Confucius wrote that life is really simple, but people insist on making it complicated. The investment business takes this truism to the extreme. What could be relatively simple is often twisted, layered, tranched, and repackaged in the name of new and exciting, where something dull and well-understood would suffice. And, the industry profits handsomely from this “new” advice.

Take asset allocation. When investors require an annual cash flow from their portfolios each year, like in retirement, some advisors might launch into a long discussion about portfolio construction using Monte Carlo risk analysis to reduce the probability of ruin over average life expectancy. In my view, this makes things needlessly complicated and the results are often amazingly similar to the KISS or “Keep It Simple, Stupid” approach. At Burgundy, our Investment Counsellors typically advocate an uncomplicated KISS approach to portfolio construction that looks like the following for an investor with an average risk tolerance:

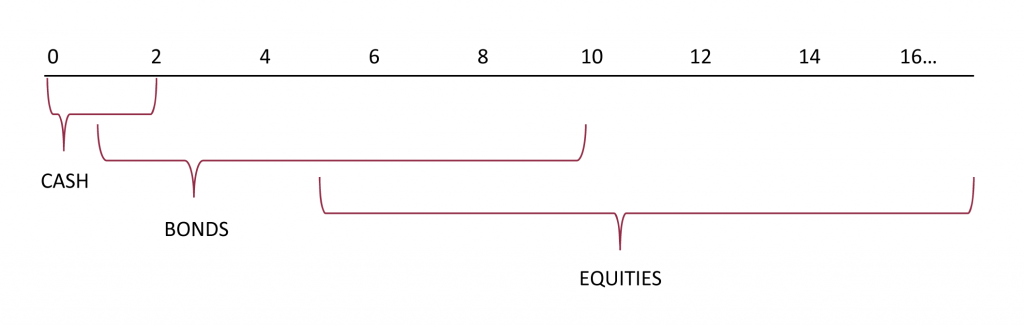

- Short term: cash flow required over the next one to two years is invested in short-term, default-free securities like short-term treasuries or a high-quality money market fund.

- Medium term: cash flow required from year two through at least five (and up to year 10 depending on a person’s willingness and ability to tolerate volatility) should be invested in high-quality fixed income securities (bonds).

- Long term: Any cash flow that will not be needed for the next five to 10 years should be allocated to a high-quality, diversified equity portfolio.

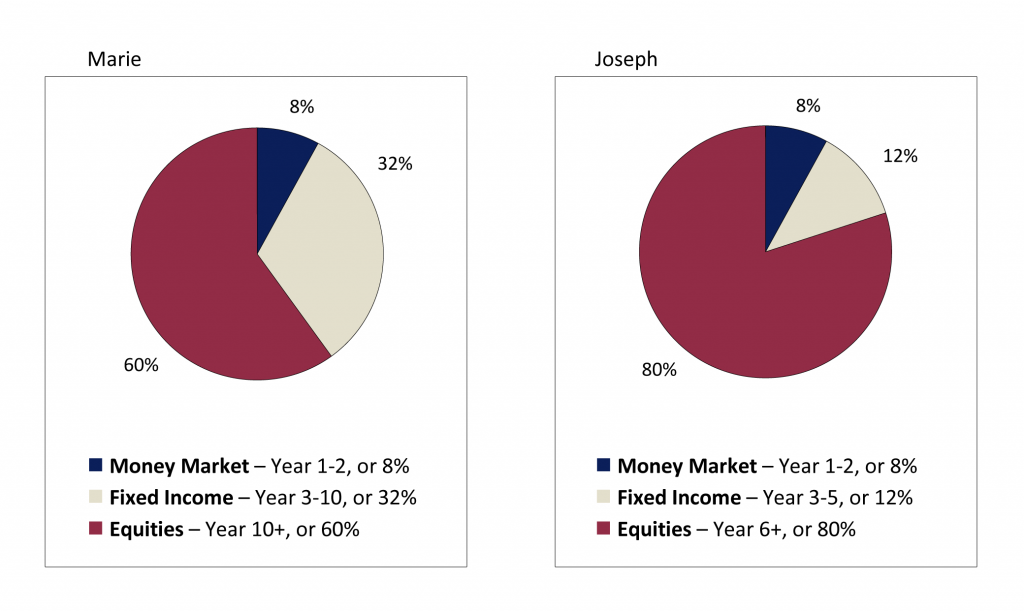

For example, Marie and Joseph are two recently retired investors, each with a $1 million portfolio and annual cash flow requirements of $40,000, or 4% of their respective portfolios. While Marie has an average willingness to manage short-term volatility, Joseph has a higher willingness for the prospect of earning a higher return. As a starting point in our discussion, I would typically recommend the following long-term strategic asset allocations for each client:

The rationale behind this approach, as my title suggests, is quite simple.

- Short term: Over the next two years, Marie and Joseph can be certain that their cash flow needs are covered because they are invested in almost risk-free securities (money market).

- Medium term: the funds that they will require in either years three through 10 in Marie’s case or three through five in Joseph’s case are invested in relatively low-risk fixed income securities that will provide some income and medium-term preservation of capital.

- Long term: most importantly, the combination of the money market and bond allocation provides a five- to 10-year cash flow cushion for equity market appreciation. Joseph’s higher allocation to equities may mean increased volatility in the short term, but would offer the opportunity for higher returns over the long term. Historically, the probability of a nominal loss from investing in equities over a five-year period is low and over a 10-year period is very low.1 The average appreciation is around 9% per year.

Using this simple approach and rationale, their portfolios are positioned to protect their short- and medium-term cash flow needs and to grow their portfolios over the long term. It doesn’t have to be much more complicated than this!

1. Since 1926, the S&P 500 Index has produced a positive return 85% of the time over five-year periods. Over 10-year periods, the Index is positive 94% of the time. While these returns are historical, they are not indicative of future performance and may not have application to future returns either as to extent or frequency.

This post is presented for illustrative and discussion purposes only. It is not intended to provide investment advice and does not consider unique objectives, constraints or financial needs. Under no circumstances does this post suggest that you should time the market in any way or make investment decisions based on the content. Select securities may be used as examples to illustrate Burgundy’s investment philosophy. Burgundy funds or portfolios may or may not hold such securities for the whole demonstrated period. Investors are advised that their investments are not guaranteed, their values change frequently and past performance may not be repeated. This post is not intended as an offer to invest in any investment strategy presented by Burgundy. The information contained in this post is the opinion of Burgundy Asset Management and/or its employees as of the date of the post and is subject to change without notice. Please refer to the Legal section of this website for additional information.