Amid claims of a corporate governance makeover and an endorsement from Warren Buffett, many foreign investors have developed a renewed interest in Japan. Drawing on his expat perspective, Investment Analyst Steven Boisvert navigates through this market exuberance, examining the influence of gaman and providing an update on Burgundy’s investment strategy in the island nation.

KEY POINTS

- Gaman’s Influence: The cultural emphasis on collective well-being permeates various aspects of Japanese society, including corporate governance.

- Gradual Reforms: While progress is ongoing, corporate governance reforms are not uniform across all Japanese companies.

- Long-Term Perspective: A disciplined, long-term approach is essential for navigating the challenges and opportunities in the Japanese market.

- Our Expertise: With a 25-year track record and a deep understanding of Japan, Burgundy is well-positioned to capitalize on the country’s evolving investment landscape.

Endure the Unendurable

At noon on August 15, 1945, days after atomic bombs reduced the cities of Hiroshima and Nagasaki to rubble, citizens across Japan rallied around their neighbourhood radios. Through crackling static, Emperor Hirohito told his subjects that Japan had lost the war. They would now have to endure the “unendurable” and bear defeat’s “unbearable” consequences. In the wake of the broadcast, Hirohito’s call for endurance ignited a collective determination to rebuild, setting a trajectory for economic growth and transformation.

In Japan, prioritizing harmony over individual desires is called, 我慢 or gaman in English. During times of hardship, you are expected to restrain selfish emotions.

As a child, I have early memories of learning Hirohito’s lessons in the classroom. This call for endurance shaped daily life, influencing the country’s structures and systems. Later, I witnessed its impact in my workplace, where personal economic profits were sacrificed in favour of the collective good. Though this context is often overlooked in the headlines, you can’t fully grasp Japan today without it.

Interest in the Island Nation

In recent years, there has been a significant uptick in investment interest in Japan. Before we explore this trend, let’s rewind to when we first entered the region.

When Burgundy began investing in Japan in 1998, the country’s financial system was in ruins, and sentiment was dismal. “Value only appears when things look bleak,” reads a line from The View from Burgundy The Sun Also Rises, “and things look very bleak in Japan.” After Japan’s post-war “economic miracle” from 1945 to 1991, where it became a manufacturing juggernaut climbing to the number two economy in the world, the Asian Financial Crisis kicked off a period of economic stagnation known as the “lost decades.”

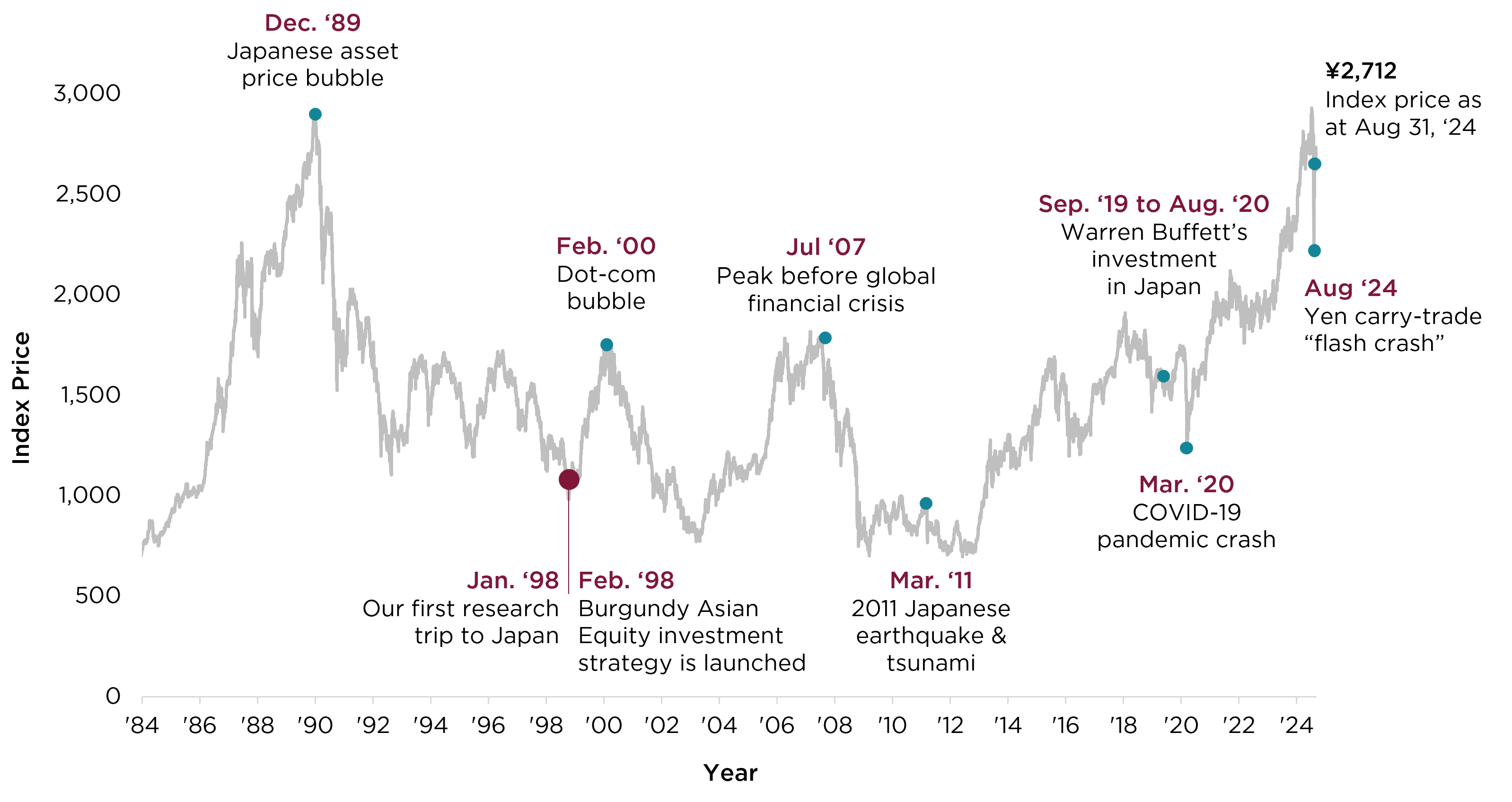

Just imagine investing in the stock market for 30 years and seeing no returns. Until this past year, this was the reality for many passive investors in the Japanese market. Since its peak, which occurred alongside the Japanese asset bubble collapse of the early 1990s, the Tokyo Stock Price Index (TOPIX) struggled to sustain growth, with a gradual recovery marked by periods of volatility. Despite the sentiment, Burgundy still found opportunities by choosing the right companies, the ones able to weather this challenging backdrop. Such companies generate profits and cash flow during uncertain times, allocate that cash flow into areas with long-term potential, and differentiate from their competitors by developing new products. For example, the year we started investing in Japan, we initiated a position in Keyence, a provider of factory automation solutions. We continue to own the company today. Ultimately, we opted to explore, while others chose to ignore.

FIGURE 1. HISTORY OF THE TOKYO STOCK PRICE INDEX

Source: FactSet in Japanese Yen as at August 31, 2024

Historical prices for the Tokyo Stock Price Index (or TOPIX) for the last 40 years.

Investor sentiment in Japan underwent significant changes during the COVID-19 pandemic when, following the sharp declines experienced by global markets, investor confidence gradually improved. By mid-2024, the TOPIX climbed to a new all-time high. So, why after two lost decades, are global investors paying attention?

An endorsement from Warren Buffett for one thing. Over the past few years, the Oracle of Omaha has sent a powerful signal to the global market, investing billions into Japanese trading houses through Berkshire Hathaway. Perhaps more compelling than Buffett’s bullishness, we’ve seen growing excitement surrounding ongoing corporate governance reforms and an increased focus on shareholder returns. The prospect of such improvements has sent many foreign investors flocking to Japanese stocks. To understand why, we need to revisit the reasons Japan’s corporate governance had a poor reputation in the first place.

VOLATILITY STRIKES

Japan continues to attract significant global attention, as demonstrated by the dramatic stock market swings during the summer of 2024. After hitting all-time highs in mid-July, the latter part of the month and early August saw Japanese stocks experience a violent crash before largely correcting. The crash and subsequent rebound were triggered by a combination of the weak yen and a carry-trade blow-up (where investors borrow at a low interest rate, like in Japan, and invest in an asset that provides a higher rate of return), all unfolding over just a few days.

Despite dropping over 20% in just a matter of weeks, Japanese markets continue to trade above their levels when entering 2024.

The Corporate Governance Makeover

When we began investing in Japan back in the late 1990s, the country’s poor corporate governance was one of the main reasons foreign investors avoided it. Japanese management lacked accountability to shareholders. They also had bloated and inefficient boards of directors reticent to accept external influence. Returning to Japanese cultural practices, including gaman, the emphasis on harmony and collective well-being has historically taken precedence over shareholder rights and transparency.

“Returning to Japanese cultural practices, including gaman, the emphasis on harmony and collective well-being has historically taken precedence over shareholder rights and transparency.”

Recently, however, this has started to loosen. Japan’s corporate governance reforms have garnered significant interest in the market, both domestically and internationally. Longstanding practices that discouraged foreign investment, such as limited board representation and cross-shareholdings (where one publicly traded company holds a significant number of shares of another publicly traded company), are now giving way to reforms.

Many companies have begun to embrace outside directors, prioritize profitability and shareholder returns, and focus on efficient capital allocation. Internationally, foreign investors see these reforms as a positive step toward improving the country’s investment climate, welcoming the changes and increasingly engaging with Japanese companies on governance-related issues. Though not applied across all companies, we have seen evidence of these changes. Looking to our portfolio, Ariake Japan, the leading provider of natural seasonings, is an example of a company seeking to implement these positive practices. Following a recent change in the management team, improvements in corporate governance have started to take hold, and we have noticed that the company is now actively communicating with its shareholders. We are seeing this trend elsewhere as well. More companies are now willing to speak with investors; some that historically wouldn’t engage at all are more open to meetings and conversations. Through our interactions with companies and other research, we will pay close attention to disclosure and transparency, stakeholder engagement, and shareholder rights.

Another recent reform aimed at improving transparency comes from the Tokyo Stock Exchange (TSE), which now requests that companies disclose their cost of capital. The TSE is also asking that all the prime companies (1,500 of the 4,000 companies listed in Japan) disclose key financial statements in English, lifting what was previously a significant barrier for foreign investors. Although there are encouraging signs of progress, it remains slow and inconsistent, and additional efforts are needed to satisfy the high expectations of investors.

If a Rising Tide Lifts All Boats, What About Our Competitive Edge?

With a heightened focus on corporate governance, companies are expected to raise their standards, prioritizing sound business decisions with the cost of capital in mind. This shift should help narrow the valuation gap compared to global counterparts. Japan will continue attracting more investors, boosting liquidity and strengthening its investment landscape. As the investment pond deepens, the adage “a rising tide lifts all boats,” should hold.

You may question whether increased eyes on Japan will impact our competitive edge. While greater attention may heighten investor competition, it also brings benefits. These reforms may accelerate the improvement process, potentially transforming businesses with mediocre governance into companies that meet Burgundy’s quality standards. As strong governance becomes more prevalent among quality businesses, our opportunity set will broaden, and we will have more to look at. Yet, change is gradual, and with its unique cultural nuances, this is especially true in Japan.

“While greater attention may heighten investor competition, it also brings benefits. These reforms may accelerate the improvement process, potentially transforming businesses with mediocre governance into companies that meet Burgundy’s quality standards.”

Looking at this from another angle, good and bad businesses will continue to coexist amid heightened competition. To borrow from Charlie Munger, “If you mix raisins with turds, they’re still turds.” There are still good and bad businesses and inherently poor ones can’t be fixed. So, we will continue to choose the raisins and avoid the turds disguised as raisins. This is where our process comes in — a process that hinges on dedicated research and a 25-year history of investing in the region.

Another differentiator for us is where we are looking. While the market currently favours large-cap Japanese stocks, we remain focused on small and medium-sized businesses, which historically have proven advantageous. We will continue to favour this subset of businesses, as they are often less understood and offer greater opportunity for market mispricing – or the “value” component of our quality/value approach.

AN IMPORTANT REMINDER

Burgundy’s approach is different. We are long-term investors who aren’t afraid to stand apart from the crowd or an index, and we maintain a disciplined focus on quality and value. These principles are fundamental to our strategy, but they can, of course, be imitated. Studying anything for a long time leads to experience, which in turn shapes judgment. We believe our experience gives us an advantage relative to newer investors in understanding and capitalizing on changes in Japan. However, experience does not ensure success. Continuous learning, growth, and adaptation are critical to our progress as investors. Like the companies we look for, we must relentlessly pursue opportunities while staying true to our principles.

An Approach that Lasts

We can’t understand Japan today without looking back at the country’s historical evolution. Devastation and recovery, explosive transformation, and the profound influence of gaman’s hand are all part of the story. While it may be tempting to apply a Western lens, we must also remember that the Japanese economy isn’t Adam Smith’s economy. While profitability remains important for Japanese businesses, these pursuits are still motivated by contributing positively to society. Even as this stronghold of society over shareholders begins to relax, changes in corporate governance will be gradual and inconsistent among companies.

At Burgundy, our approach to investing in Japan has not wavered since 1998, concentrating on the careful selection of both the right companies and the right management teams. And like Japan, our portfolio is poised to endure, whether the popularity of Japanese equities keeps climbing or investor interest shifts. With over two decades of experience and a steadfast commitment to quality and value, we are confident in our ability to continue to deliver strong, long-term results for our clients, regardless of the changes or fluctuations in the Japanese market.

Subscribe to Views & Insights

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.