Investment Strategies

FOR INSTITUTIONS

Balanced Foundation II at a Glance

Year Launched

2012

Geography

Global, including Canada

A RESPONSIBLE FOCUS ON BURGUNDY’S BOTTOM-UP INVESTMENT APPROACH

- Provide an investment alternative for foundations and endowments that require a long-term bond weighting of approximately 30%

- Managed according to Burgundy’s long-term, bottom-up value investment philosophy

- Invested according to Burgundy’s Responsible Investment Policy, which excludes companies directly producing tobacco, armaments and cannabis, as well as gambling-related companies

FIXED INCOME ALLOCATION

- Min. 20% in government bonds

- Max. 35% in non-investment grade bonds

- Max. 80% in corporate bonds

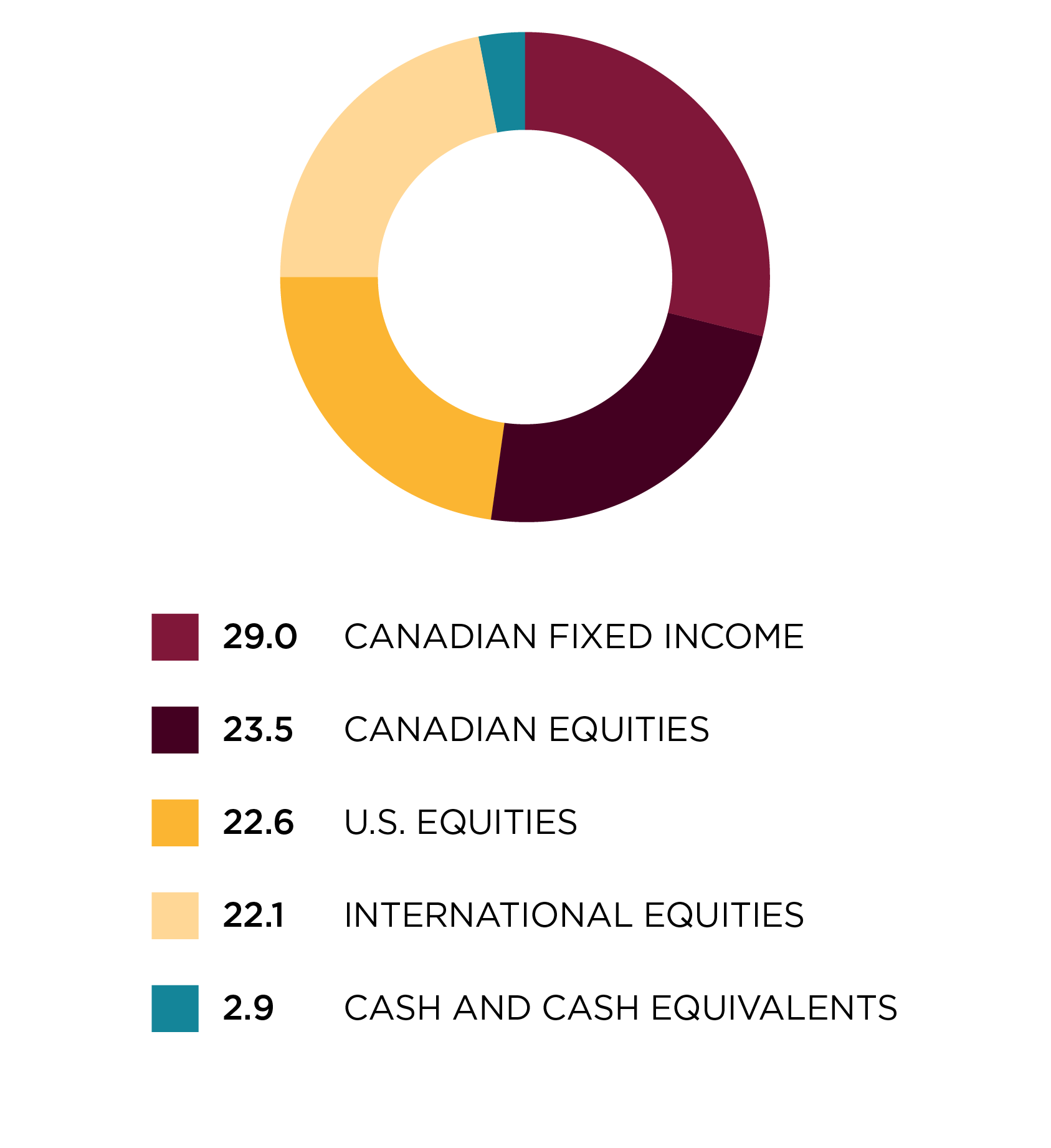

Portfolio Breakdown

Position Sizing

Maximum 10% of market value in any one company

Target Duration

+/- 3 years of the FTSE Canada Universe Bond Index

Regional Allocation (%)

As at December 31, 2023.

Portfolio Manager

ANNE METTE DE PLACE FILIPPINI

SENIOR VICE PRESIDENT, CHIEF INVESTMENT OFFICER

- Joined Burgundy in 2008

- Portfolio Manager for Partners’ Global and Balanced strategies

- 30+ years of combined professional experience

Learn More

Investment Team

Burgundy’s Investment Team consists of decentralized, autonomous, regional teams working in a unified, collaborative, idea-sharing environment in Toronto, Canada.

The Team concentrates on bottom-up fundamental research, frequently travelling around the world to study companies up close and meet with management teams face-to-face.

13

Portfolio Managers

17

Investment Analysts

469

Years Combined Experience

Contact us to learn more

KYLE COATSWORTH, CFA

VICE PRESIDENT, HEAD OF INSTITUTIONAL