Views & Insights

Periodically we publish content that puts our principles and views into practice, because education is an essential component of long-term investment success.

CATEGORY: Being a successful investor

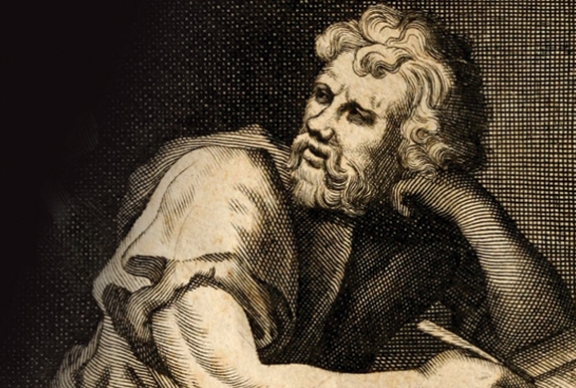

PDF: Stoicism and the Art of Portfolio Intervention

The View | February 2013

Warren Buffett and other successful quality/value investors have given us a capital compounding system that works. But few follow the program. In this issue of The View from Burgundy,...

Narrowing the Scope for Effective Decision-Making

The Journal | February 2013

In a post last month, Anne Maggisano provided one step towards better investment decision-making: to consider the range of possible outcomes and the probability of their occurrence before making a...

Go Global

The Journal | January 2013

Burgundy has long been a proponent of global investing. We believe that limiting the geographic scope of your equity investments will both reduce return potential and add to portfolio risk....

Make the Choice to Think Deliberately

The Journal | January 2013

In November I had the great fortune to participate in the Investment Decisions and Behavioural Finance course at the Harvard Kennedy School in Cambridge. It was an intense and exhilarating...

Quick Brain, Thoughtful Brain

The Journal | November 2012

In my last post I explained that the human brain is built ill-equipped for the investment world. The typical human fear/greed responses are counterproductive to our long-term investment goals...

Surviving Success: Investment Management and Value Added

The View | October 2012

The job we do as trustees is one of the hardest I can think of. I say we, because I have served as trustee on several pension and endowment funds....

Our Primitive Brain: An Impediment to Investment Success

The Journal | October 2012

My first post on the topic of behavioural finance introduced the idea that investors, rather than listening to logic that tells them to buy low and sell high, do just...

Emotional Investing is Bad for your Wealth

The Journal | June 2012

Each year I visit my Alma Mater, the Ivey School of Business at the University of Western Ontario, to teach a seminar to MBA students. It’s one of the...