s disruptors are hoping to steal market share. While some may not consider these companies particularly novel or as exciting as others, we understand their value. We enjoy finding companies with track records of sustainable growth, consistent profitability and strong capital allocation that are also trading at reasonable prices. As you might expect, our portfolios are looking a bit out of touch once again, as investor euphoria rides high. But in many cases we believe the expectations behind the newcomers are just too strong.

How should clients think about Burgundy’s recent underperformance? Has Burgundy lost its winning streak? Is the concept of quality/value investing dead? Have we, like venture capitalist Chamath Palihapitiya suggested in a CNBC interview, entered into a new era where central bankers will forever shield us from recessions3? Is this time really different? We at Burgundy sure don’t think so, but only time will tell. For now, we can reflect on the advice provided by Tom Bradley in 2008:

It would be easy for investors to load up on firms at the top of their game […] and give a pass to others that are struggling. Conversely, contrarians like me would be inclined to go the other way. But neither approach is good. The “hot versus not” measure shouldn’t be a key determinant of who you hire. Manager selection should be based on people, investment approach and business philosophy, and whether the combination of those ingredients has made clients money over time.

1. Steadyhand.com “Burgundy v. Sprott: Opposite Ends of the Performance Cycle – For Now”

2. iShares MSCI BRIC ETF

3. CNBC.com “Central banks have almost eliminated recessions, venture capitalist Palihapitiya says”

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.