Investment Strategies

FOR INSTITUTIONS

China Equity at a Glance

Year Launched

2020

Geography

Companies with a majority of revenues generated in China

Market Cap

Min. US$500 million at initial purchase

Number of Holdings

Concentrated: 15-25

Portfolio Breakdown

Active Share

77%

Average Annual Turnover

27%

Position Sizing

Maximum 10% of market value in any one company

Sector Limits

Although the Fund will not have explicit sector targets or limits, it will seek to be adequately diversified

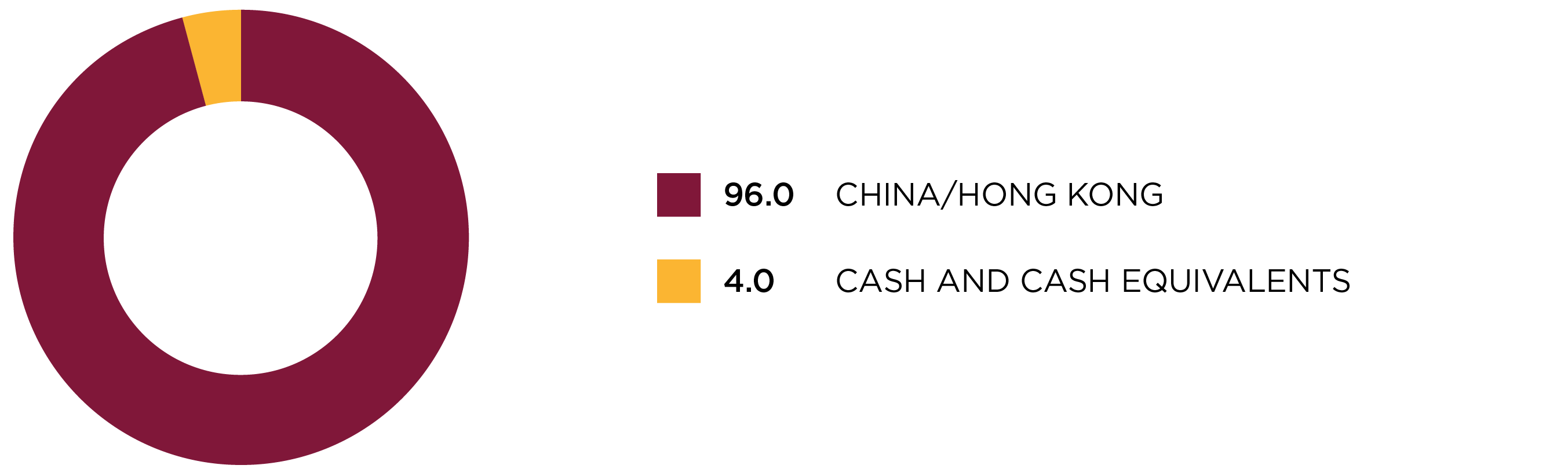

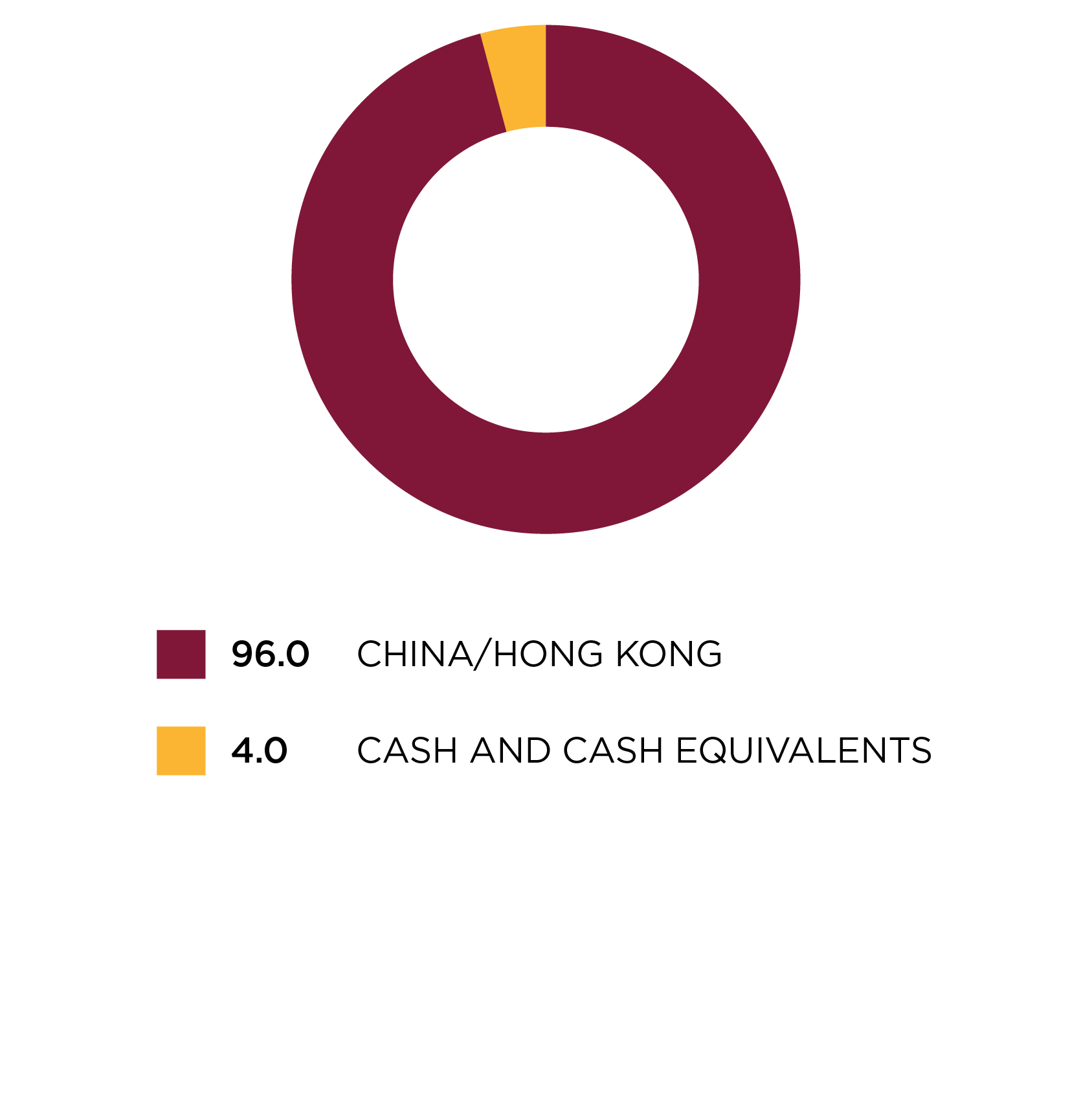

Regional Allocation (%)

As at December 31, 2023.

Active Share

Active share measures the degree to which a fund differs from its respective benchmark — the higher the active share, the lower the fund’s correlation to its benchmark (100 being completely different from the benchmark and zero being a replica of the benchmark).

Active share is calculated for the Burgundy China Equity Fund vs. MSCI China Index. Source: FactSet.

Average Annual Turnover

10-year average annual turnover is calculated using full calendar year portfolio turnover figures only. Partial inception year turnover figures are also excluded from the calculation, where applicable. Newer strategies are calculated since inception.

Portfolio Manager

CHING CHANG, CFA

VICE PRESIDENT, PORTFOLIO MANAGER

- Joined Burgundy in 2016

- 10+ years of combined professional experience

Learn More

Investment Team

Burgundy’s Investment Team consists of decentralized, autonomous, regional teams working in a unified, collaborative, idea-sharing environment in Toronto, Canada.

The Team concentrates on bottom-up fundamental research, frequently travelling around the world to study companies up close and meet with management teams face-to-face.

13

Portfolio Managers

17

Investment Analysts

469

Years Combined Experience

Contact us to learn more

KYLE COATSWORTH, CFA

VICE PRESIDENT, HEAD OF INSTITUTIONAL