A recent bid on Rocky Mountain Equipment inspires this latest View from Burgundy. With an eye on Western Canada’s agricultural equipment environment, Portfolio Manager Andrew Iu, Canadian small cap equities, offers insight into Burgundy’s voting decision. Andrew highlights how he values the company, why it’s important to avoid selling at the beginning of an up cycle, and how to think about potential fiduciary concerns.

DEAL SUMMARY

On November 2, 2020, Rocky Mountain Equipment entered into an agreement to be acquired for $7 per share by a company controlled by Rocky Mountain’s current Chairman and Chief Executive Officer. We will not vote for this deal. We believe the offer is inadequate and would rather participate in the nascent recovery of agricultural equipment sales in Western Canada.

All reference to currency is in Canadian dollars.

WHY WE OWN ROCKY MOUNTAIN

Rocky Mountain Equipment is the largest dealer of Case New Holland agricultural equipment in the Canadian Prairies (Alberta, Manitoba, and Saskatchewan). Like an auto dealership, Rocky Mountain sells equipment, including tractors and combines, and provides after-sales servicing and repairs. Since the growing and harvesting season in Canada is short, it’s imperative that farmers have functional equipment at all times. As such, the parts and service business is more stable than equipment sales, and is what attracted us. Another appealing feature of the industry is that it is effectively a duopoly. Case New Holland and John Deere dominate the market for large agricultural equipment, which limits competition. Every year, farmers use either Case or Deere equipment on 130 million acres of farmland across the Canadian Prairies, creating a dependable stream of parts and service revenue for Rocky Mountain.

Our strategy for investing in dealerships like Rocky Mountain is to invest when equipment sales are weak, which often causes the share price to fall below book value,1 and to hold for the up cycle in equipment sales. Since the parts and service business remains stable during difficult economic times, these revenues allow us to hold through down cycles. During past periods of strong farm confidence, Rocky Mountain’s return on equity has approached 20% and has traded at significant premiums to book value. Burgundy has used this contrarian strategy of investing in dealership businesses several times in its Canadian equity portfolios, including with AutoCanada (car dealership) and Finning (Caterpillar equipment dealership).

“Our strategy for investing in dealerships like Rocky Mountain is to invest when equipment sales are weak, which often causes the share price to fall below book value, and to hold for the up cycle in equipment sales.”

THE PERFECT STORM

The last two years have presented a difficult operating environment for Rocky Mountain. When farmers buy new equipment, they usually trade in their used equipment, which Rocky Mountain will later resell. In this last up cycle, however, in an attempt to grow Case New Holland’s market share, Rocky Mountain accepted too much used inventory. Consequently, Rocky Mountain’s used inventory turnover ratio (i.e. how quickly they can sell) declined and earnings suffered. As used inventory velocity slows, there is an earnings impact.

Rocky Mountain finances its used inventory by borrowing, so interest expense increases when Rocky Mountain carries more inventories. Slow inventory turnover also weighs on earnings because aging equipment suffers from “lot rot,” meaning that inventory depreciates if it doesn’t sell quickly.

Rocky Mountain recognized this issue and, starting in 2019, set out to reduce its used inventory. Unfortunately, Rocky Mountain’s timing was unlucky as it started this process just as a confluence of events was weighing on farmers’ confidence. First, China levied an embargo against Canadian canola in 2019 in retaliation for Canada’s decision to detain Huawei’s Chief Financial Officer. This devastated Canadian farmers since canola is one of Western Canada’s largest crops, and China is one of Canada’s largest export markets for canola. Next, Indigenous activism resulted in rail blockades across Canada, which prevented Canadian farmers from getting their crops to market. Finally, COVID-19 hit in March 2020, creating broad uncertainty among farmers. As a result of these difficulties, farm equipment sales fell dramatically. The Association of Equipment Manufacturers reported that sales of farm equipment in Canada hit a 15-year low in 2019 and early 2020.

THE TIME TO SELL IS NOT AT THE BEGINNING OF AN UP CYCLE

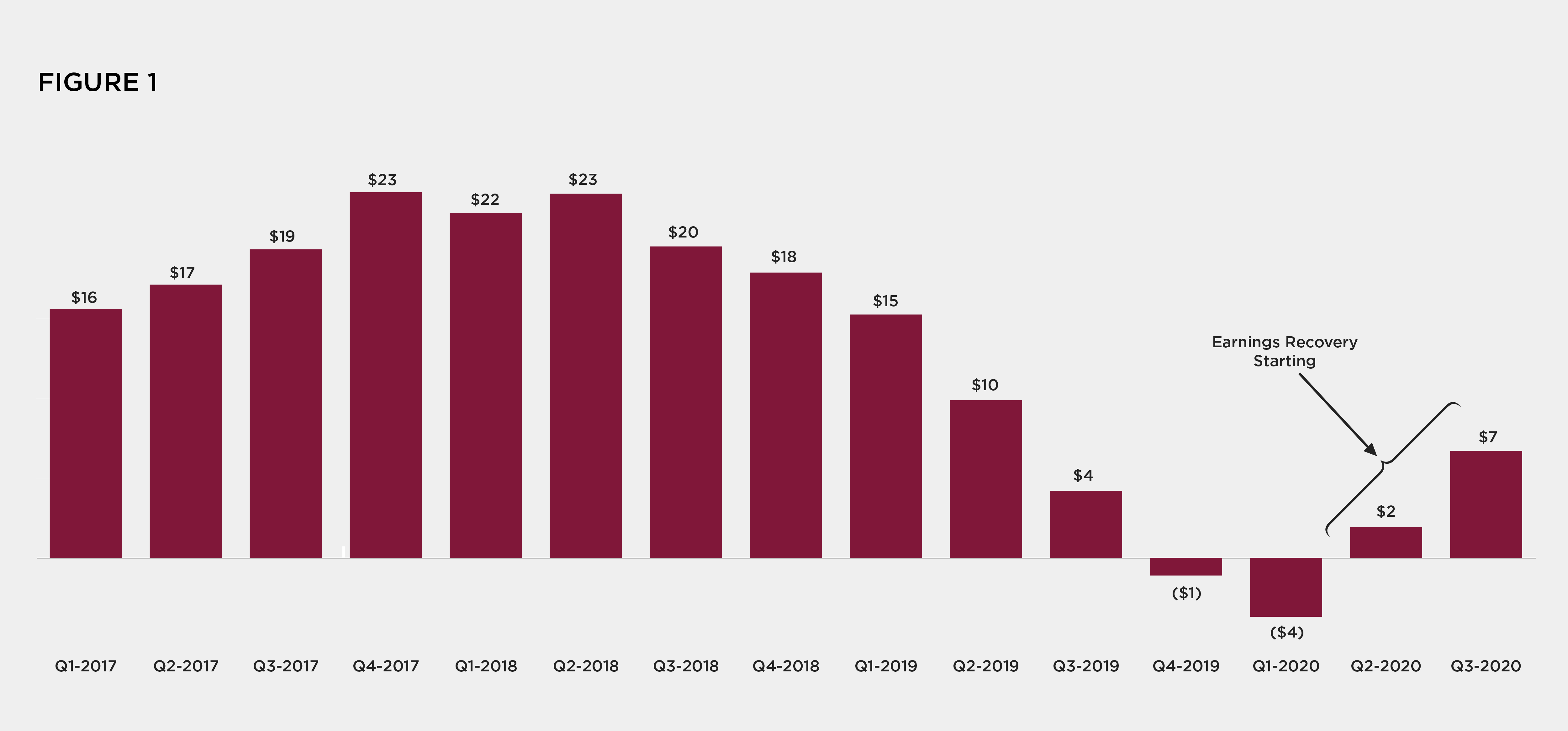

While the 12 months prior to the summer of 2020 were challenging times for Rocky Mountain, the company and the industry are turning a corner. Canadian farmers have found new export markets for canola, and the realized prices for these crops have correspondingly improved. Furthermore, this past summer was one of the best harvests in recent memory in Western Canada. Low oil prices further bolstered farm incomes because diesel is an important input cost for farmers. As conditions have improved over the last six months, farm confidence has recovered, allowing Rocky Mountain to sell used inventory, improve its inventory turnover ratio, and generate higher earnings. We believe this earnings recovery is in its early innings, which we have shown in Figure 1.

ROCKY MOUNTAIN’S TRAILING TWELVE MONTHS EARNINGS

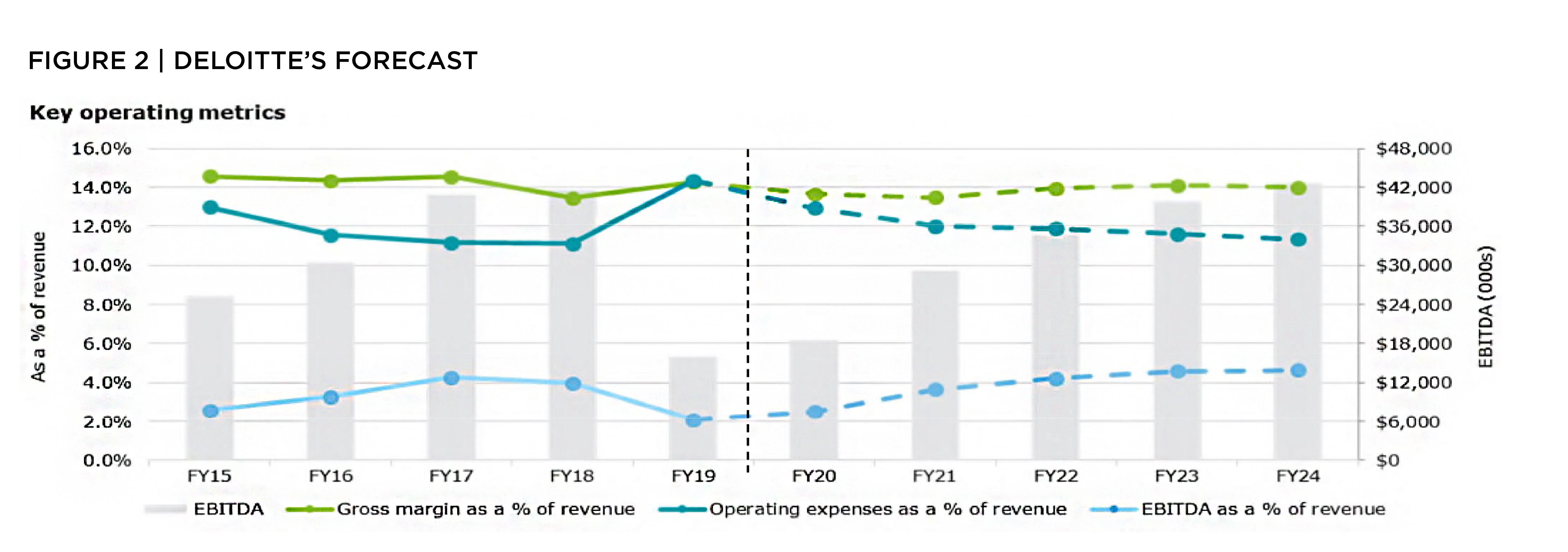

As part of the proposed transaction, Rocky Mountain recently hired Deloitte to conduct a fairness opinion. Deloitte’s report is included in the Management Information Circular on the deal and shows the discounted cash flow model the firm used. This model is based upon Rocky Mountain’s own financial forecasts. Figure 2 shows the forecast for operating profit (earnings before interest, tax, depreciation and amortization, or “EBITDA”) over the next five years. As you can see, the company is forecasting a strong recovery in EBITDA.2

ROCKY MOUNTAIN MANAGEMENT’S FIVE-YEAR FORECAST FOR OPERATING PROFIT

This forecast was completed by Deloitte on October 31, 2020. This forecast is available on page 261 of the PDF containing the Management Information Circular.2

VALUATION

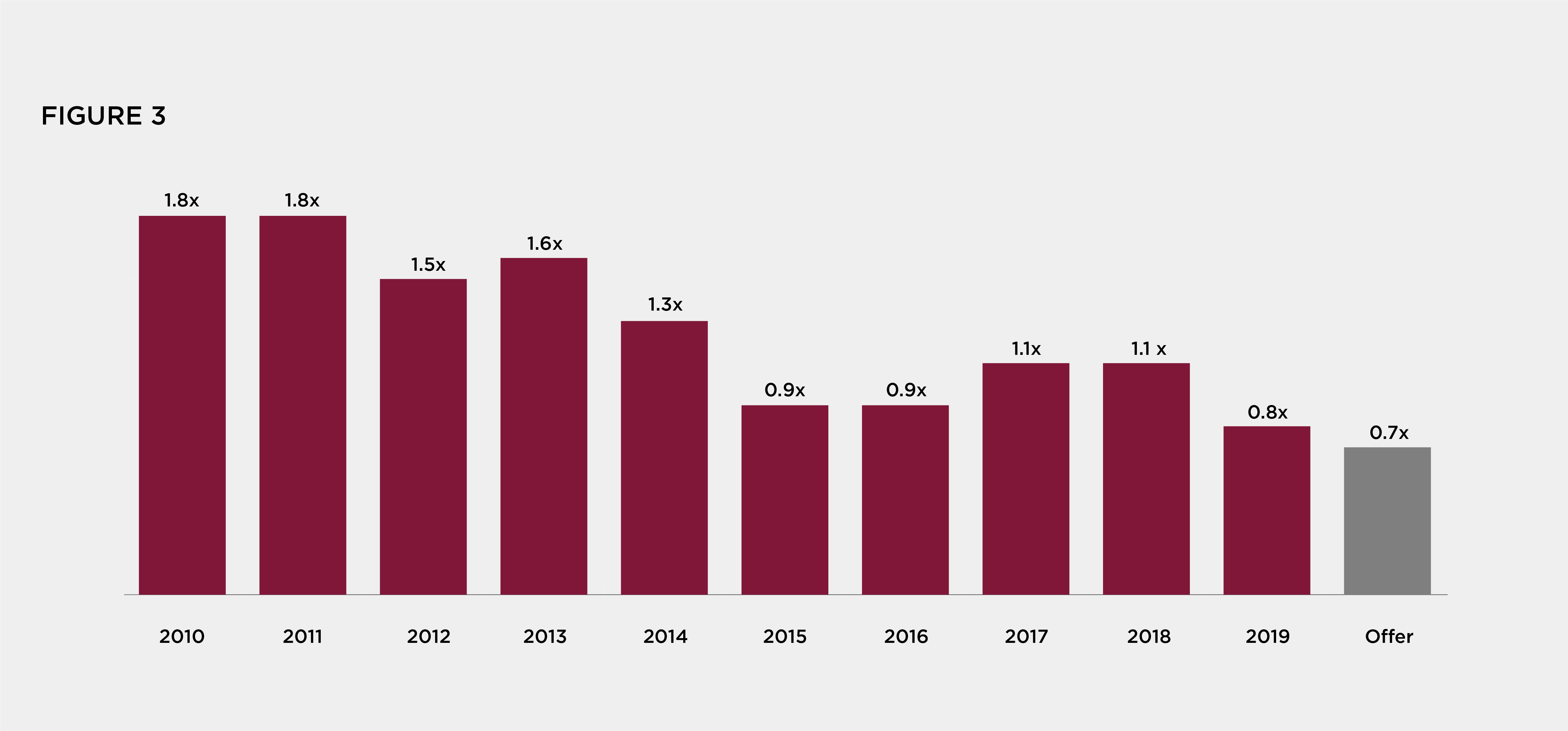

Despite the nascent earnings recovery, Rocky Mountain’s public valuation remains depressed from the difficult conditions of last year and earlier this year. The buyout group is offering a 26% premium to this depressed valuation, but the offer is still a 28% discount to book value. As mentioned earlier, book value is a key indicator of Rocky Mountain’s intrinsic value. The vast majority of Rocky Mountain’s book value is inventory (both new and used), which provides a concrete valuation anchor and explains why Rocky Mountain has historically tended to trade around book value. In Figure 3 we show the average price-to-book multiple Rocky Mountain has traded at each year for the last 10 years and compare this to the price-to-book value of the buyout group’s offer. The offer represents a lower multiple than Rocky Mountain has traded at during any point from 2010 to 2019. Even after deducting intangible assets like goodwill, which cannot be sold or liquidated, the offer is still 19% below tangible book value.

ROCKY MOUNTAIN’S AVERAGE PRICE-TO-BOOK MULTIPLE

A different way to frame the inadequacy of this offer is to look at the valuation of Titan Machinery. Titan is the largest Case New Holland dealer in the Midwestern United States (effectively, the Rocky Mountain of the United States) and currently trades at 1.2 times price-to-book value.

FIDUCIARY CONCERNS

After reviewing the press release on the acquisition offer, we have several concerns around Rocky Mountain’s board fulfilling its fiduciary duties to shareholders.

First, the board’s special committee is recommending an offer at a 19% discount to Rocky Mountain’s tangible book value which, as we mentioned earlier, is primarily inventory. Under International Financial Reporting Standards (IFRS), inventory must be marked at the lower of cost or net realizable value. The board’s audit committee, whose members are all part of the special committee, has responsibility for the veracity of the financial statements. By extension, the audit committee must believe that the inventory on Rocky Mountain’s balance sheet is worth at least the net realizable value, if not more. The audit committee members are therefore contradicting themselves, simultaneously endorsing Rocky Mountain’s inventory value as representative of net realizable value while encouraging investors to sell their shares well below this value. This contradiction is truly puzzling to us.

Second, Rocky Mountain’s Vice Chairman, Derek Stimson, opposes the transaction. The information circular on the transaction says, “On November 1, 2020, the Board met and, after receiving the recommendation from the Special Committee and after careful deliberation, approved the proposed Arrangement … Derek Stimson opposed the resolution.”3 Derek Stimson is one of the founders of the business and served as Rocky Mountain’s president from 2007 to 2015. He owns 9.6% of Rocky Mountain. If anyone knows what Rocky Mountain is worth, surely it is Mr. Stimson.

Third, the board’s fiduciary duty requires it to maximize shareholder value, which includes running a competitive auction process with sufficient time for potential bidders to conduct due diligence. The go-shop period announced along with the offer is only 35 days, which is at the low-end of the typical 30 to 60-day period. We feel that a 60-day go-shop period is most appropriate to maximize shareholder value.

Finally, the offer is $0.15 (or 2%) above the low end of Deloitte’s fair value range, which we referenced earlier. Given Rocky Mountain’s earnings power, which we have highlighted above, a 2% premium to the lowest fair value provided by Deloitte is laughable.

A POTENTIAL COMBINATION WITH TITAN MACHINERY

The similarities between Titan Machinery and Rocky Mountain lead us to believe that a combination of these two companies could create meaningful shareholder value. Titan Machinery’s territories are contiguous to Rocky Mountain’s, which could create inventory optimization synergies. In order to sell into the U.S. market, Rocky Mountain opened a used inventory outlet in Kansas in 2018, suggesting there is strategic rationale in selling Rocky’s inventory through Titan’s U.S. stores.

Furthermore, we estimate that Rocky Mountain’s corporate costs are over $4 million annually, representing the combination of executive compensation, board fees, and public company costs. On normalized pre-tax earnings, we believe this represents an accretion opportunity of over 15% for a strategic buyer like Titan Machinery, who could eliminate a meaningful number of these costs.

A combination with Titan would also dramatically improve liquidity. Titan’s average daily trading value is approximately $2.6 million, compared to Rocky Mountain’s average daily trading value of $0.15 million before the deal was announced.

WE NEED A BETTER DEAL

We own 1.4 million shares in Rocky Mountain on behalf of our clients, representing 7.3% of the outstanding shares. We will not vote for the proposed deal (as of November 26, 2020). We would consider an offer from Titan Machinery that involves some stock, allowing Rocky Mountain shareholders to participate in the potential synergies we outlined above and the nascent recovery in Western Canadian agricultural equipment sales. We will not vote for a cash deal at a material discount to tangible book value.

1. Book value measures the net worth of the business attributable to shareholders. In Rocky Mountain’s case, book value largely represents the value of Rocky Mountain’s inventory.

2. This quote is available on page 261 of the PDF containing the Management Information Circular. The PDF is available on SEDAR at the following IP address: https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00026106

3. This quote is available on page 56 of the PDF containing the Management Information Circular. The PDF is available on SEDAR at the following IP address: https://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00026106

Source: Burgundy research, company filings, Bloomberg.

This View from Burgundy is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints, or financial needs. Under no circumstances does this View from Burgundy suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently, and past performance may not be repeated.

Certain securities may be shown for illustrative purposes only and should not be taken as a recommendation in any capacity. Furthermore, the securities described here do not represent all securities purchased, sold, or recommended for advisory clients, nor do they indicate the overall performance or characteristics of any strategy in any way. The information included herein does not entail profitability at any time. The voting preferences and projections described in this document are not intended to solicit or recommend votes or investment decisions from other shareholders in any capacity and should only be interpreted as an expression of Burgundy’s individual perspective. Further information can be provided upon request.

This View from Burgundy is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of publishing and is subject to change without notice. Please refer to the Legal section of Burgundy’s website for additional information.