Investment Strategies

FOR INSTITUTIONS

Strategic Credit at a Glance

Year Launched

2005

Geography

Global fixed income

BURGUNDY’S INVESTMENT APPROACH FOR FIXED INCOME

- A vehicle for sophisticated investors seeking an attractive yield and an opportunity for capital appreciation

- An opportunity to invest in a well-diversified portfolio of bonds with a focus on preserving capital while earning a high, fixed rate of return

- The main objective is to generate positive incremental returns with minimal additional risk over the long term

Portfolio Breakdown

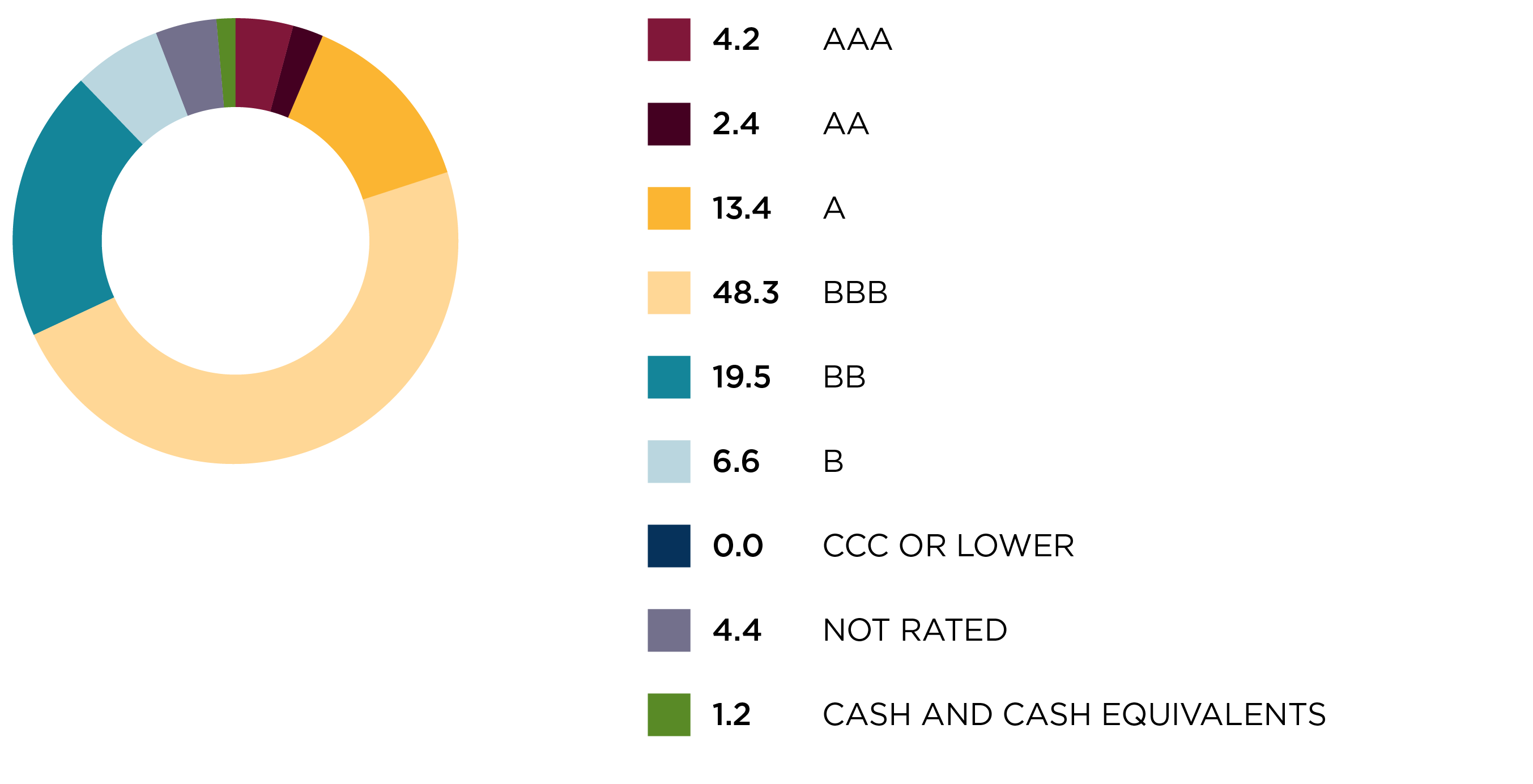

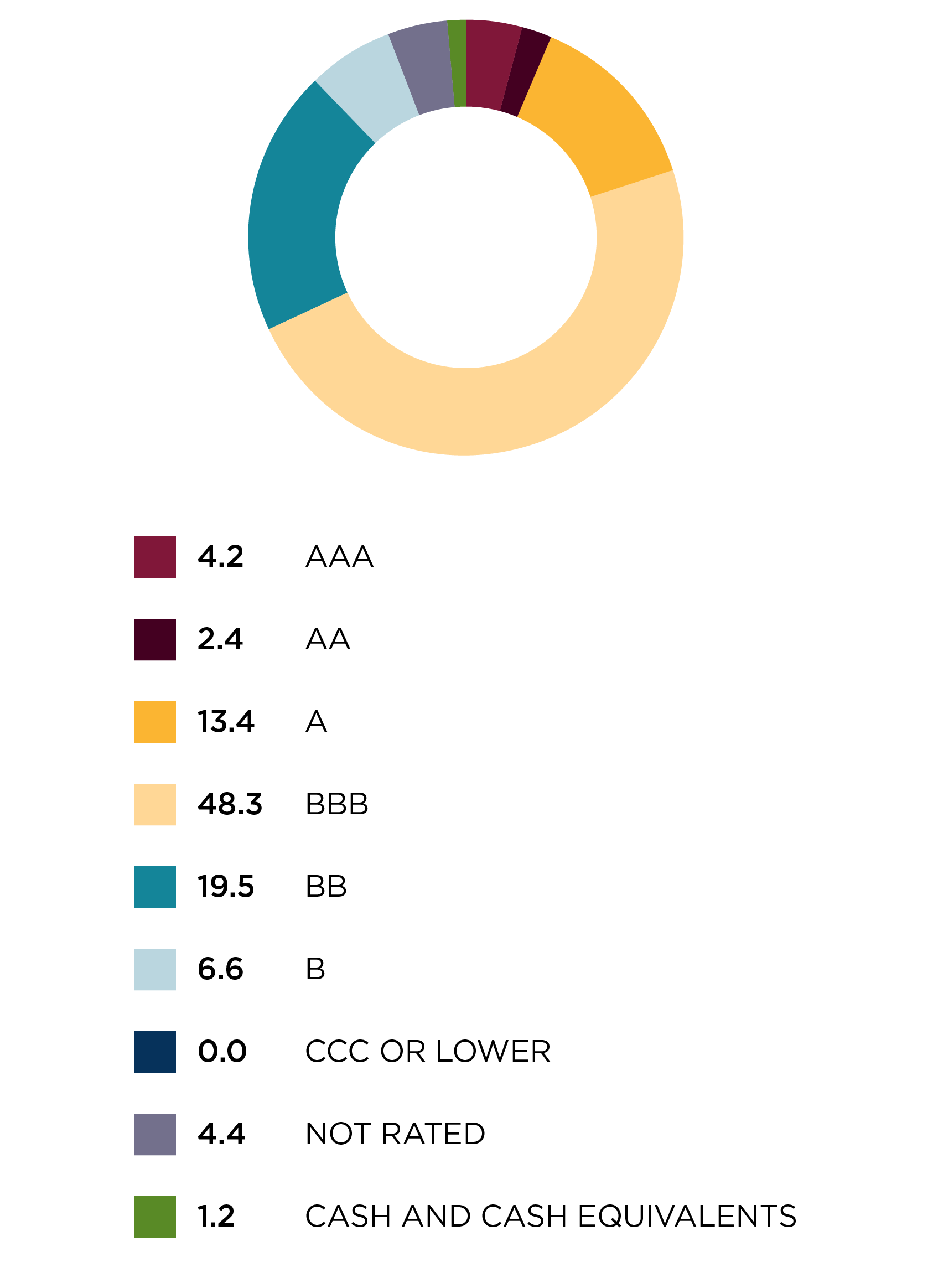

Credit Quality

May invest in corporate bonds across the ratings spectrum, including those rated below investment grade

Maximum Allocation

Investments in non-investment grade bonds will be limited to 60%

Credit quality allocation (%)

As at December 31, 2024.

Effective January 1, 2025, the Burgundy Total Return Bond Fund was renamed to the Burgundy Strategic Credit Fund.

Derivatives such as swaps and forwards may be used to hedge against currency fluctuations.

Portfolio Manager

JAMES ARNOLD, CFA

SENIOR VICE PRESIDENT, PORTFOLIO MANAGER

- Joined Burgundy in 2017

- 15+ years of combined professional experience

Learn More

Investment Team

Burgundy’s Investment Team consists of decentralized, autonomous, regional teams working in a unified, collaborative, idea-sharing environment in Toronto, Canada.

The Team concentrates on bottom-up fundamental research, frequently travelling around the world to study companies up close and meet with management teams face-to-face.

13

Portfolio Managers

14

Investment Analysts

23

Average PM Years Experience

Contact us to learn more

KYLE COATSWORTH, CFA

SENIOR VICE PRESIDENT, HEAD OF INSTITUTIONAL