Amid COVID-19 uncertainty, Portfolio Manager James Arnold provides insight into the elusive world of bonds. In this educational piece, James sheds light on the role of ratings and offers perspective on the common characteristics of investment-grade and high-yield bond issuers.

The COVID-19 pandemic has spurred an economic backdrop rife with challenges for all companies. It was just declared by the National Bureau of Economic Research that the United States officially entered a recession in February. While recent data has shown some improvement, and many jurisdictions are currently staging partial reopenings, the global economy remains significantly impaired. Significant declines in economic activity, along with social distancing and job losses have made it increasingly difficult for companies to generate revenue and meet their expenses. Many of the struggles facing companies may be obvious in our day-to-day lives as we see local shops and restaurants offering reduced hours, patio-only seating, curbside pick-ups, or even total closures. What may not be as obvious to us, or what we might not even consider, is that these companies could also be bond issuers.

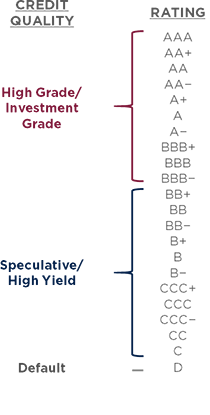

The fixed-income space can feel elusive to outsiders. Terms like “investment grade” or “junk” are often thrown around, affixed with pluses and minuses, and attached to a letter-grade system that takes you back to grade school. It’s no wonder it’s a difficult environment for many investors to make sense of. In order to shed some light on this space, we will break down the ABCs of the rating world and highlight some common characteristics of both investment-grade and high-yield bond issuers.

THE ABCs OF CORPORATE BONDS

Before we begin our discussion, let’s explore the fundamentals of the letter-grade ranking system alluded to above. Most corporate bonds are rated by third-party bond rating agencies, such as DBRS Morningstar, Standard & Poor’s, Moody’s or Fitch. These ratings are intended to be used as a broad measure of credit risk.

While the various agencies may differ in their approach to assign a rating, they all use a similar scale, which ranks credits from strongest to weakest. As shown in the chart (left), AAA is the rating assigned to the highest-quality credits, followed by AA, and then A. The ranking sequence is the same for B and C, eventually ending at the lowest-quality and highest-risk rating of D, or Default. To further complicate matters, each category has positive and negative modifiers. For instance, BBB+ is considered a stronger rating than BBB, which in turn is considered stronger than BBB-. The highest ratings are often, though not always, reserved for government bond issuers such as Canada and the United States. Numerous complex factors can influence a bond’s rating. Additionally, some rating agencies may assign different ratings to the same bond based on their own published methodologies. Despite their different approaches, all rating agencies attempt to predict the probability of default by combining several quantitative and qualitative measures. The goal is to match the rating with the bond’s probability of default.

INVESTMENT GRADE & HIGH YIELD: WHAT’S THE DIFFERENCE?

Large bond issuers are often the companies with the most recognizable names or brands. Among these heavy hitters, we find the world’s largest restaurant chain, a global chain of coffee shops, and even the world’s largest sports apparel company. Despite being in various industries, these companies all share several characteristics. They are in relatively stable industries and do not generally experience large fluctuations in profitability. They all operate globally with significant portions of their revenue derived from outside of the United States. Their globally recognized brands are associated with specific standards for quality service and pricing, lending themselves to high-ranking, competitive positioning within their industry. They do not generally employ excessive amounts of debt and they have ample liquidity on hand to meet short-term obligations. Based on these characteristics, the bond world generally considers debt issued by these types of issuers to be investment grade.

Companies that operate in industries such as event promotion, casinos and gaming, along with some corners of the travel and leisure sector, also share several characteristics. They tend to be smaller companies that derive more of their revenue from concentrated geographies, often operating in more fragmented and competitive industries. Since these industries are inherently more cyclical, these companies see more volatility in profitability. They also tend to have higher debt burdens (relative to earnings and cash flow) and less cash on hand relative to short-term obligations. As a result, debt issued by these types of issuers is generally considered to be high yield. Ultimately, high-yield bonds have a higher probability of default than investment-grade bonds, and each subsequent lower rating level has a higher probability of default.

Due to their reputation for being higher quality, investment-grade bonds, are often referred to as high-grade bonds. From a credit-rating perspective, these bonds are rated BBB- or higher. Conversely, high-yield bonds are of lower quality. They are also known as speculative grade, non-investment grade or junk bonds. These bonds are rated BB+ or lower.

While we do not rely on bond ratings to drive our investment decisions at Burgundy, we recognize that the delineation between investment grade and high yield is important for investors.

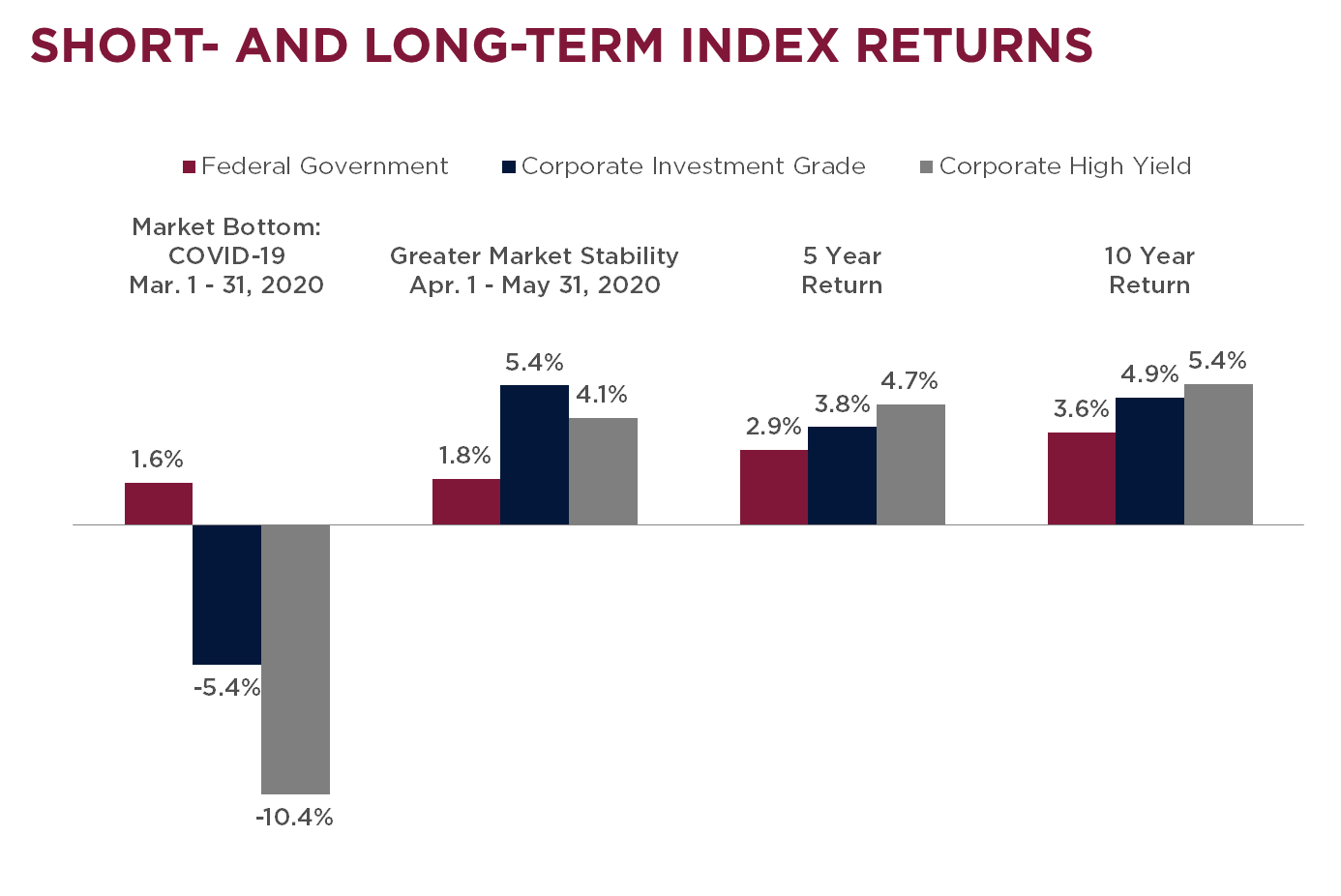

DOES HIGHER RISK = HIGHER RETURN?

Since high-yield rated bonds have an increased risk of default relative to investment-grade-rated bonds (and especially government bonds), they should generate higher returns. Over longer periods of time (as demonstrated in the chart below), high-yield bonds outperform both investment-grade corporate bonds and government bonds. Over a shorter time period, however, high-yield bonds may exhibit significant volatility and suffer negative returns. When compared to higher-quality bond returns, these negative returns are more closely correlated to equity returns. This is because they tend to be exposed to more cyclical business models that experience more stress during times of economic hardship, such as COVID-19.

As at May 31, 2020

Returns posted in Canadian dollars.

Returns for periods greater than one year are annualized.

OUTLOOK AMID COVID-19

The COVID-19 pandemic is presenting challenges for all companies, including investment-grade and high-yield bond issuers. As we see our local retailers and restaurants either closed or operating at a reduced capacity, we know these stores are losing significant amounts of revenue while rent, insurance, and interest payments are all still due. Event promoters and casinos have experienced an even more significant shock. Companies in these industries have been among those hardest hit as travel restrictions and strict social distancing protocols initially brought these businesses almost to a complete halt.

As analysts, we must continue to assess all of our investments in this new light, focusing on liquidity, flexibility, and adaptability in a constantly changing external environment. At the same time, we must balance that analysis with our revised return expectations. At first blush, it may appear sensible to sell bonds issued by companies that are so severely affected by this pandemic. We disagree.

Many large retailers and restaurants continue to operate, albeit at a significantly reduced capacity, in most markets via drive-through, curbside pickup, or patio-only seating, while some are considered essential services and are able to operate somewhat normally. These companies have ample liquidity to meet their upcoming obligations and operate on a global stage. As economies around the world stagger their reopenings, these companies should see increased demand. Companies that rely more on individual markets are at the whim of that particular market and individual government decisions on when and how to reopen their economy.

One area where these smaller and riskier companies have fared better than expected relates to concerts and events. Since most of these shows and festivals have been postponed as opposed to canceled, this means they are not currently issuing refunds. Barring any potential exceptions that may arise, it’s unlikely that concerts will be cancelled by artists. Musicians now derive the vast majority of their income from performing at live shows, which means they are incented to postpone their concerts and not cancel them outright. In a similar vein, some casinos have reopened, on the condition that they abide by social distancing measures. Furthermore, many of these issuers have raised debt financing over the past several months to bolster their liquidity and ensure they can survive an extended shutdown.

It is impossible to predict what the new normal will look like once the world emerges from this pandemic. Many things may never be the same. Still, we remain confident in our conviction as bondholders and believe that our investments are well-equipped to weather this storm and meet their debt obligations in the future. Ticket holders will return to stadiums and concert halls to see their favourite artists perform, casinos will continue to attract thrill-seekers, and coffee shops will welcome back patrons who have missed their daily (or more frequent) visits for a cup of joe. We also believe that the risks these securities present are appropriately compensated for by the current yield. As always, in an effort to protect your capital, we will continue to balance these risks and the return potential of these investments.

INDEX INFORMATION

FTSE Canada Federal Bond Index (denoted as Federal Government)

The FTSE Canada Federal Bond Index represents the federal government segment of the FTSE Canada Universe Bond Index, which is a broad measure of the Canadian investment-grade fixed income market.

FTSE Canada All Corporate Bond Index (denoted as Corporate Investment Grade)

FTSE Canada All Corporate Bond Index represents the corporate segment of the FTSE Canada Universe Bond Index, which is a broad measure of the Canadian investment-grade fixed income market.

FTSE Canada High Yield Bond Index (denoted as Corporate High Yield)

The FTSE Canada High Yield Bond Index is designed to be a broad measure of the Canadian non-investment grade fixed income market, investing only in non-investment grade securities rated less than BBB (low) but greater than D.

GENERAL DISCLAIMER

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.