Investment Strategies

FOR INSTITUTIONS

High Yield Credit at a Glance

Year Launched

2021

Geography

Global credit

BURGUNDY’S INVESTMENT APPROACH FOR CORPORATE BONDS

- A vehicle for sophisticated investors seeking an attractive yield and an opportunity for capital appreciation

- An opportunity to invest in a portfolio of corporate credit investments with a focus on preserving capital while earning a fixed rate of return

- The main objective is to generate positive incremental returns with minimal additional risk over the long term

Portfolio Breakdown

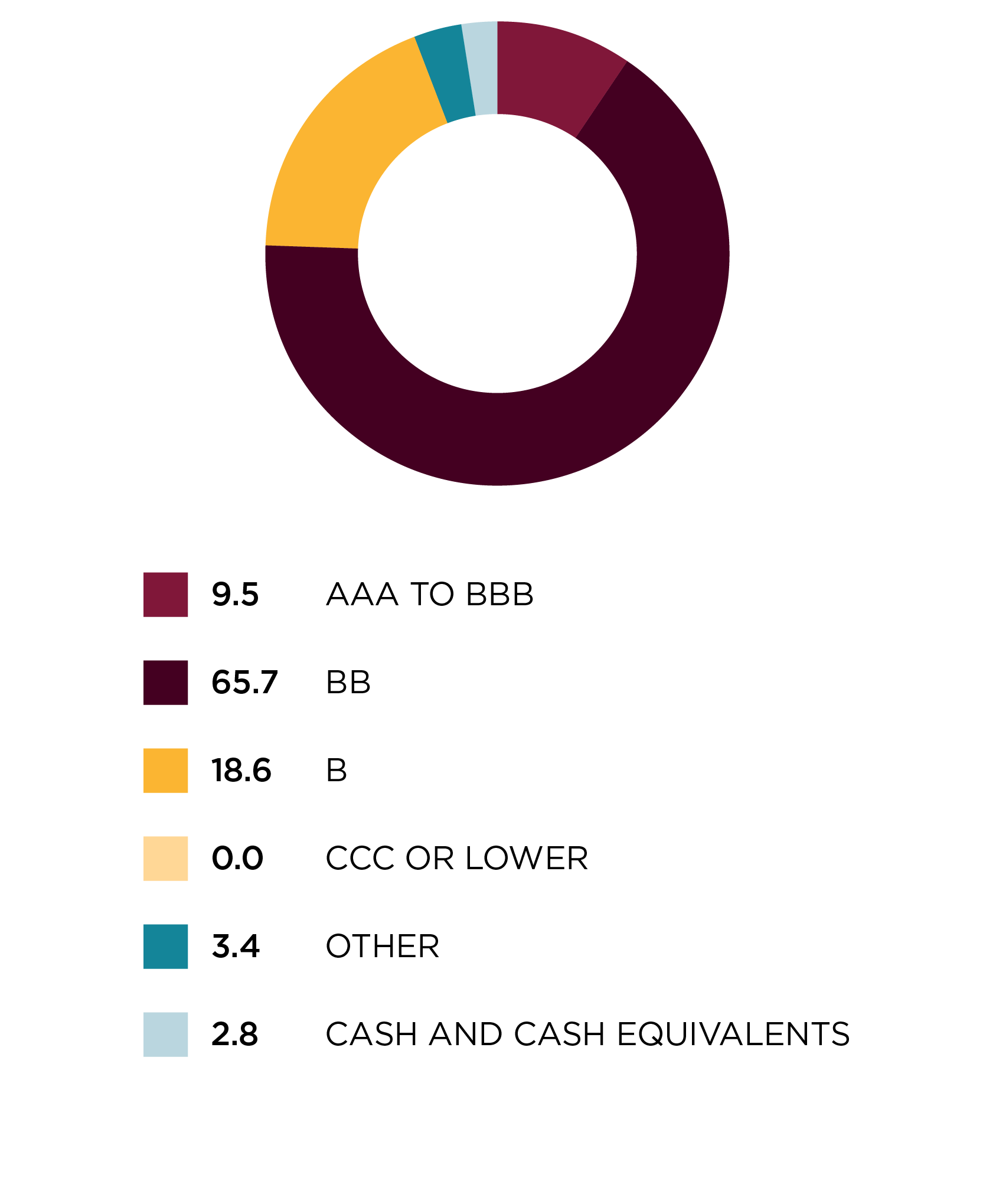

Credit Quality

Investment in BBB or higher will be limited to 10% of portfolio market value †

Currency

May invest in securities denominated in multiple currencies

Credit Quality Allocation (%)

As at December 31, 2024.

Effective January 1, 2025, the Burgundy High Yield Bond Fund was renamed to the Burgundy High Yield Credit Fund.

† BBB High, BBB and BBB Low, as rated by DBRS or equivalent rating agency.

Derivatives such as swaps and forwards may be used to hedge against currency fluctuations.

Portfolio Manager

JAMES ARNOLD, CFA

SENIOR VICE PRESIDENT, PORTFOLIO MANAGER

- Joined Burgundy in 2017

- 15+ years of combined professional experience

Learn More

Investment Team

Burgundy’s Investment Team consists of decentralized, autonomous, regional teams working in a unified, collaborative, idea-sharing environment in Toronto, Canada.

The Team concentrates on bottom-up fundamental research, frequently travelling around the world to study companies up close and meet with management teams face-to-face.

13

Portfolio Managers

12

Investment Analysts

22

Average PM Years Experience

Contact us to learn more

KYLE COATSWORTH, CFA

SENIOR VICE PRESIDENT, HEAD OF INSTITUTIONAL