Why should we care about our wealth identity? According to wealth psychotherapist Joan DiFuria, understanding the interplay between our personal stories, beliefs, and emotions about money holds significant importance. Beyond shedding light on the motivations behind our decisions, it underscores the foundation of our financial well-being.

After spending nearly 30 years in the field of wealth psychology, I’ve learned invaluable lessons about the dynamics of wealthy families. Throughout the COVID-19 pandemic, my colleagues and I had time to take a fresh look at our work. We wanted to know how we could best serve our clients. After much discussion, we arrived at the one question we wanted to answer: “What do families of wealth desire most?” The answer? Building thriving, connected families, while using wealth as a tool to support overall flourishing.

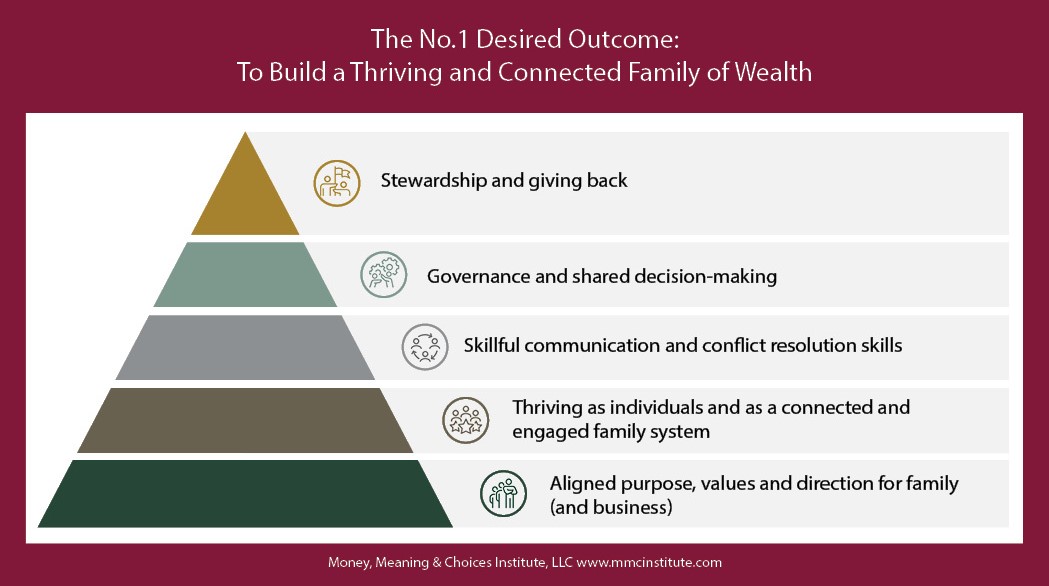

But how do we achieve this? It requires five key elements working in concert (see below chart). It begins with defining a clear purpose and shared values. Then, families should focus on fostering thriving and connected relationships. The next stage involves effective communication and conflict resolution, which are crucial for establishing solid governance.

Often, we see intelligent and successful families trying to leap straight to stewardship and giving back. However, just as a house cannot stand without its foundation, neither can robust communication and governance structures stand without the fundamental elements of shared values and purpose. Our research and experience show that families that thrive prioritize each member’s individual growth and leave no one behind.

WEALTH IDENTITY: THE FOUNDATION OF FINANCIAL WELL-BEING

Wealth identity is a valuable concept that can support the development of shared values, purpose, and, ultimately, a thriving and connected family of wealth. Understanding one’s wealth identity—the interplay of personal stories, beliefs, and feelings about money—is crucial. No matter who you are or how much money you have, we all have stories about earning, saving, spending, and sharing wealth. These stories can move you toward your goals, but they can also hold you back because they influence your financial behaviour and life decisions.

Take my sense of frugality, and where it came from, as an example. My grandmother immigrated to the United States at the age of 13, and [decades later], after her husband passed away, she came to live with our family. A vivid memory I have of her is her dedicated bread crumb drawer—she never allowed us to throw away even the smallest breadcrumbs. She had a remarkable talent for transforming these breadcrumbs into delicious desserts. To this day, whenever I find myself discarding a piece of bread, I can’t help but look up and say, “Sorry, Grandma.” This generational story is why I am still frugal today.

Our stories are the threads that intertwine our beliefs, emotions, and values, and they are especially relevant when making financial decisions. Understanding your personal story is crucial in comprehending why you make the financial choices you do. When our stories combine with our feelings and beliefs about money, they culminate in our wealth identity, which can resonate through generations.

Parents and adult children may have very different money stories, and both parties are often hesitant to discuss their concerns, ideas, and plans with one another. Parents grapple with issues like “What, when, and how much should I tell my children about our money?” and “Should we be equitable or fair with what we give each child given they have different careers?” Children wonder: “How can I approach my parents without being seen as greedy? I would like to know their intentions, their long-term plans, and if they have their needs taken care of.” Both generations have their own questions, their own money stories, and their own wealth identity.

BETTER WEALTH IDENTITY, BETTER OUTCOMES

Now, let’s explore the four stages of wealth identity. No matter how secure you are in your relationship to money, there’s room to feel more secure and more certain. Ultimately, this involves navigating through four stages, each marked by separate opportunities and challenges. It’s a continuous journey that is affected by your self-esteem, values, financial literacy, and maturation at the point of entry.

Stage 1: The Honeymoon Phase

This initial stage is a time when one views their money as either entirely good or entirely bad. When money is all good, this stage is like the thrilling rush of a new romance—everything seems perfect and we’re wearing rose-coloured glasses. Individuals who see money as all good, wholeheartedly embrace their wealth, basking in the glow of financial success and indulging in life’s pleasures without a care in the world.

At the opposite end of the spectrum, money is seen as all bad and the root of all problems. These individuals grapple with deep-seated feelings of shame, guilt, and anxiety. Some clients frequently ask, “Do people like me for me or my money?” Trust becomes a significant issue.

Let me introduce you to Amy, a client and our heroine of wealth complexity. Amy is a successful attorney living in New York City. She is the trailblazer in her family, achieving what generations before her had only dreamed of. Amy won the lottery and came into sudden wealth. This propelled her into a whirlwind of unforeseen changes and challenges. Thanks to her newfound wealth, Amy’s family, friends, and acquaintances now saw her as their personal ATM.

It took only one week for the honeymoon to end. Then Amy felt that the money was all bad. She was embarrassed to tell me her story: “I have always felt capable, but now I am feeling so vulnerable. I wish this never happened. I would gladly give this money back. My life has been turned upside down.” Amy found herself feeling overwhelmed and isolated; the sheer magnitude of wealth overshadowed her identity. She said, “I lost the Amy I liked so well, and my newfound wealth leaves me adrift.”

“When our stories combine with our feelings and beliefs about money, they culminate in our wealth identity, which can resonate through generations.”

Amy’s story underscores a universal truth: Wealth carries a weight beyond numbers. It shapes how we perceive ourselves and how others perceive us, influencing our decisions in ways we often don’t anticipate.

For individuals finding themselves in this stage, there is a straightforward strategy: Have fun and enjoy your wealth, but remember that the honeymoon won’t last forever. It’s crucial to plan both for life’s pleasures and curve balls. Hold off on making any major decisions during this phase.

Stage 2: Wealth Acceptance

At this point, individuals begin to transition from the extreme emotions of the Honeymoon Phase to a more balanced and grounded perspective. The rose-coloured glasses are off, and one can now have a more realistic look at the pros and cons of their money. On the positive side, they appreciate having more choices and opportunities than before. On the flip side, they may find themselves feeling discomfort with and overwhelmed about money.

The goal of this stage is the integration of wealth into one’s broader identity. It involves developing a nuanced view of how wealth influences various aspects of life. There is an emerging awareness of the complexities and responsibilities that accompany wealth, and an awareness that money comes with both opportunities and challenges.

Let’s return to Amy. She initially experienced the weight of wealth as all bad during the first stage, but as she transitioned to stage two—Wealth Acceptance—she found that she had choices. Instead of saying goodbye to her career as a lawyer, she realized that she could start her own private practice that aligned with her passion for helping underserved women. For Amy, moving into stage two and developing a better wealth identity led to better outcomes.

Stage 3: Identity Consolidation

Stage 3: Identity Consolidation

In stage three, individuals have a clearer and more confident understanding of their wealth identity. They can now clearly define their values about the saving, spending, and sharing of money, as well as their lifestyle. The choices they make are based on their values, needs, and desires. There is a realization that wealth, while a significant part of their lives, does not define them as a person; it’s a tool that complements their broader goals. That said, they may also find it challenging to reconcile past and present values, especially around money.

It took Amy about a year to reach stage three. She started her private practice and realized that despite her deep bond with her family, she had to set boundaries to stay true to herself. She no longer allowed herself to be their personal ATM. She also had to examine which of the family values she grew up with she still aligned with as a married woman with two young children.

She found her equilibrium. She set up an educational trust fund for her nieces and nephews, sharing her purpose with them as follows: “My value is to use my resources to help you get a good education, build a career, build self-esteem, become financially independent, and contribute to society.” Amy became the conductor of her financial and life choices.

Stage 4: Achieving Balance—Time, Stewardship, and Legacy

The final stage is where money transforms from being an aspect of one’s identity to a compass that is guiding one’s life-long journey. Here, wealth is not just seen as a means of luxury and security. Instead, it becomes a resource for shaping needs, goals, values, and aspirations. At this stage, individuals might still be finding balance in how they wish to allocate their time.

This is when I encourage my clients to spend time reflecting on the deeper meaning and purpose of their wealth while asking themselves the following questions: How do I want to steward my financial resources? Should I spend more time traveling, more time with my loved ones, or both? Do I want to start a new endeavour, becoming a philanthropist, artist, or entrepreneur? What legacy do I want to leave?

As we all know, time is a precious resource that money cannot buy. I’ve repeatedly seen clients being pulled in countless directions, often leading them to lose track of how they genuinely would like to spend their time. Therefore, I remind my clients that wealth is not just a financial asset but a gift that offers the freedom to pursue what is truly meaningful in life. Whether it’s finding joy in simple domestic tasks, exploring new passions, dedicating time to loved ones, or changing the world, wealth provides the flexibility to make the choice to do what is truly meaningful to you.

Amy came up with her long-term plan in stage four. She found it meaningful to focus her time and money on philanthropy, helping underserved women in her community. This was part of the legacy she wanted to live and leave.

Working on Your Wealth Identity

Regardless of whether your wealth is newly acquired or a legacy that has been passed down through generations, the goal remains the same: to achieve a state of well-being with your wealth. By acknowledging and working on your wealth identity, you open doors to choices, opportunities, emotional fulfillment, and security with the decisions you make about your money and life.

Reflect on your unique money stories. These personal narratives are the building blocks for your wealth identity, which shapes your finances, life stories, and your outcomes. I encourage you to write down your top three money stories and determine if they are moving you toward or away from your goals. This process will help you make decisions that reflect your deepest values and purpose—the foundation of the framework for building a thriving family of wealth across generations.

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.

Stage 3: Identity Consolidation

Stage 3: Identity Consolidation